-

Foreclosure activity continues to subside and most of the regulatory reforms created to protect distressed borrowers have been implemented. Yet mortgage servicers still haven't fully resolved the operational challenges facing their business.

April 28 -

Black Knight Financial Services has added an application program interface to its loan origination system that will allow consumers and loan officers to access it more easily through mobile devices.

April 21 -

Robotics and other forms of intelligent automation is already helping lenders and servicers increase capacity and redeploy staff to more customer-centric tasks.

April 13 National Mortgage News

National Mortgage News -

Robotic process automation makes cumbersome loan manufacturing tasks more efficient and consistent, providing lenders and servicers with an opportunity to focus employees on activities that enhance the customer experience and increase capacity.

April 13 -

Love 'em or hate 'em, the mortgage business is full of jargony abbreviations. Test your mortgage knowledge on these key industry terms.

April 13 -

By replicating human tasks, robotic process automation technology is driving scale and efficiency in loan manufacturing.

April 11 -

The Federal Housing Administration needs additional funds to replace a 1960s-era computer operating system and make other necessary tech updates.

April 10 -

Churchill Mortgage is providing its loan officers with third-party technologies they can share with consumers to help would-be borrowers shop for homes and manage their budget.

April 5 -

loanDepot has invested $80 million in a three-part digital lending platform called mello and is opening a 65,000-square-foot technology campus in Irvine, Calif.

March 31 -

Lenders can track the effectiveness of product pricing changes on a real-time basis using a new market share analytics tool from Optimal Blue.

March 30 -

From blockchain to digital labor, here's a recap of the best moments and insights from the Mortgage Bankers Association's 2017 technology conference.

March 30 -

The industry expects to lean on technological efficiencies this year as higher rates and dwindling refinances test their businesses.

March 28 -

Fintech could cut the closing times on the simplest home loans by more than 50%, but the mortgage business' complexity means there are limits to how much time and money can be saved.

March 28 -

Here's an early look at what technology developers will be doing to dazzle and impress lenders and servicers during the Mortgage Bankers Association's technology conference in Chicago.

March 24 -

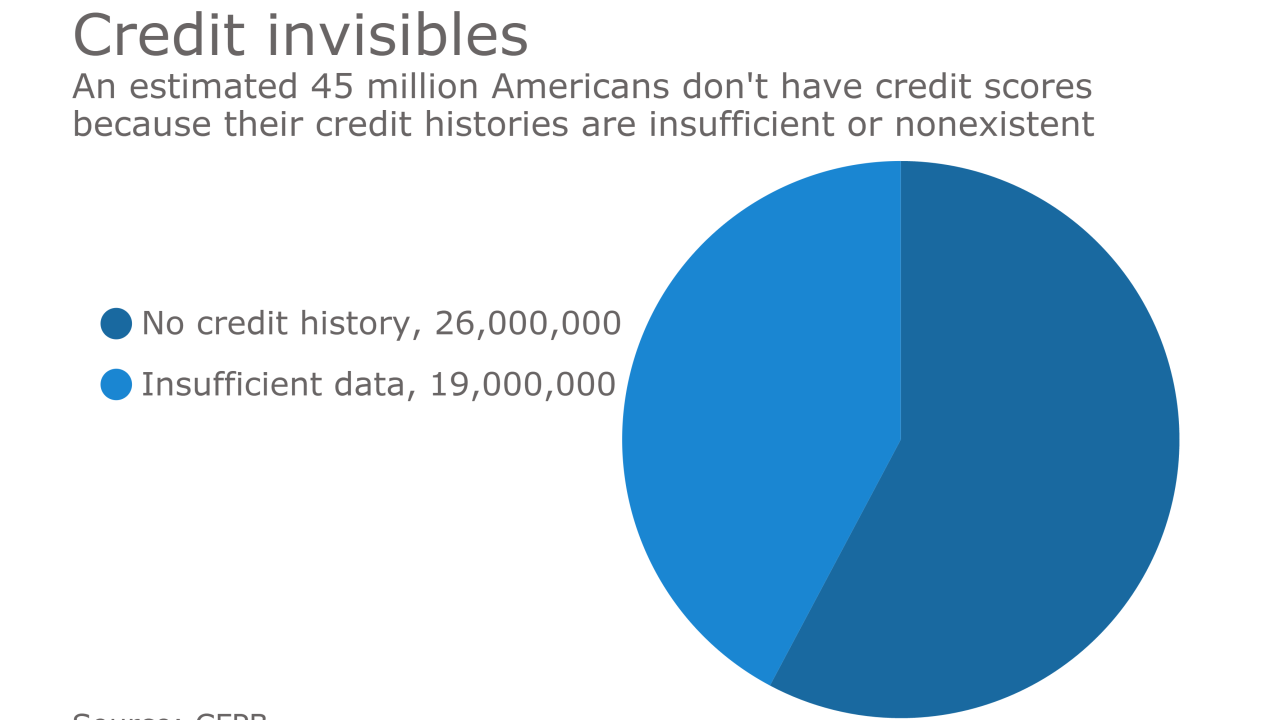

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

Experian and Finicity have released a product that aims to speed up decisions on mortgage applications, using financial data aggregation technology.

March 20 -

A startup lender is catering to tech-savvy, do-it-yourself borrowers by using online and mobile tools to replace the upfront sales and marketing work of salespeople.

March 17 -

Black Knight Financial Services is bringing its Empower loan origination system to midsized mortgage lenders by offering a preconfigured version of its highly customizable platform.

March 16 -

Dramatic shifts in borrower expectations and a growing purchase market have elevated consumer-direct mortgages from a refi-driven channel to an alternative for staff-heavy lending to homebuyers.

March 14 -

At a time when mortgage companies are adding both staff and automation to cater to borrowers' changing needs, one lender has developed a distinctive compensation plan that leverages servicing revenue to encourage retention and recruitment of top producing loan officers.

March 13