-

While qualifying got a little tougher for entry-level buyers with lower incomes in November, some other prospective borrowers had an easier time of it.

December 10 -

This group of homeowners has greater financial obligations than any generation before them and largely aren’t aware of how they can make use of their home as an asset, a survey from Hometap found.

December 8 -

Borrowers who make at least a 10.01% down payment will not be required to obtain this form of credit enhancement, as these loans are not being sold to Fannie or Freddie.

November 17 -

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

Even though one aspect of these lending standards is becoming more flexible, some say they still don’t always meet the needs of borrowers like delivery workers employed on a contract basis.

November 12 -

But overall, customers are less satisfied with their origination experience compared with the 2020 survey, according to J.D. Power.

November 11 -

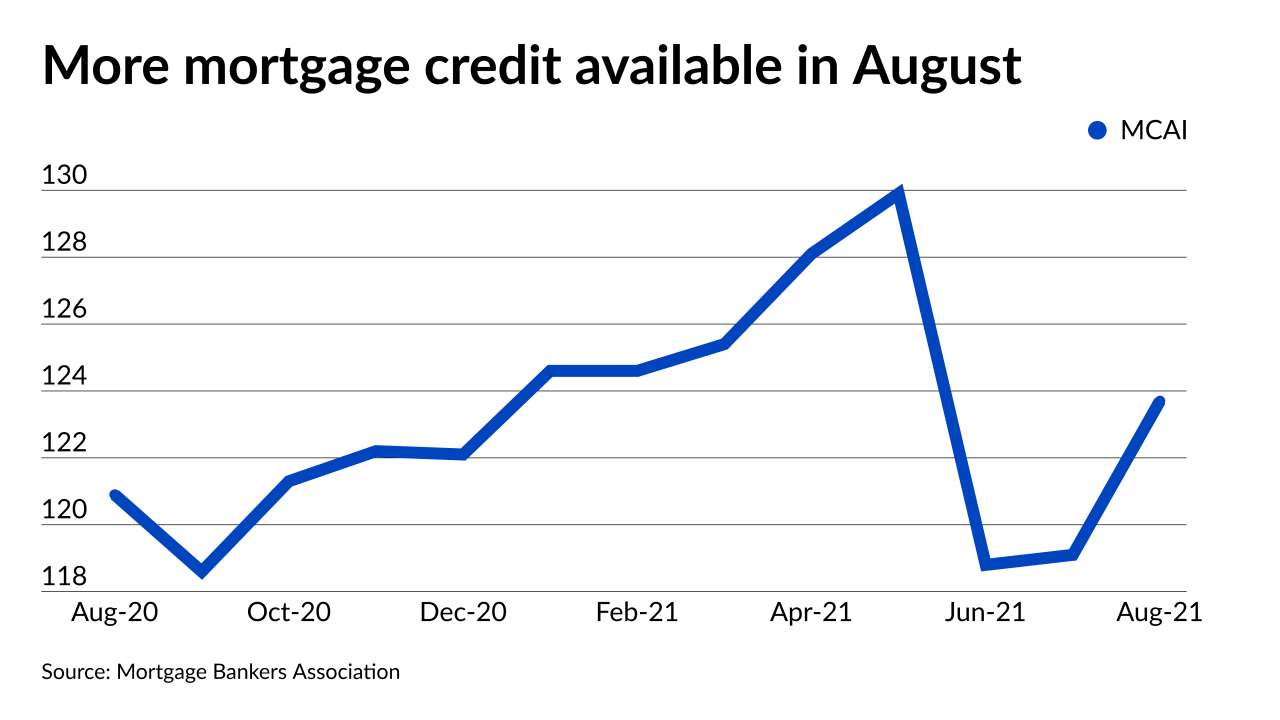

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Values are predicted to increase by just a fraction of the rate they had in 2020, CoreLogic said.

November 2 -

The financial services technology provider will leverage multiple data sources to verify borrower salaries at a “flip of a switch.”

October 20 -

Gain on sale has dipped 130 basis points per loan since the third quarter last year, but over the same period, per loan expense is up by $1,216.

October 19 -

The higher dollar amounts could be a way for companies to drive volume at a time when rates are increasing.

October 12 -

The real estate franchisor will retain its full ownership in the title agency, escrow and settlement services business.

October 7 -

Other providers like DocMagic and SimpleNexus offer similar services to originators who have yet to adopt the technology in substantial numbers.

October 6 -

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1 -

The filing by Tamara Richards also accused the founder and other execs of encouraging a "frat house" environment that mistreated women.

September 24 -

The move generally gets a thumbs up from industry participants, but what can happen in the long-term is uncertain.

September 15 -

The companies talk through their products aimed at making the processes safer and more inclusive for consumers.

September 14 -

The underwriter also agreed to assist in the New York Attorney General's investigation of no-poach agreements in the title industry.

September 10 -

The company will roll out the program it has been piloting, Appraisal Direct, nationwide on Oct. 1.

September 9 -

But refinance volume was constrained in recent weeks and many of the new offerings are aimed at low income borrowers, the Mortgage Bankers Association said.

September 9