-

Reducing unnecessary compliance burdens will pave the way for economic growth, larger job creation and wage increases, and re-evaluating technology will play an important role in doing so, according to Craig Phillips, counselor to the secretary at the Department of the Treasury.

May 21 -

Demands for loan quality aren't just coming from regulators and the government-sponsored enterprises. Secondary market partners and investors don't want to be left holding the bag if loans that lenders create have quality issues.

May 4 LoanLogics

LoanLogics -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

A data validation integration Freddie Mac is adding to its technology platform could also deliver representation and warranty relief to lenders when it verifies self-employed borrowers' incomes.

April 20 -

Mortgage companies should model cybersecurity protocols after their compliance strategies to avoid being underprepared in the event of a data breach.

April 19 -

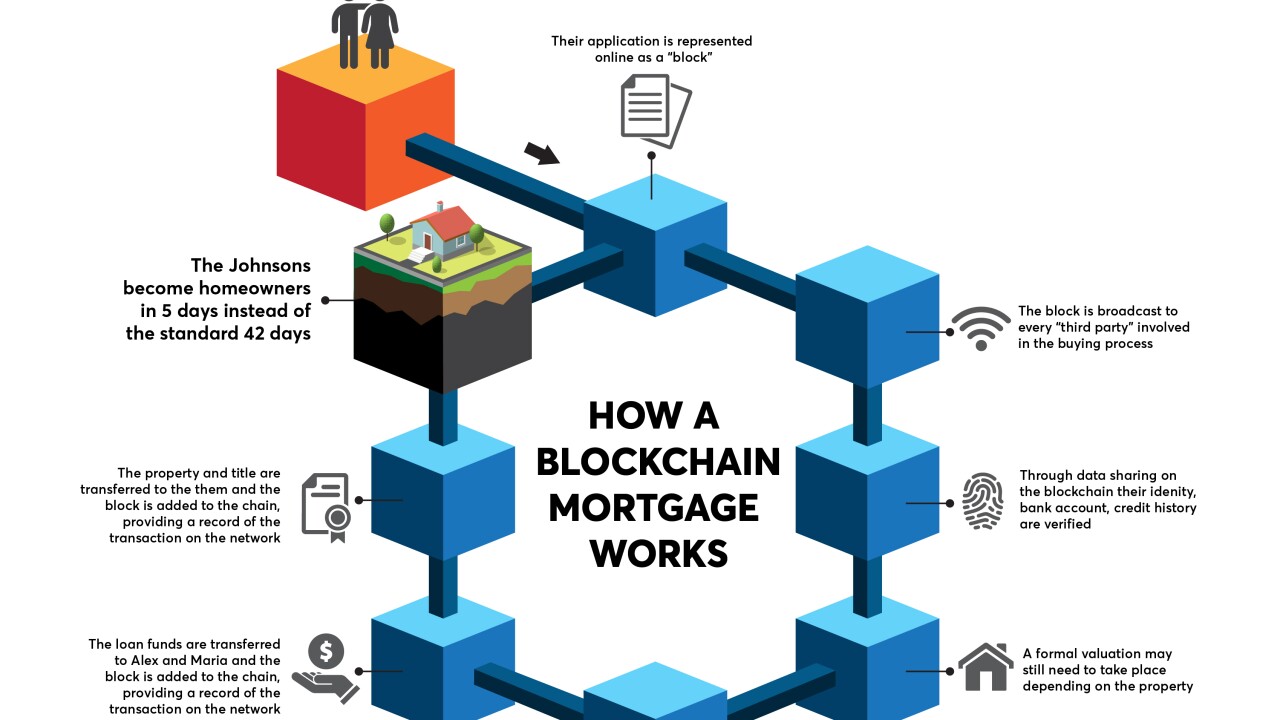

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

CoreLogic, which has already acquired several appraisal technology and services vendors, snagged another one with its purchase of a la mode technologies.

April 12 -

Automating the mortgage process will force tighter margins, but drive higher volume, for lenders.

April 12 HouseCanary

HouseCanary -

The bank says its partnership with Lender Price will help streamline and simplify its home loan process.

April 12 -

While the mortgage industry heads in a digital direction, homebuyers are still expecting a more electronic experience during the mortgage process, which would also stand to benefit lenders.

April 11 -

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

Ranieri Solutions, a fintech investment firm in the mortgage space, has partnered with blockchain and smart contract company Symbiont to explore opportunities to implement blockchain technology in the mortgage industry.

April 6 -

While mobile applications have become increasingly present in the originations segment of the mortgage industry, they're now making their mark in the servicing space.

April 5 -

While the industry continues adopting digital mortgage methods, homebuyers expect to be able to apply for a mortgage and complete the application online, but still want human interaction, according to Ellie Mae.

March 20 -

Quicken Loans affiliate Amrock Inc. is appealing a jury verdict ordering it to pay $706.2 million to analytics company HouseCanary in a legal dispute over a software licensing agreement.

March 19 -

Hope LoanPort will receive funding and guidance to expand its loss mitigation platform for servicers, housing counselors and mortgage borrowers from the Finance of America Foundation, a nonprofit with ties to former Rep. Barney Frank.

March 13 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13