-

The most successful mortgage originators will use artificial intelligence and machine learning to enhance and enable their people to have better, more meaningful engagements with customers.

September 20 Total Expert

Total Expert -

Mortgage industry hiring and new job appointments for the week ending Sept. 20.

September 20 -

Mortgage rates had their largest week-to-week uptick since October 2018 as bond market investors reacted to positive news about the economy, according to Freddie Mac.

September 19 -

Self-service technology gives borrowers the control, speed and convenience they desire, while providing lenders with higher origination volume.

September 18 Finastra

Finastra -

Mortgage applications decreased 0.1% from one week earlier as conforming and jumbo interest rates climbed back above 4%, which slowed refinance activity, according to the Mortgage Bankers Association.

September 18 -

The low mortgage rates of August drove new homebuyers to cannonball into the purchase market compared to the year before, according to the Mortgage Bankers Association.

September 17 -

Lower rates and signs that more affordable housing inventory is being built drove Fannie Mae's 2019 origination numbers higher in its latest forecast.

September 17 -

Mortgage industry hiring and new job appointments for the week ending Sept. 13.

September 13 -

Mortgage applications increased 2% on an adjusted basis from one week earlier driven by gains in the purchase market while refinance activity was flat, according to the Mortgage Bankers Association.

September 11 -

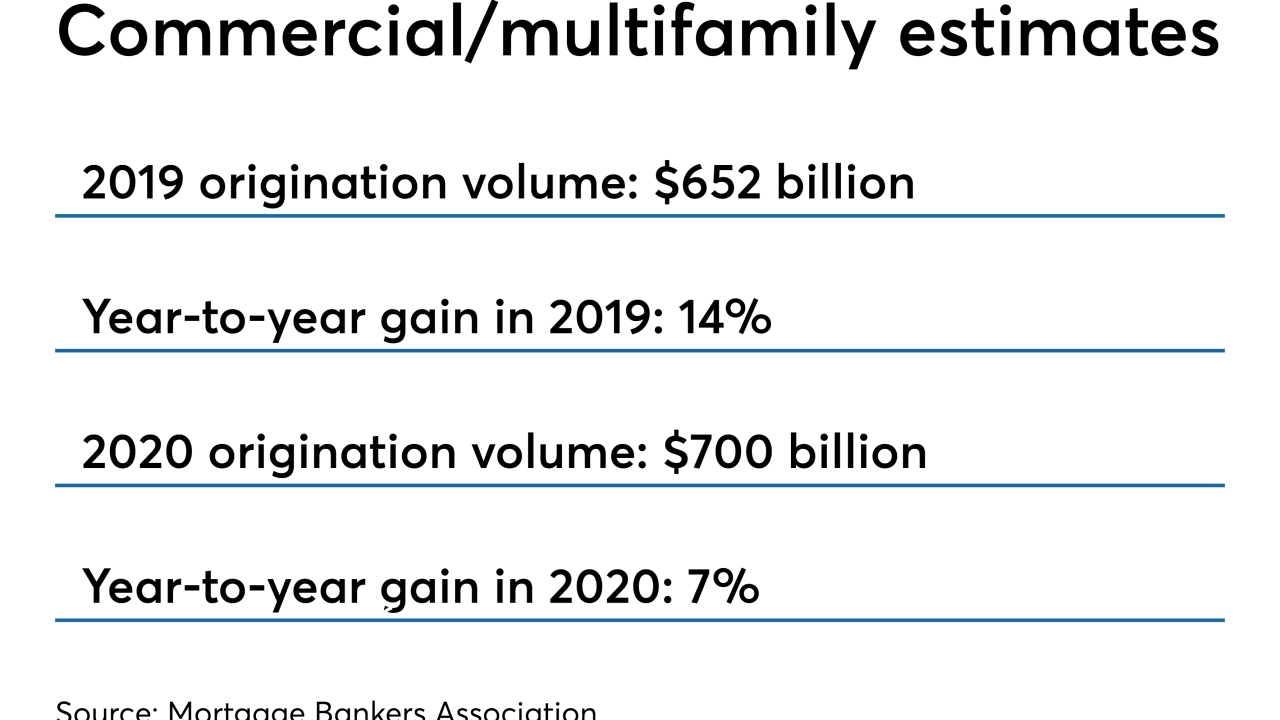

Lower interest rates are expected to drive financing secured by income-producing properties to new heights by year-end, according to the Mortgage Bankers Association.

September 10 -

Mortgage industry hiring and new job appointments for the week ending Sept. 6.

September 6 -

Mortgage applications fell 3.1% from one week earlier even with another decrease in rates, according to the Mortgage Bankers Association.

September 4 -

In Denmark, where banks have been grappling with negative interest rates longer than in any other country, there's one corner of their business that's raking in a lot more money.

September 4 -

Mortgage industry hiring and new job appointments for the week ending Aug. 30.

August 30 -

Independent mortgage bankers reported their highest average profit per loan originated in almost three years, benefiting from a large drop in production expenses, the Mortgage Bankers Association said.

August 29 -

Waterstone Mortgage hired Andy Peach as its new president and CEO, replacing A.W. Pickel III, who was terminated by the company in March.

August 28 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28 -

Digitizing the lending experience can go a long way toward boosting mortgage applications even as interest rates continue to fluctuate.

August 26 Fincity

Fincity -

Mortgage industry hiring and new job appointments for the week ending Aug. 23.

August 23 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22