-

The product being tested would join another on the market from Finicity, which is nearing the final stage of approval for use by Fannie Mae and Freddie Mac.

March 4 -

While many lenders have verification processes and systems of record in place for their structured data, they lack digital solutions capable of addressing the volume of customer data from documents that create a broad area of vulnerability for them, writes Reggie Twigg, director of digital enterprise at ABBYY.

March 4 ABBYY

ABBYY -

The expansion of borrower data collected in the new URLA upends an industry standard and lenders are experiencing some growing pains.

March 3 -

The merger with Capitol Investment V values the title insurer at $3 billion.

March 3 -

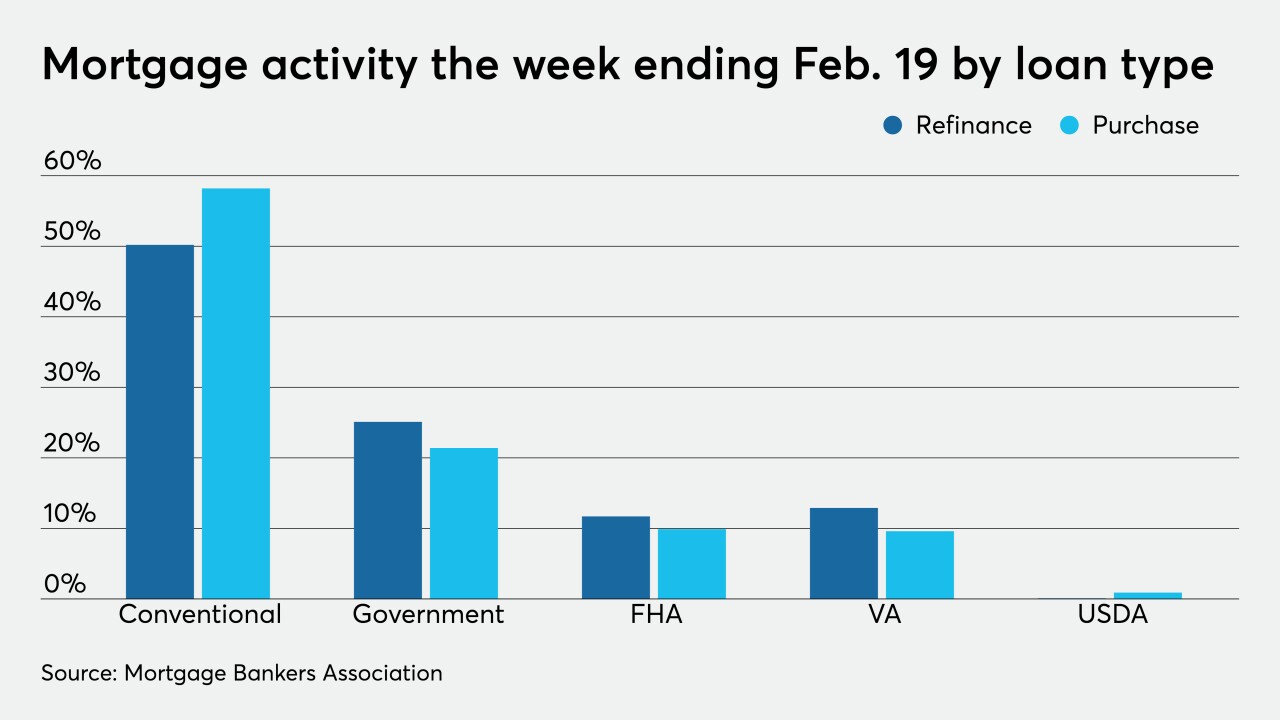

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

Major secondary market players have been testing Fincity’s technology, which is in the final approvals stage with Fannie Mae and Freddie Mac.

March 1 -

Virtual events will continue to replace the large in-person gatherings for the foreseeable future, lenders in the Best Companies to Work for list say.

March 1 -

Amid a wave of initial public offerings and acquisitions, originators with employee stock ownership plans say the underutilized company structure has helped with recruiting and retention in a competitive market.

March 1 -

How mortgage companies with 500 or more employees stacked up against each other.

March 1 -

National Mortgage News presents the third annual Best Mortgage Companies to Work For — a survey and awards program dedicated to identifying and recognizing the industry's best employers and providing organizations with valuable employee feedback.

March 1 -

But profitability may have peaked. Rocket reported a 4.41% profit margin on newly originated loans last quarter but told investors on Thursday to expect margins on new loans this quarter to be around 3.6% to 3.9%.

February 26 -

The automation is more prevalent but the net adoption rate is low, the Stratmor Group found.

February 25 -

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

The company received an undisclosed amount of Series A funding from two investors to expand technology currently focused on helping lenders with timelines that are, on average, spinning out of control.

February 22 -

The organization postponed the issuance of its next set of revisions, which would have gone into effect at the start of 2022.

February 22 -

Also: CoStar boosts CoreLogic offer, Biden extends forebearance and the Fed sounds alarms on commercial real estate

February 19 -

Redfin expects the FTC to be more open to its proposal to buy RentPath than it was to CoStar’s earlier offer, Chief Financial Officer Chris Nielsen said.

February 19 -

With historic barriers of systemic discrimination, predatory lending and wealth inequities to overcome, change will take time, but leaders from National Association of Real Estate Brokers and other groups propose lenders take these steps now.

February 19 -

The newly public digital mortgage giant is relying on a diverse set of loan channels to take on competitors in an increasingly crowded field, CEO Anthony Hsieh said in an earnings call this week.

February 18