-

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

Today's mortgage broker is tech savvy, sophisticated and better equipped to thrive in a wholesale channel that's far more competitive than in the past.

March 8 -

The bank will spend an additional $1.4 billion on technology in 2018 to gain share and boost efficiency, executives said Tuesday. But they were peppered with questions about whether the big investment will yield a big financial return down the road.

February 27 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16 -

Banco Santander joined existing investors JPMorgan and USAA as well as others in raising $25 million in secondary-round financing for Roostify, which seeks to build a paperless mortgage process.

February 15 -

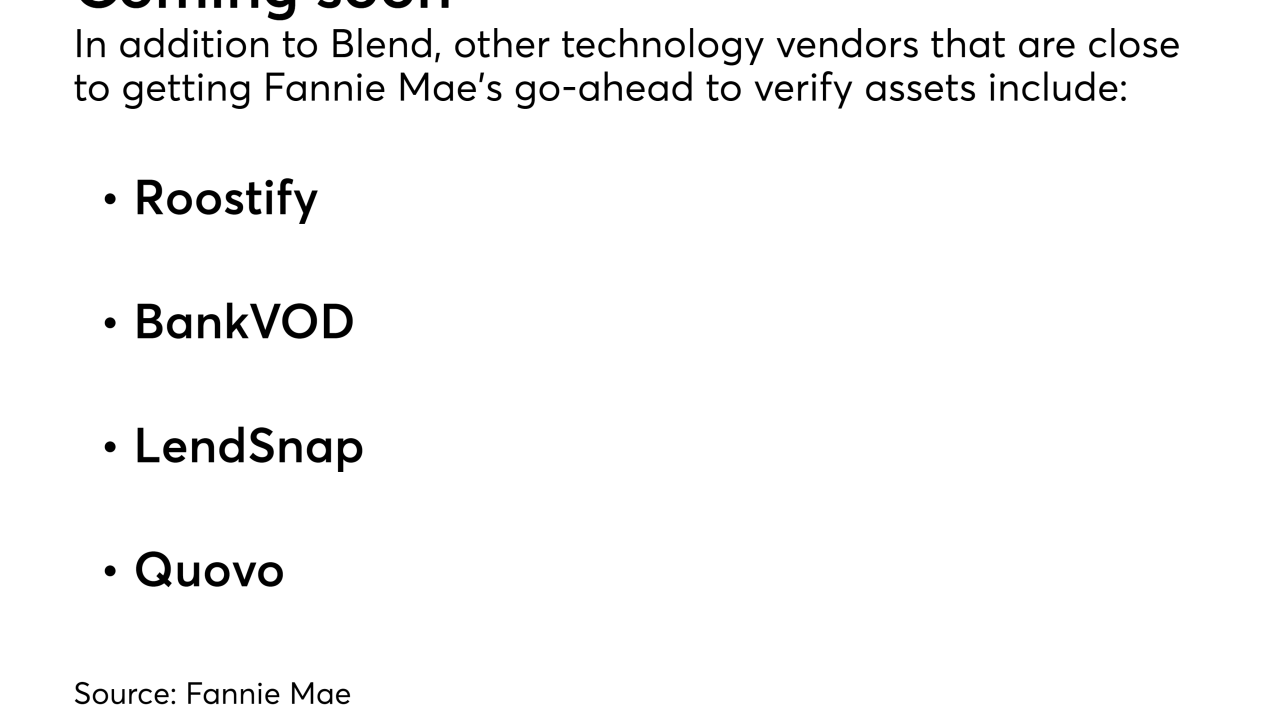

Fannie Mae is doing more to expand its list of Day 1 Certainty report suppliers, naming Blend as the first online point of sale system to directly offer asset validations.

February 13 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

From insights about borrower payment preferences to new automation assisting with natural disaster recovery efforts, here's a roundup of news coming out of the Mortgage Bankers Association Servicing Conference.

February 7 -

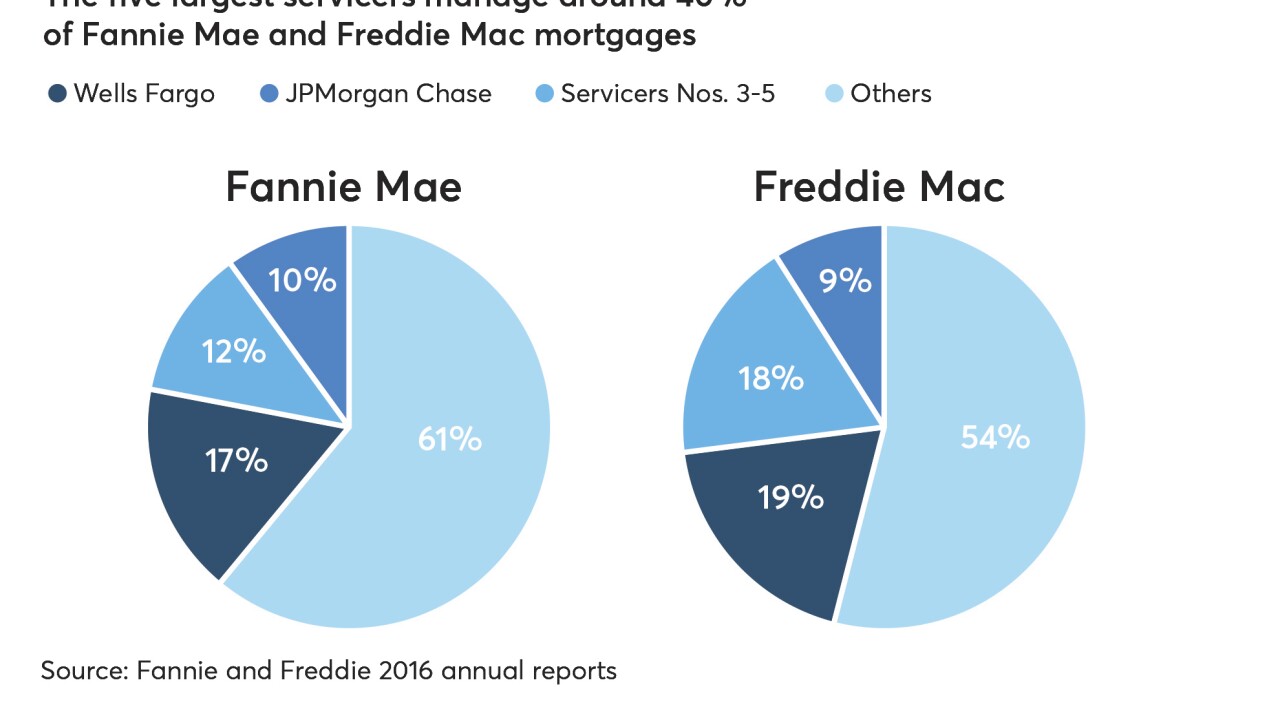

Wary of concentration risk, secondary market participants are backing initiatives to give more players a piece of the action.

February 6 -

From responding to natural disasters to emerging technology strategies, here's a look at six top trends on the agenda for the 2018 MBA Servicing Conference.

February 2 -

QuestSoft is buying data verification and audit services firm Investors Mortgage Asset Recovery Co. at a time when lenders are more widely using technology to verify information.

February 1 -

Compliance is a significant cost center for mortgage lenders. But with bulk rates, technology and better process management, some lenders have found new ways to reduce the burden.

January 29 -

Roostify has integrated its mortgage transaction technology into LendingTree's lead generation system, creating a seamless path from product search through closing.

January 26 -

LoanDepot Inc., a mortgage lender basing its growth around digital applications, isn't giving up on humans' role in the home-buying process just yet.

January 23 -

A group of big financial institutions wants to use the blockchain to make it easier and less costly to track home mortgages packaged into securities.

January 18 -

Startups that have developed the technology for real estate finance are starting to conduct a broader array of transactions, including property sales.

January 2 -

With recommended reads from Chase Mortgage's Mike Weinbach, New American Funding's Patty Arvielo and more, check out these 13 books every mortgage pro should have on their winter reading list.

December 29