-

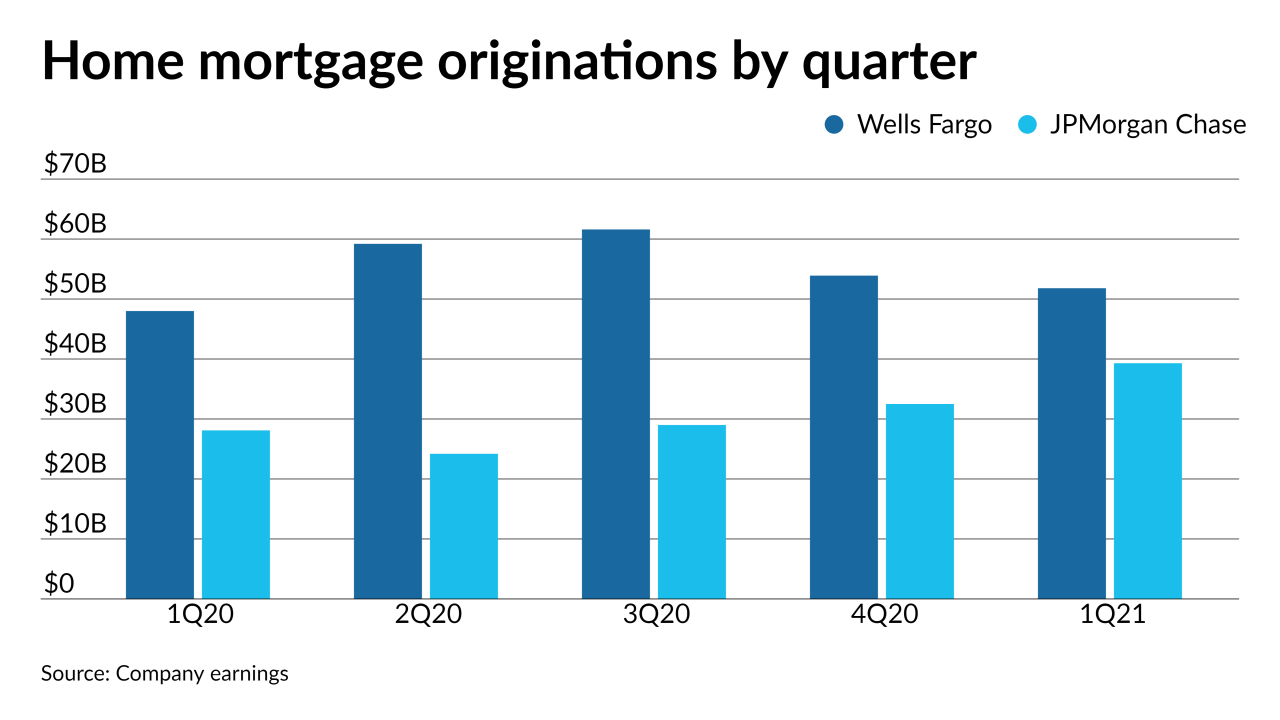

First quarter volume was up 3% among eight depositories that reported so far, compared with models that predicted industry-wide drops as large as 13%.

April 20 -

Long-term home-based operations are more likely than they were prior in March of last year, but some origination and servicing professionals will return to the office, a recent survey suggests.

April 20 -

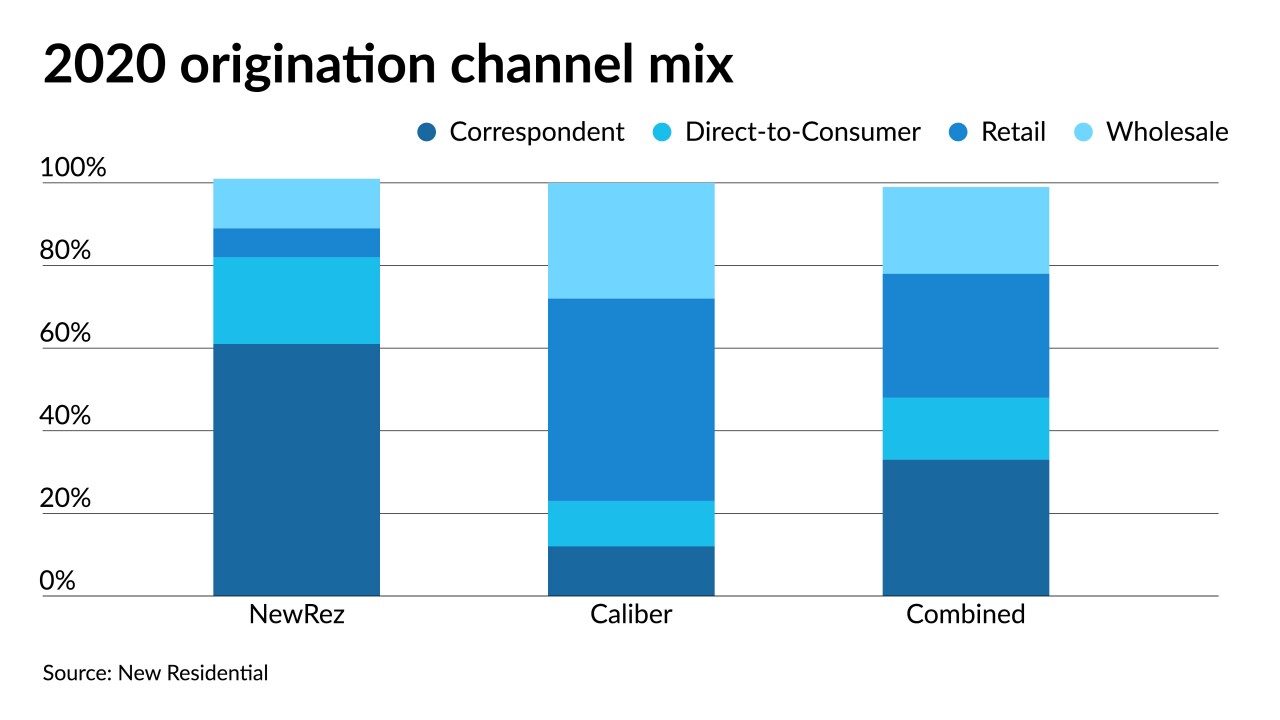

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

The market appears to be undergoing a shift away from refinances and remote operations, but the top producers interviewed for this article don’t plan to abandon either any time soon.

April 16 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

Gene Thompson goes to deciding what the company's next steps are, rather than implementing them.

April 16 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

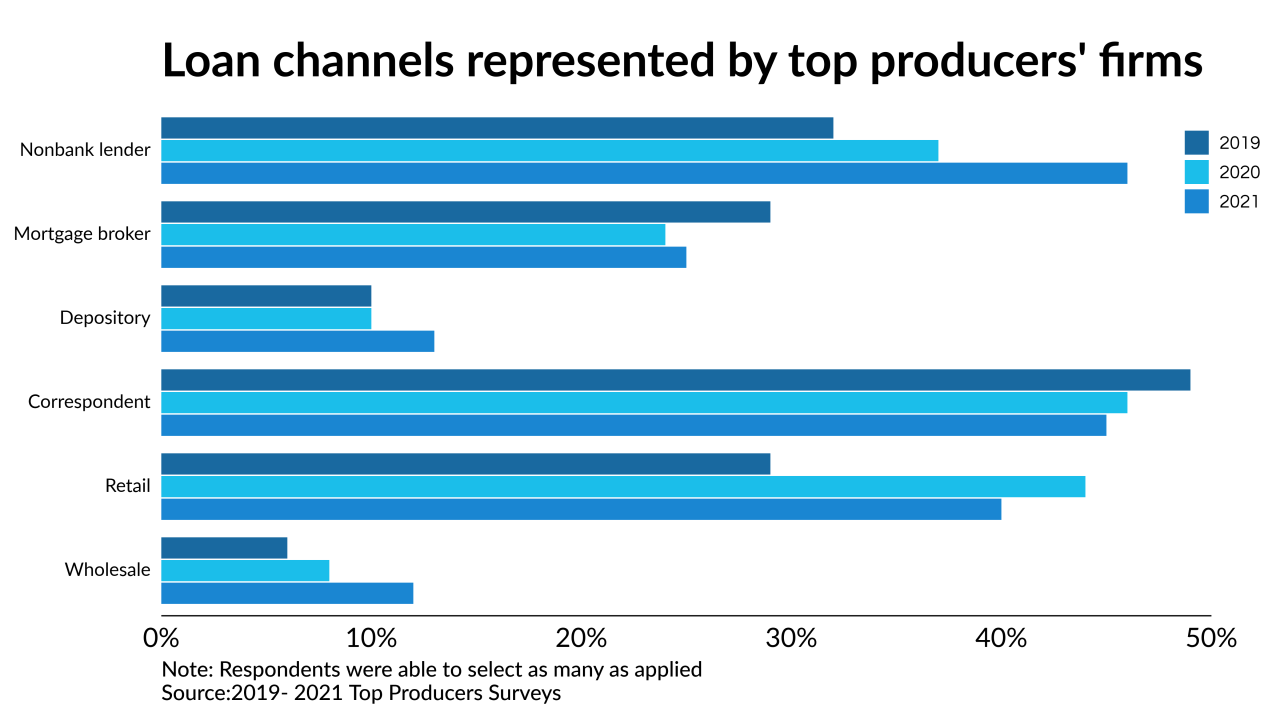

The loan officers who brought in the highest volumes last year offer their perspectives on social media, the GSEs, loan channels and more.

April 15 -

Their numbers suggest that the quarter’s home lending may be stronger than industry forecasts for a 6 to 13% decline.

April 14 -

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

There’s a 20 percentage-point gap between Black and white consumers who have the income necessary to qualify for a mortgage on a new median-priced home.

April 13 -

However, companies were largely unable to use that cash infusion to make investments that lower their costs, since they had to pay out more in compensation.

April 13 -

A loan officer logging a billion-dollar volume topped the ranking for the first time in the 23-year history of the survey.

April 12 -

During a record-breaking year for lending, these loan officers brought in the highest volumes of the 400 on the list.

April 12 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

The shift ended a long run of higher rates that have depressed loan application activity, and it temporarily creates a new refinancing incentive for some borrowers.

April 8 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

That means depreciation is a risk that could creep back into some regions, potentially requiring lenders and government-related agencies to consider it when setting down payment requirements or managing loan workouts once forbearance ends.

April 6