-

Bee Mortgage App will use blockchain and automation provided by Elphi to create "a COVID tool for real estate agents" to get fully digital mortgage approval in under three minutes.

November 25 -

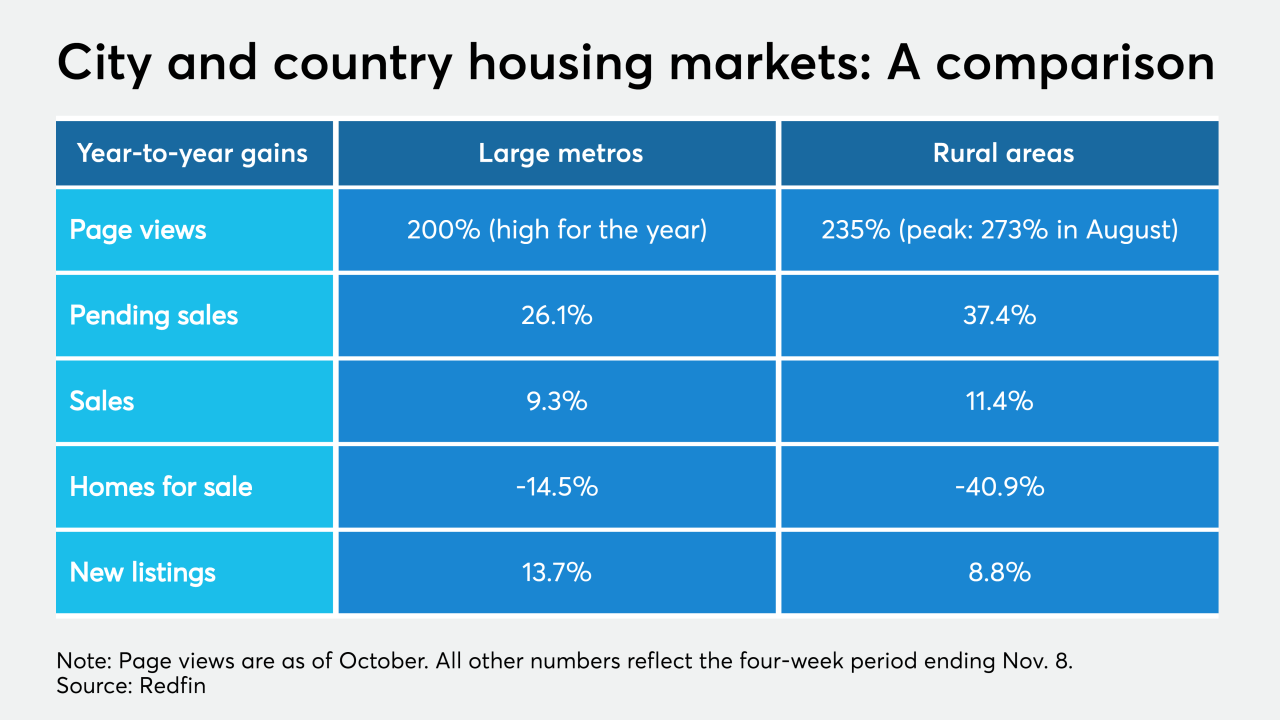

The year-over-year increase in monthly page views for properties hit a high for the year in large metropolitan areas as gains in rural locations decelerated.

November 25 -

To truly manage risk, banks must invest in more sophisticated modeling, reporting and analytics to track market movements and ultimately maximize profitability, Vice Capital Markets’ Christopher Bennett says.

November 19 Vice Capital Markets

Vice Capital Markets -

The move follows a report last year that the government-sponsored enterprise was looking into working with the provider of artificial intelligence-driven credit-risk models.

November 19 -

Use of mortgage technology was fast-tracked due to coronavirus lockdowns and kept the lending industry humming, laying the foundation for a greater share of digital closings in 2021.

November 19 -

After ending their hostile bid, the two investors continued their push for greater control of the mortgage technology company.

November 17 -

The substantial Series D fundraise fuels speculation on whether Better.com will be the next mortgage company to hop on the IPO trend.

November 13 -

The draft IPO filing for its Class A shares follows speculation that it would follow the lead of Rocket Cos. and other nonbank lenders in going public.

November 11 -

The company reached a new record high for closed loan volume, and reported a cyclical drop in gain-on-sale margins reflecting changes in its product and channel mix.

November 11 -

The price for the commercial valuation and budgeting technology company was not disclosed.

November 4 -

The technology rolled out by the Department of Housing and Urban Development aims to provide lenders with immediate and expanded responses related to Federal Housing Administration insurance eligibility.

November 2 -

Two investors pushing CoreLogic Inc. to explore a sale won partial support from a prominent shareholder advisory firm, which urged shareholders to support three of the dissident group’s nominees for the board.

November 2 -

The bank operating system’s integration with a technology platform for construction loans adds to indications of nCino’s increasing relevance to real estate-secured lending.

October 29 -

The company said it is "engaging with third parties" that are reportedly willing to pay at least $14 per share more than Senator Investment and Cannae Holdings.

October 28 -

-

After nearly a year in the works, Roostify takes a "strategic bet" on a partnership with Google, aiming to unlock a fully automated loan process.

October 23 -

The Libor transition is creating huge headaches for the industry; harnessing AI technologies may be the key to tackling it.

October 23 ABBYY

ABBYY -

The war of words between Senator Investments, Cannae Holdings and CoreLogic continues in the run-up to the Nov. 17 special shareholders meeting.

October 23 -

The coronavirus pandemic has turned every industry on its head. For lending, it exposed the need for modernized, fully digital platforms.

October 22 -

HUD Deputy Secretary Brian Montgomery questioned "whether we could ever totally accept desktop-only appraisals" at the Mortgage Bankers Association conference this week.

October 21