-

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

Mr. Cooper plans to hire an additional 2,000 employees by the end of this year as record low interest rates spur home purchases and mortgage refinancings.

September 2 -

Inconsistent loan processing was a pain point for Remax's Motto Mortgage franchisees and the acquisition should solve that, executives said.

September 2 -

-

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

In the past, the people that close the loan have been left out of developing this technology.

August 19 International Document Services Inc.

International Document Services Inc. -

There are five separate note offerings with maturities ranging from 2023 to 2060.

August 18 -

All states that had licensing restrictions related to remote work temporarily lifted them due to the pandemic, but whether those changes could become permanent remains to be seen.

August 17 -

May’s overall delinquency rate was up over 100% from the prior year.

August 11 -

Scheduling the meeting will remove uncertainty for CoreLogic shareholders over the hostile bid, its board said.

August 10 -

Conditions have improved for the first time since November.

August 6 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

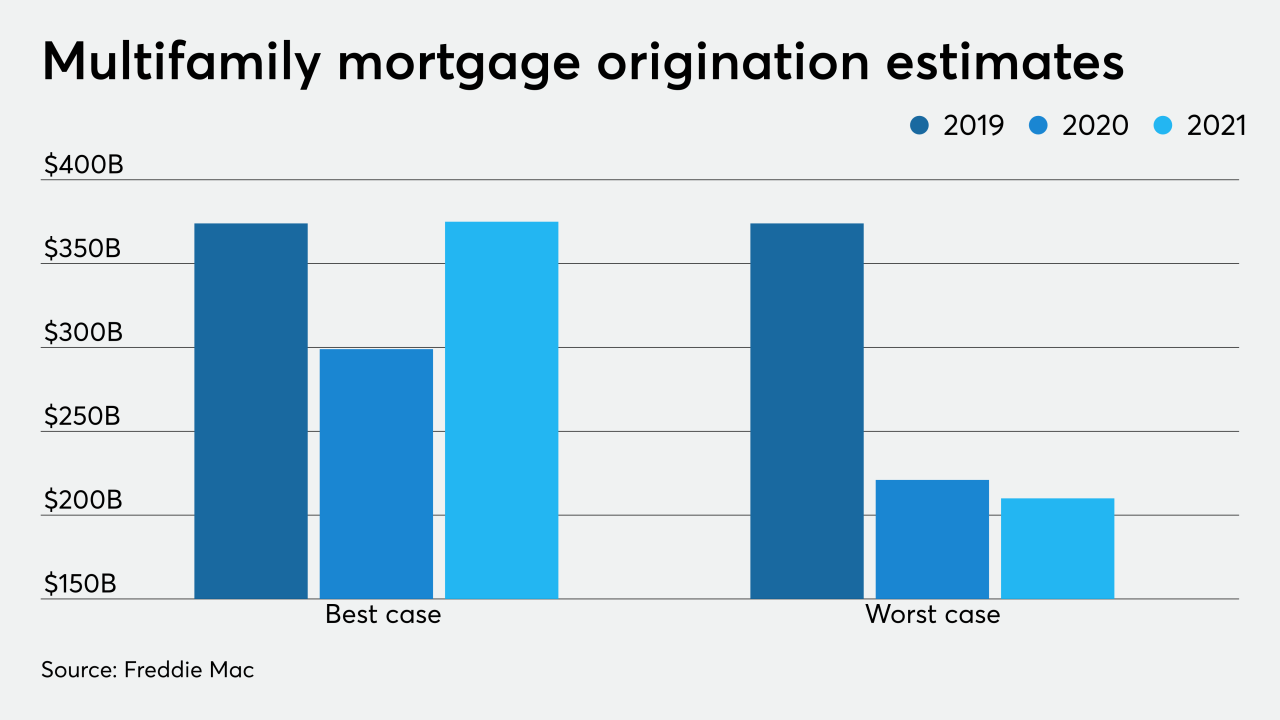

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

The investors seeking to take over CoreLogic plan to solicit support from fellow shareholders to replace nine directors, after the company refused to engage in talks over their $7 billion proposal to take it private.

July 29 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

Optimal Blue is being combined with Compass Analytics.

July 27 -

Citing possible exploitation, Bank of America instituted a policy that put limits on loans to persons in guardianship. It later ended the policy.

July 24