-

Dollar losses from business email compromise attacks, many of which target real estate transactions, grew to $2.4 billion last year from $1.8 billion in 2020, a Federal Bureau of Investigations report found.

March 23 -

But since every customer’s case is different, it is hard to quantify how large a boost borrowers might get by not having this information on file.

March 22 -

Production costs reached a high as secondary-market loan sale margins continued to decline.

March 22 -

The effect is likely to be felt in consumer debt burdens and application misrepresentations, industry leaders say.

March 17 -

As the rising rates shrink the number of potential customers, mortgage brokers are seeking these products in order to keep business up.

March 16 -

The mortgage payments fintech completed a $31 million Series C capital raise with Bain Capital Ventures and SignalFire as the lead investors.

March 15 -

These are the first partnerships the Encompass software creator has made with outside providers and more such integrations are expected, company leadership said.

March 14 -

However, all but one company did less business in the most recent period than during the third quarter, and new insurance written was down across the board compared with one year prior.

February 23 -

A rise in reverse occupancy fraud is contributing to the uptick, a CoreLogic report found.

February 16 -

Using stimulus checks and money saved from lower spending were each cited by just under one-quarter of those looking to buy in the next 12 months, a Redfin survey found.

February 4 -

Rohit Chopra, the director of the Consumer Financial Protection Bureau, has cautioned banks, credit unions and fintechs about fair-lending violations that may stem from reliance on artificial intelligence. His comments threaten to discourage financial firms from using the technology to crunch nontraditional data about borrowers, experts say.

February 1 -

The co-founder of Arch Capital Solutions reviews the changes made to reporting disclosures on mortgages for condominiums and units located in HOAs that were part of a response to the tragic condo collapse in Surfside, Florida.

January 28 Arch Capital Solutions

Arch Capital Solutions -

The CEO of the Lincoln Family of Companies brand details its expansion strategy, which is unique for the settlement services business.

January 28 -

The mortgage broker business was never a driving force for the Chicago-based firm's purchase of Stearns Lending, so dropping it wasn't totally unexpected.

January 14 -

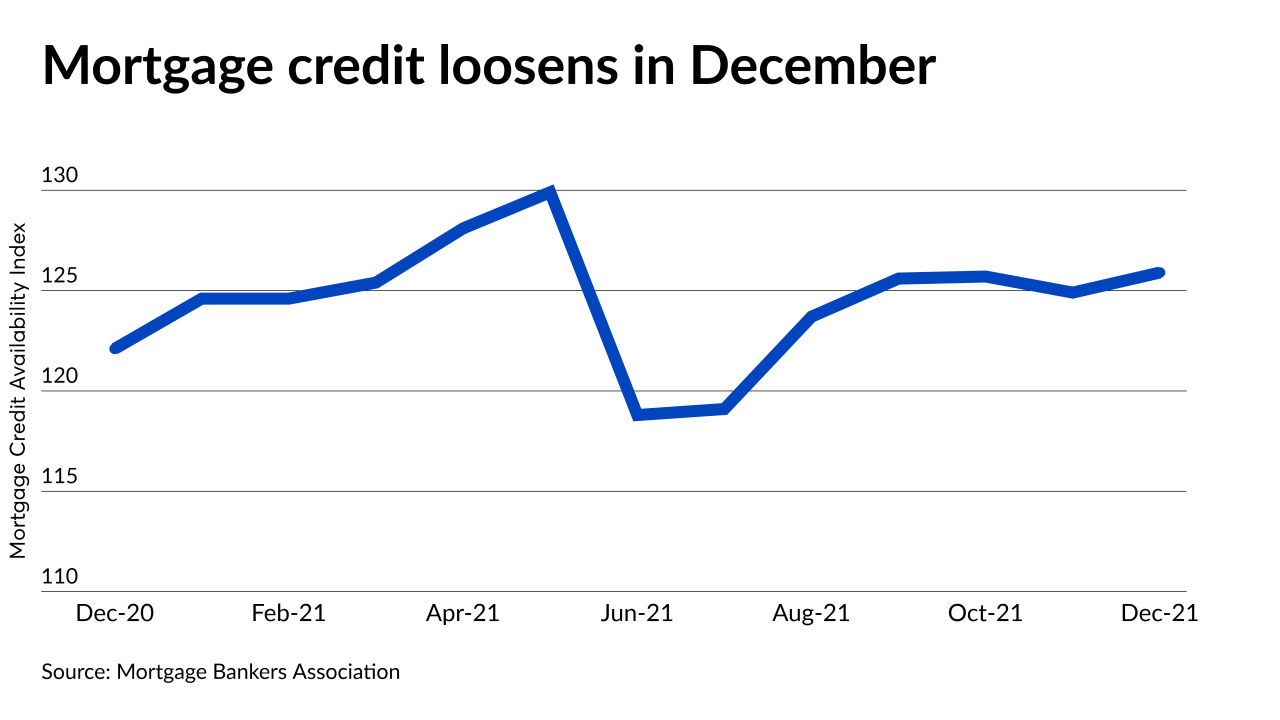

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

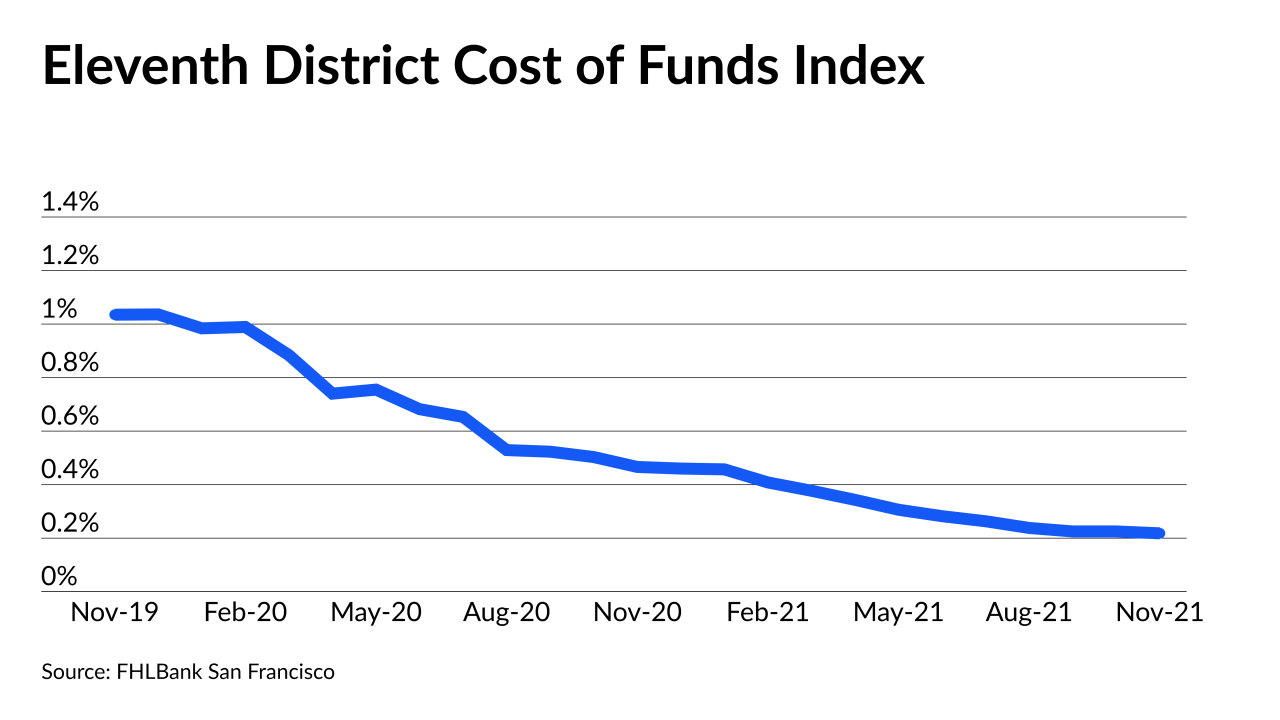

The metric’s imminent end after more than 40 years means servicers need to put replacement plans in motion if they haven’t already.

January 3 -

But low mortgage rates and higher wages are allowing borrowers to meet conforming loan underwriting terms — at least for now.

December 30 -

-

Error findings related to income and employment reached a high point since Aces Quality Management started its report in 2016.

December 14 -

Activity is down 20% from one year ago, driven by a 65% falloff in rate and term refinancings, Black Knight said.

December 13