Mortgage rates jump to 3-month high as Treasury yields climb

After a two-week holding pattern, mortgage rates finally caught up with the growing Treasury yields and gradual economic recovery driven by the most recent stimulus package.

The 30-year fixed rate mortgage shot up 8 basis points to 2.81% from 2.73%

Read the full story

Western Alliance to buy parent company of AmeriHome Mortgage

Western Alliance agreed on Tuesday

Read the full story

Biden extends mortgage forbearance and foreclosure protections

The administration pushed both the forbearance enrollment deadline and the foreclosure moratorium on FHA, VA and USDA loans by three months to June 30, 2021. Borrowers who entered forbearance prior to June 30, 2020, will be allotted an additional six months of coverage in three-month increments.

The announcement comes

Read the full story

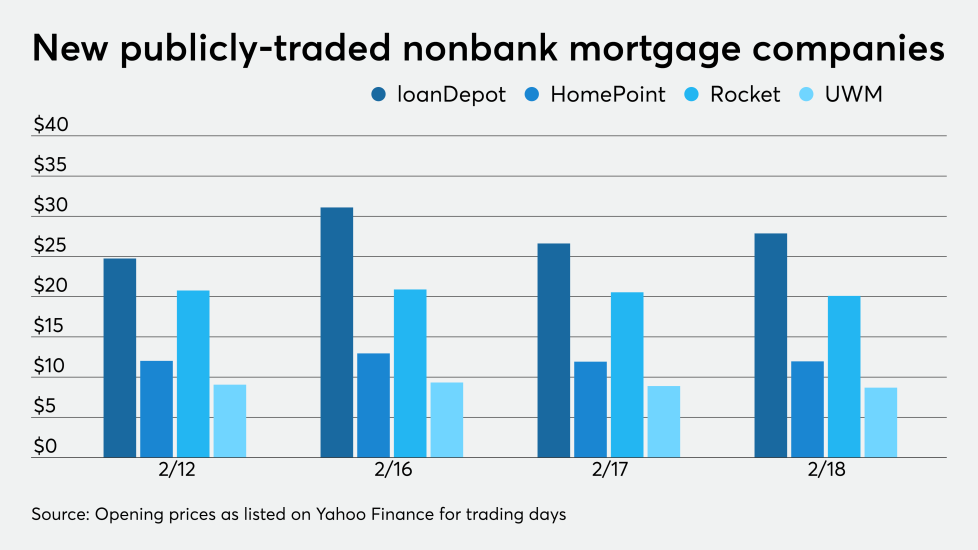

LoanDepot's earnings reveal strong originations, thinning margins

The company recorded $2 billion in net income and a more than 100% year-over-year gain in annual originations, outstripping the industry’s average growth, which was closer to 50% according to the Mortgage Bankers Association.

However, while its 3.38% gain-on-sale margin was up from 2.81% a year ago, it was down from 4.48% in the third quarter. Its stock price at deadline was down a little over $2 on the day of the earnings announcement, at $25.69. LoanDepot’s closest competitor among nonbank mortgage companies new to the market, Rocket Cos., has been trading at roughly $20 per share.

Read the full story

CoStar boosts its offer to acquire CoreLogic to $6.9 billion

CoreLogic’s

He added he was “stunned” to read about the deal.

CoStar’s newest offer represents an equity value of approximately $6.9 billion, a 20% more than the earlier offer, CoStar said in a statement.

“We do not believe the pending transaction maximizes value for CoreLogic stockholders and we continue to believe in the strong strategic rationale for the combination of our two companies,” Florance said in the letter. “The fact that CoreLogic stock continues to trade well above the pending transaction price is a clear indication that the shareholders agree with us.”

Read the full story

Two reports predict a foreclosure wave will be avoided

That’s in part because the Biden administration’s

There were 841,977 borrowers in the government-sponsored enterprise forbearance plans in November, down from 922,589 the month before, according to the Federal Housing Finance Agency. That decrease, combined with broader declines in unemployment, means the incidence of distress is stable to lower for the average mortgage borrower.

Read the full story

Refinancing activity dies down on the heels of rate rise

The dip in refis during the week ending Feb. 12 brought their share below 70% for the first time since October, the trade group found. The refi share during the latest week tracked by the MBA was 69.3%, down from 70.2%

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive but constrained by inventory shortages.

“The uptick in rates has slightly dampened refinance activity, with MBA’s index falling for the second week in a row,” said Joel Kan, MBA’s associate vice president of economic and Industry forecasting.

Read the full story

Fed sounds alarm on commercial real estate, business bankruptcy

“Business leverage now stands near historical highs,” the central bank said in its semiannual Monetary Policy Report to Congress. “Insolvency risks at small and medium-sized firms, as well as at some large firms, remain considerable.”

In part encouraged by government and Fed programs, businesses have taken on more debt over the past year as they’ve struggled to deal with the economic and financial fallout from COVID-19, including in some cases forced shutdowns.

Read the full story

Appraisers get 24-hour payment cycle from Incenter

Incenter Appraisal Management is rolling out a new program that allows appraisers to be paid within 24 hours of submitting a report.

The

"We looked at that problem, we realized we could do something about it," Walser said. "In our case, we looked to take the billing piece [and provide] peace of mind and make that a reality for our appraiser panel."

Read the full story

Why the spring home selling season may be obsolete

Home sales activity in 2020 was far different than any year in recent memory, as the pandemic forced changes to traditional patterns and practices. After the pandemic’s onset and subsequent lockdowns in March, April and May, buyers — many motivated by record

"The housing market is unseasonably hot — it's behaving like it normally does in the spring, with plenty of demand from homebuyers," Redfin Chief Economist Daryl Fairweather said in a Jan. 15 press release. "Typically, the vast majority of homes for sale in December are homes that have been sitting on the market because they're overpriced or there's a problem with the property. This December, with so many Americans moving, scores of desirable homes hit the market — but not enough to satisfy

Read the full story

One-stop-shop trend continues with Propertybase’s Unify buy

Cross Media owns Unify, a customer relationship management platform for the residential mortgage industry aimed at lead generation and client retention, as well as real-time loan origination system integration. The company works with roughly 80 mortgage companies in North America, mining and analyzing potential borrower data through automation to produce higher-intent leads. Its new owner, PropertyBase, offers lead generation, CRM, compliance management and other software tools, which are used by 4,500 real estate entities across the country, the company said.

Read the full story

Despite shrinking inventory, 2021 home sales started ‘with a bang’

But constraints remain: the number of for-sale properties fell to the lowest point since Remax started its National Housing Report in 2007, setting up high demand and potentially limiting future sales volumes. January inventory dropped 12.1%

Read the full story

5 ways to increase the Black homeownership rate right now

With historic barriers including discrimination,

“Since 2015 there have been approximately 1 million new Black homeowners. Unfortunately, the number of black applicants has not reached pre-2008 levels,” said Antoine Thompson, executive director of the National Association of Real Estate Brokers, the oldest minority trade group in the nation. “Marketing and outreach, diversity in loan officers and staff and mortgage underwriting criteria may play key roles in increasing Black homeownership.”

Read the full story

Cash-out refis help drive pandemic-era mortgage boom

The homebuyers who took advantage of rock-bottom mortgage rates during the pandemic included many investors and purchasers of second homes who flocked to the market at levels unseen since before the Great Recession, according to

Cash-out refinancings also hit a post-financial-crisis high, as many households tapped into the equity they have accumulated as home prices have climbed over the last decade. Mortgage origination volume last year totaled $3.7 trillion, by far the highest level since 2003.

The data is most notable for one major contrast that it reveals between the current boom and the previous one: borrowers’ creditworthiness. Last year, roughly 70% of mortgage borrowers had credit scores of 760 or higher, compared with around 30% in 2003.

Read the full story

Ellington set to price next $251.8M non-QM RMBS

Ellington Mortgage Trust 2021-1 is a $251.8 million transaction, which includes a Class A $188.7 million tranche with preliminary AAA ratings from Kroll Bond Rating Agency and S&P Global Ratings.

A “notable” concentration of loans were issued with alternative income documentation under qualified-mortgage rules of the Consumer Financial Protection Bureau, according to Kroll, with 66.1% of the loans made to self-employed borrowers, with 49.6% of the loans underwritten with bank statement income verification (including less than 24 months verified).

Read the full story