-

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

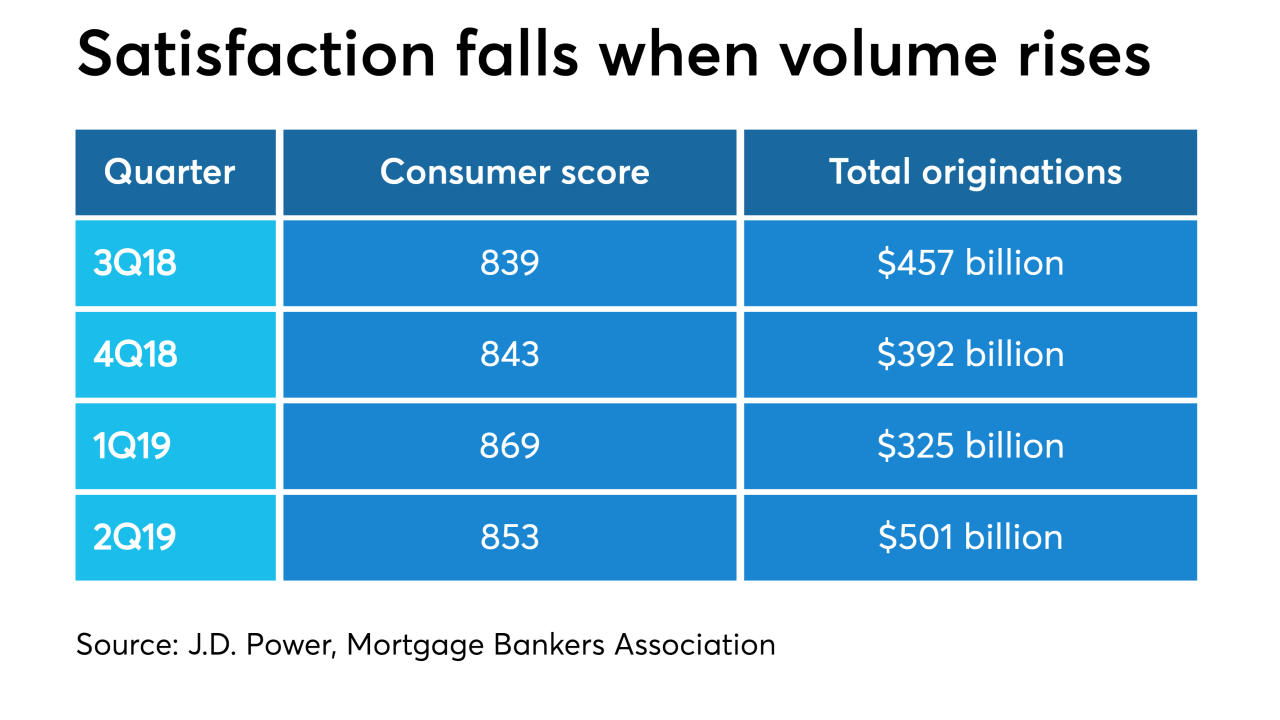

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

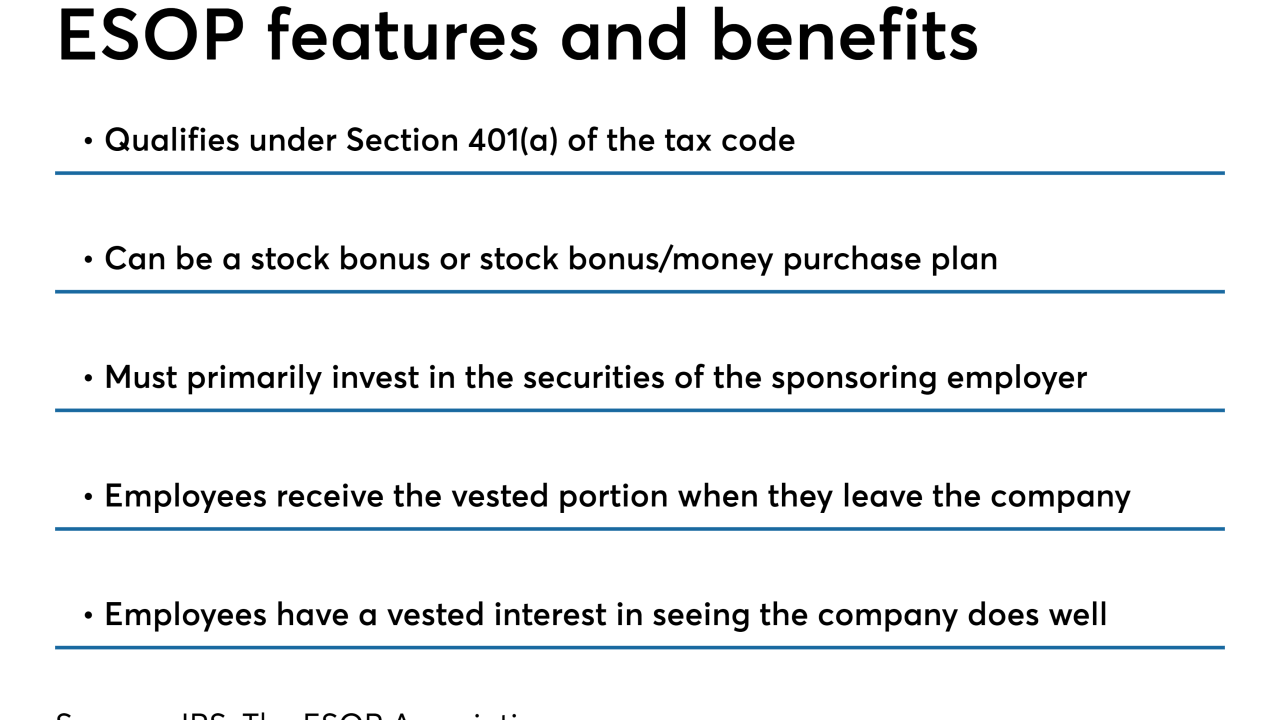

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

IndiSoft will continue to support the distressed-borrower assistance platform formerly known as Hope LoanPort after the nonprofit that runs it winds down operations at the end of this year.

November 11 -

In the latest example of a new wave of mortgage-related fintech investment, Snapdocs will boost its artificial-intelligence capabilities with its new $25 million funding round.

November 7 -

Brent Chandler of FormFree, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans share their Digital Mortgage 2019 highlights

November 7 -

Rick Lang of Freddie Mac, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans discuss the key objectives – from customer experience to system integrations – that mortgage companies are pursuing through digitalization.

November 7 -

Aaron King of Snapdocs, Brent Chandler of FormFree, Tim Mayopoulos of Blend, and Chris Backe of Ellie Mae talk about system fragmentation, data access issues, personnel management and other hurdles that still stand between the industry and comprehensive digitalization.

November 7 -

Black Knight and PennyMac Financial Services are suing each other in separate disputes linked respectively to the latter's creation of a servicing platform and the former's dominant position in the market.

November 6 -

The average number of attempts to defraud mortgage companies each month increased by 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions.

October 29 -

Loan origination system provider Ellie Mae has agreed to purchase mortgage technology firm Capsilon, citing the growing appeal of artificial intelligence-driven automation and interest in becoming more active as an acquirer.

October 29 -

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

Denver beat out Salt Lake City to snag another technology firm looking to escape the Bay Area's escalating costs.

October 24 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

The next phase of the digital mortgage revolution is starting and lenders need to use a holistic process to create their plans in order to get up to speed.

October 23 Capco Consulting

Capco Consulting -

BSI Financial's chief executive weighs in on changes in the interest rate environment, the evolution of digital mortgage servicing and natural disasters.

October 21 -

Many mortgage servicers are still relying on spreadsheets to manage their tasks, rather than looking to automation as a problem solver.

October 17 Clarifire

Clarifire -

The Minneapolis company attributed the uptick to new tech tools, additional loan officers and other process improvements — not to mention the refi boom fueled by lower rates. It’s a formula other banks are expected to copy.

October 16 -

Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to Fannie Mae.

October 16 -

The ways in which hedging can be improved by a digital process are more often than not presumed versus proven by industry practice.

October 11 Vice Capital Markets

Vice Capital Markets