-

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

The government-sponsored enterprises set a Sept. 30 deadline for sellers to accept applications for Libor adjustable-rate mortgages.

October 8 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

When the economy inevitably slides, leaders with a culture based on the mantra, "Treat people like family, and the money will take care of itself," won't need a miracle to survive.

October 6 Incenter

Incenter -

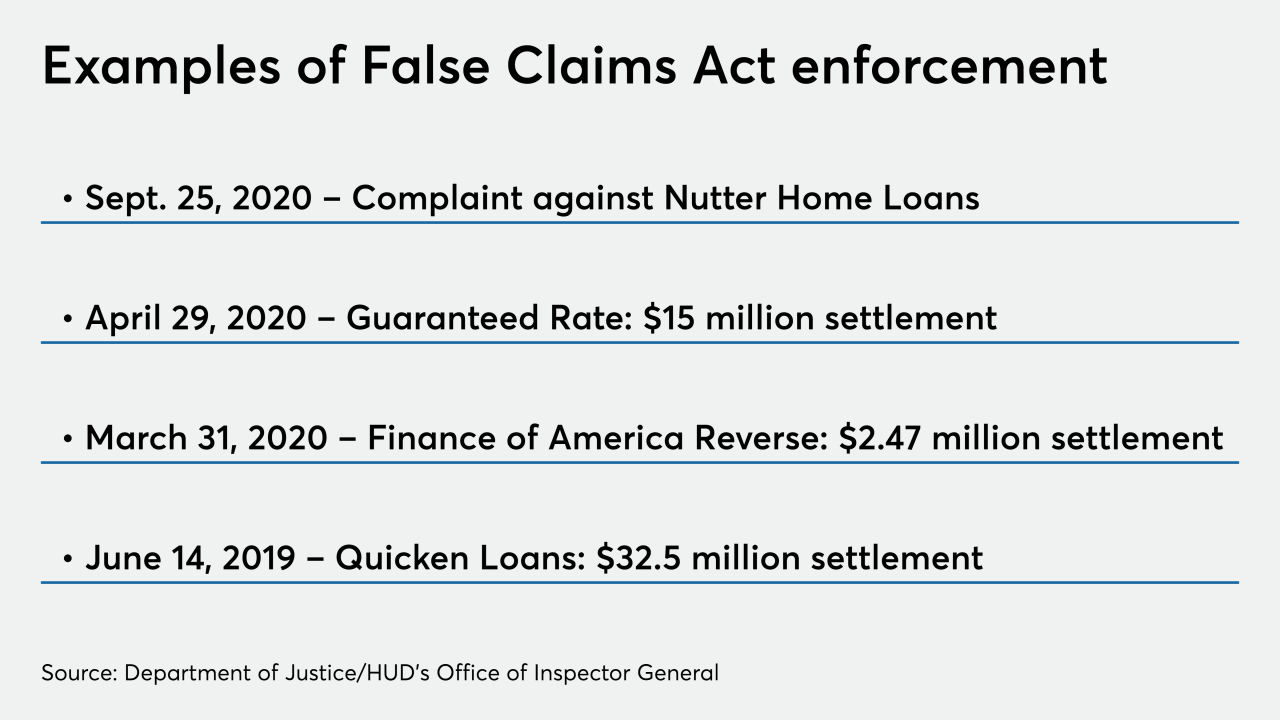

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

The donation will go through the Association of Independent Mortgage Experts in an effort to expand and diversify opportunities in the industry.

September 25 -

Retiring Ellie Mae CEO Jonathan Corr and new ICE Mortgage Technologies President Joe Tyrrell discuss how the two companies will be merged.

September 25 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24 -

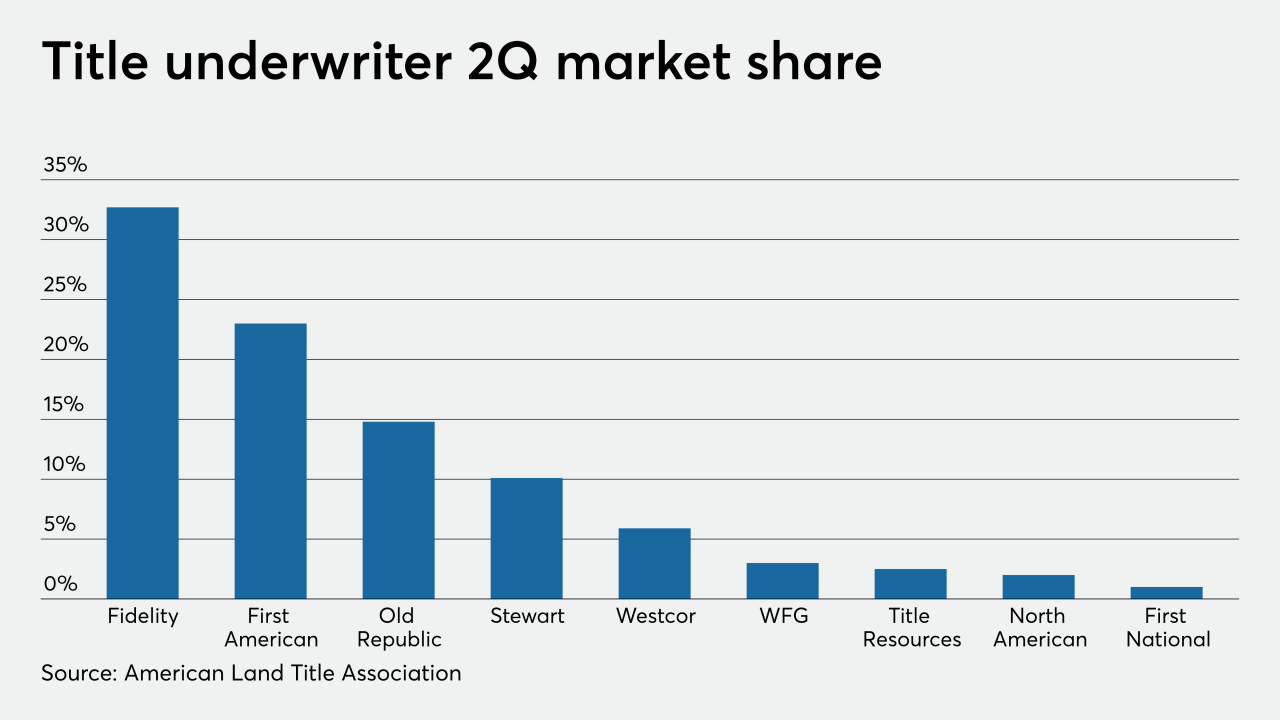

Westcor has been gaining market share, growing to 5.9% of premiums written in 2Q 2020, versus 3.4% in the first quarter of 2019.

September 21 -

Lenders and vendors are starting to realize that there are both areas in which artificial intelligence can be used more broadly, and areas in which technology’s role should be limited.

September 16