-

A culture that celebrates diversity, fun, and an employee-driven value system.

January 29 -

National Mortgage News presents the second annual Best Mortgage Companies to Work For — a survey and awards program dedicated to identifying and recognizing the industry's best employers and providing organizations with valuable employee feedback.

January 29 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

Blend, a vendor that outfits some of the biggest banks and other lenders with consumer-facing digital mortgage technology, has released a new mobile application for mortgage professionals.

January 17 -

A recent earthquake is adding to servicing challenges in Puerto Rico caused by multiple natural disasters, power outages and some companies' insufficient use of technology, according to one vendor.

January 13 -

Quicken Loans, which has a history of advertising its Rocket Mortgage digital application with high-profile Super Bowl promotions, is doubling down on its ties to the National Football League event.

January 7 -

Sagent Lending Technologies has agreed to buy ISGN Corp. in a deal that would enlarge the company's loan servicing division.

December 24 -

There are no statutory restrictions on the books in any state prohibiting lenders from conducting mortgage closings electronically or remotely.

December 20 NotaryCam

NotaryCam -

In a recent interview, Plaza Home Loans CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

In a recent interview, Plaza Home Mortgage CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

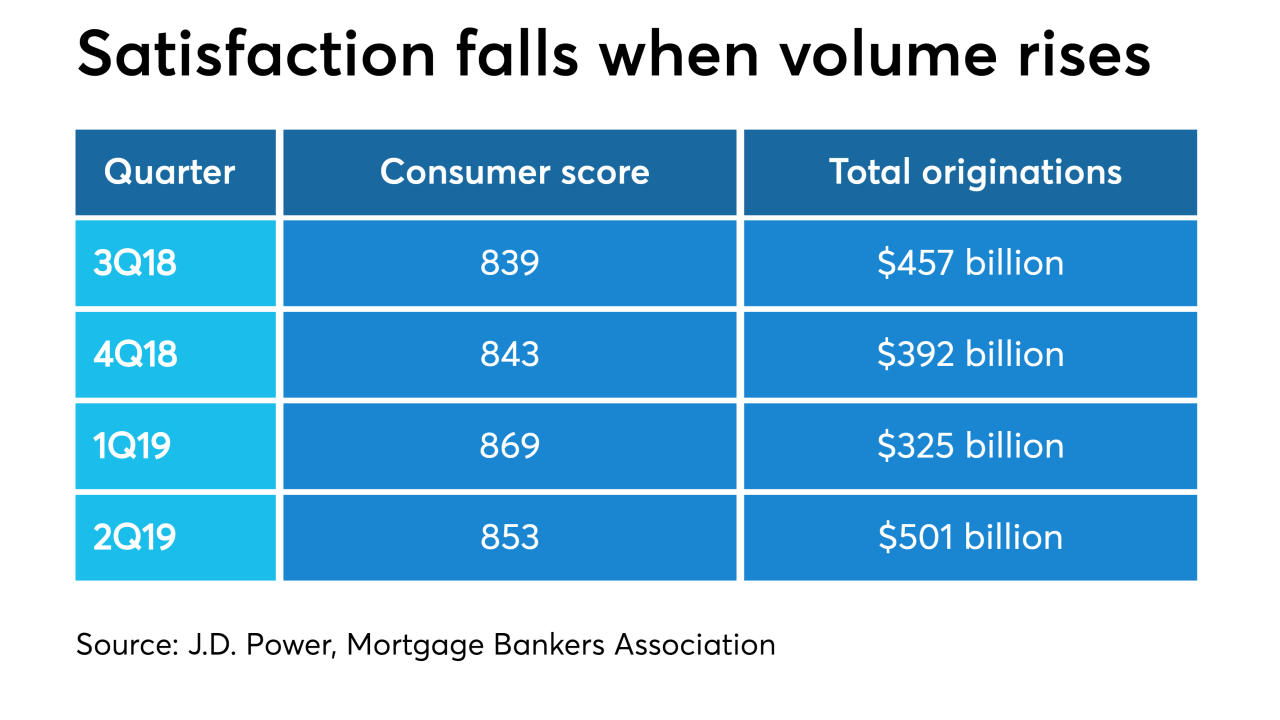

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

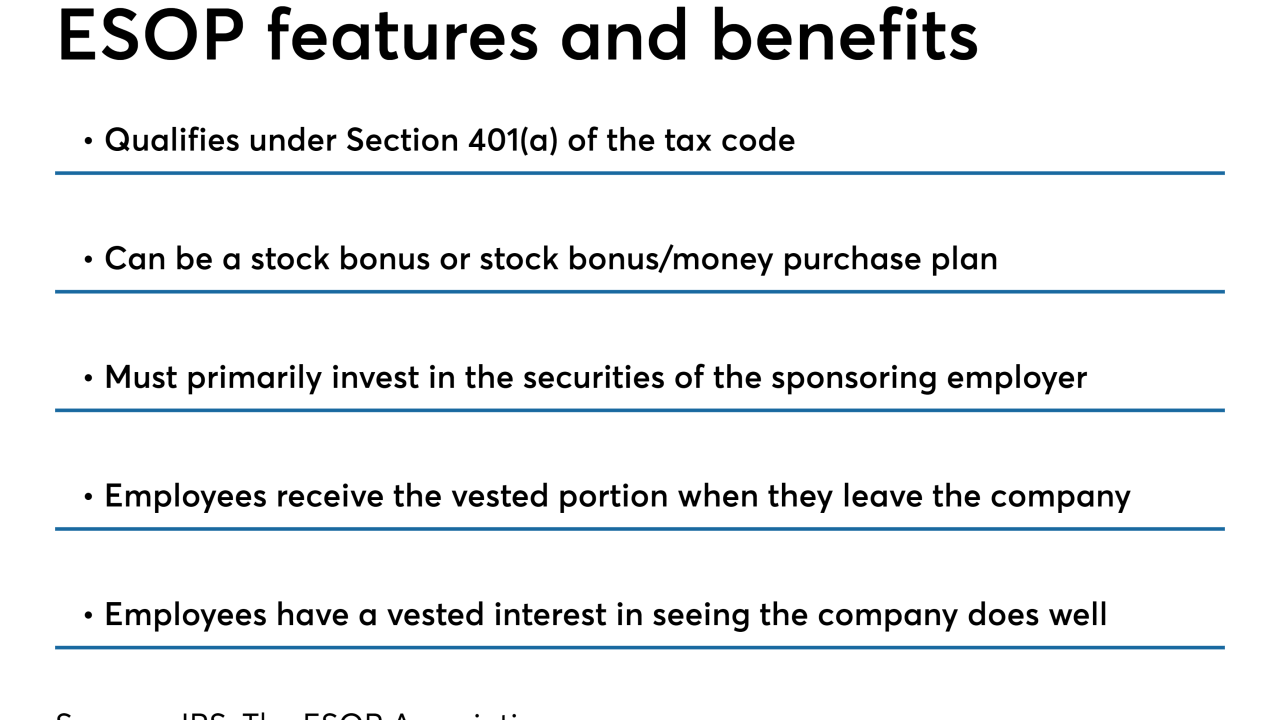

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

IndiSoft will continue to support the distressed-borrower assistance platform formerly known as Hope LoanPort after the nonprofit that runs it winds down operations at the end of this year.

November 11 -

In the latest example of a new wave of mortgage-related fintech investment, Snapdocs will boost its artificial-intelligence capabilities with its new $25 million funding round.

November 7 -

Brent Chandler of FormFree, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans share their Digital Mortgage 2019 highlights

November 7 -

Rick Lang of Freddie Mac, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans discuss the key objectives – from customer experience to system integrations – that mortgage companies are pursuing through digitalization.

November 7 -

Aaron King of Snapdocs, Brent Chandler of FormFree, Tim Mayopoulos of Blend, and Chris Backe of Ellie Mae talk about system fragmentation, data access issues, personnel management and other hurdles that still stand between the industry and comprehensive digitalization.

November 7 -

Black Knight and PennyMac Financial Services are suing each other in separate disputes linked respectively to the latter's creation of a servicing platform and the former's dominant position in the market.

November 6 -

The average number of attempts to defraud mortgage companies each month increased by 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions.

October 29