-

Lower mortgage loan origination volume in 2018, on top of 2017's decline, will lead to further reduction in title insurer profitability and a possible increase of merger activity.

January 3 -

Mortgage application volume decreased 2.8% during the last two weeks of 2017, according to the Mortgage Bankers Association.

January 3 -

With recommended reads from Chase Mortgage's Mike Weinbach, New American Funding's Patty Arvielo and more, check out these 13 books every mortgage pro should have on their winter reading list.

December 29 -

Mortgage industry hiring and new job appointments for the week ending Dec. 29.

December 29 -

Employees at HarborOne Bank and its Merrimack Mortgage Co. subsidiary will see their minimum wage rise to $15 per hour, the latest company to accelerate plans to hike salaries.

December 28 -

From consolidation to tech innovation, here's a look at some of the top challenges and trends that mortgage executives from lenders, servicers and vendors are focused on for 2018.

December 28 -

Billionaire Dan Gilbert's Quicken Loans Inc. outgrew almost every U.S. mortgage provider by unfurling technology like its online Rocket Mortgage platform faster than big banks.

December 28 -

From origination to servicing and everything in between, here's a look at what's in store for the mortgage industry in 2018.

December 26 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

As digital mortgage technology helps consumers take a more hands-on approach to the mortgage process, lenders are stepping up their adoption of automation and machine learning through artificial intelligence capabilities.

December 26 -

Lending outside the qualified mortgage rule will likely become more prominent in 2018, as originators continue to struggle to replace lost refinance volume and their compliance and risk management processes become more robust.

December 26 -

Mortgage industry hiring and new job appointments for the week ending Dec. 22.

December 22 -

The share of new refinance mortgage applications reached its highest point since December 2016, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 20 -

Top officials at the Internal Revenue Service met with mortgage industry groups this week to discuss possible fixes to the agency’s verification system, which lenders rely on to process mortgage loans.

December 19 -

Mortgage lenders are bracing for big delays in the processing of mortgage applications, citing a problem with the income verification system at the Internal Revenue Service.

December 17 -

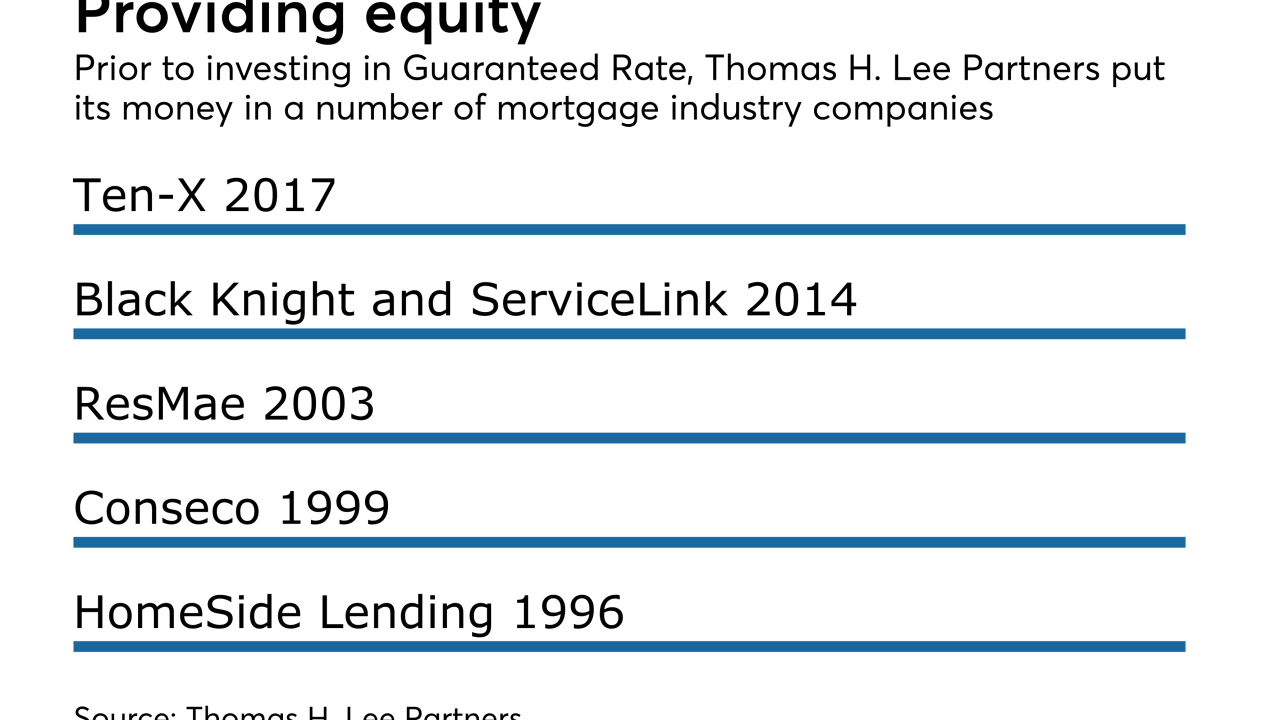

Guaranteed Rate Inc. is the latest mortgage industry investment for Boston-based private equity firm Thomas H. Lee Partners LP.

December 15 -

Mortgage industry hiring and new job appointments for the week ending Dec. 15.

December 15 -

The share of new refinance mortgage applications reached its highest point since January, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 13 -

The House Financial Services Committee, by a vote of 60-0, approved a bill amending key provisions of the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

December 13 -

Mortgage applications for new home purchases increased by 12.2% in November from the same period a year ago, according to the Mortgage Bankers Association.

December 12