-

The software provider’s offering hit the top of its price range estimate and started trading at $18 per share.

July 16 -

One provision calls for the Consumer Financial Protection Bureau to look at unfair, deceptive or abusive acts and practices regarding competition.

July 16 -

The new deal will remove manual bid taping and automate secondary loan sales directly on the Encompass platform.

July 15 -

This is the second acquisition in the private equity firm’s newly established technology vertical.

July 7 -

The company is looking to sell 20 million shares, with a 3 million underwriters' option, at between $16 and $18 per share.

July 6 -

The deal comes after a tumultuous 12-month period for CoreLogic, which saw itself twice targeted for acquisition.

June 30 -

Lending startup Tomo Networks will eschew refinances to focus exclusively on purchases.

June 30 -

The move is a vote of confidence for the private market in financing, which has been revitalized by limits government-related investors have put on certain loan purchases.

June 23 -

The company plans on trading on the New York Stock Exchange under the ticker symbol BLND

June 21 -

While usage of this process in mortgage closings picked up steam last year, only 34 states have permanent laws in place and two do not permit it at all.

June 21 -

Consumer-permissioned access to bank or payroll information could be used to evaluate borrowers who still need relief after payment suspensions for pandemic-related hardships end.

June 16 -

The real estate technology company had a $498 million valuation, according to PitchBook, but it could get a sizable premium to that if it were to go public.

June 15 -

The long-time title and mortgage technology industry executive wants to reduce the number of public company boards he serves on.

June 14 -

There are plans to incorporate the code into the Encompass eClose product, which will allow for secure storage of digital mortgages and notes.

June 11 -

In the aftermath of 2020’s historic year of mortgage originations, lenders are concerned with keeping employees and insulating themselves from the negative effects of the boom and bust cycle, according to a survey from The Mortgage Collaborative.

June 8 -

The digital title insurance, closing, escrow, and recording services provider has now raised a total of $110 million in funding.

June 2 -

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

Rather than completing another equity raise, the five-year-old mortgage technology company went looking for a partner.

May 27 -

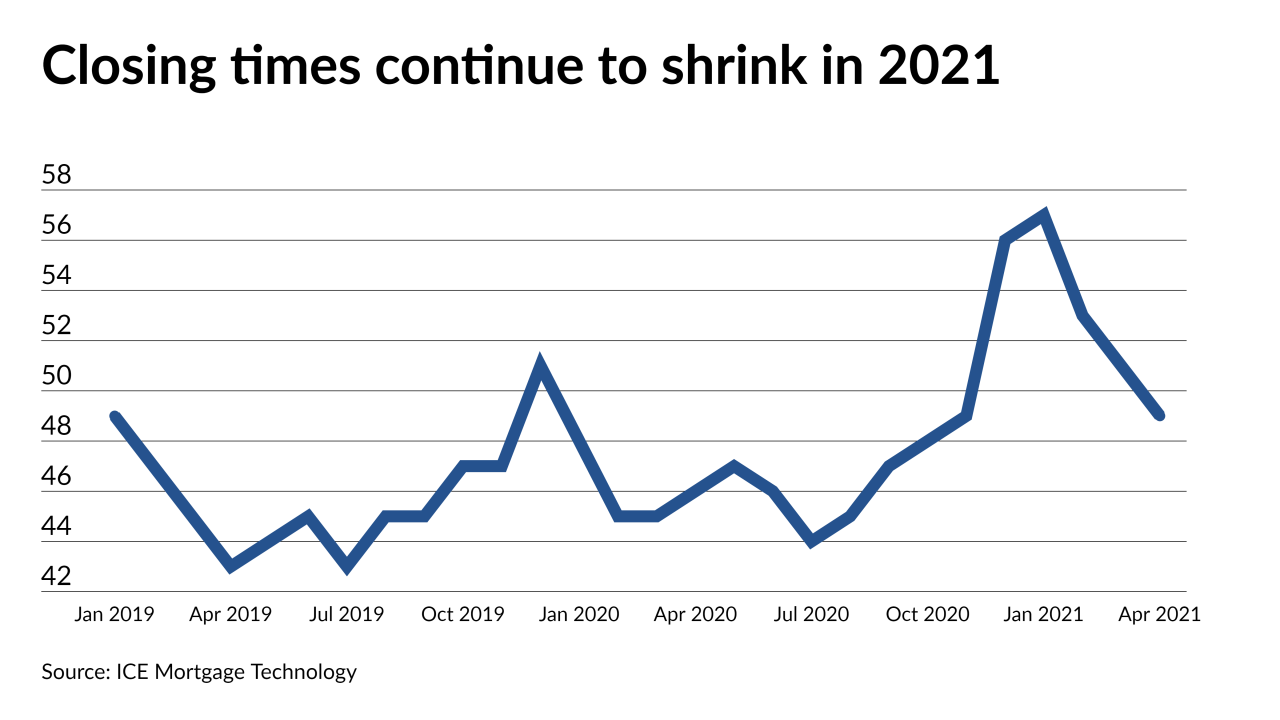

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

The cloud-based mortgage closing platform’s Series D round earned $150 million for the company.

May 25