-

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

March 20 -

Mortgage industry technology providers are adjusting their processes to allow for originations to keep flowing through the system as the nation combats the coronavirus.

March 18 -

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

March 17 -

Electronic closings are a solution in efforts to limit people congregating, but there could be some state law concerns.

March 16 -

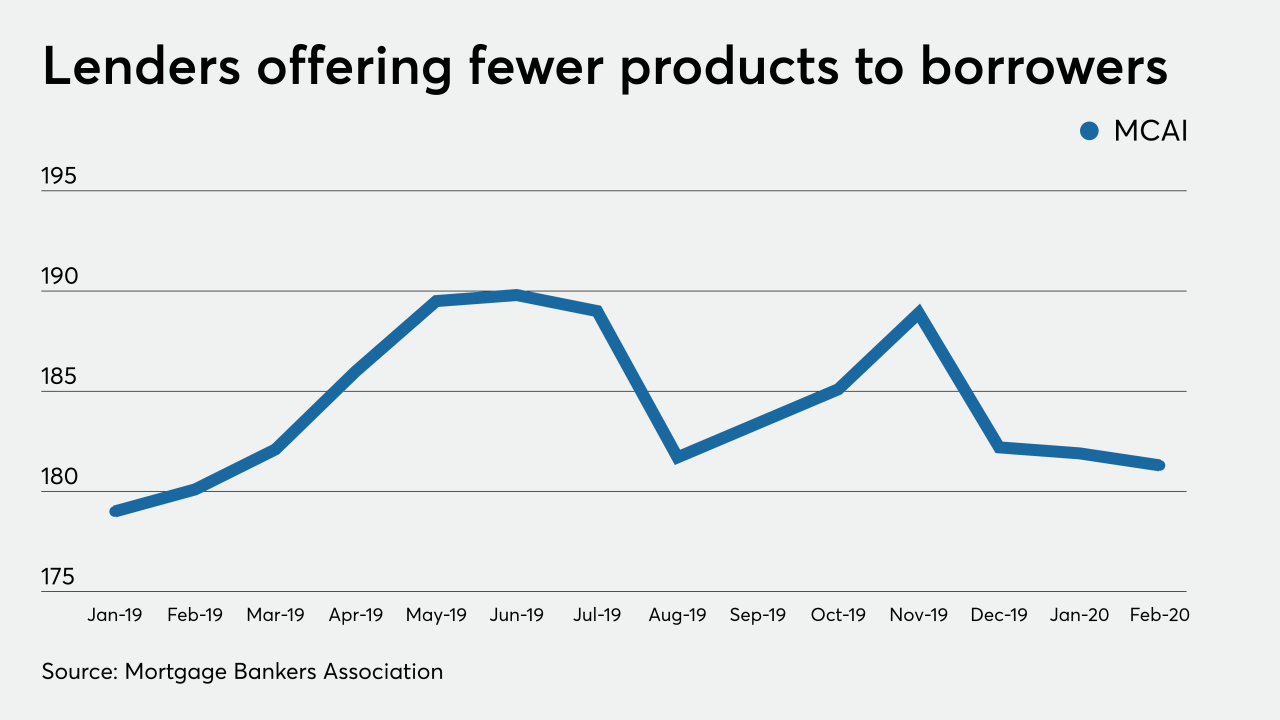

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

The dollar amount of fix-and-flip properties purchased using financing reached a 13-year high in 2019, but the share of flips financed was lower year-over-year, according to Attom Data Solutions.

March 5 -

A drop in interest rates in response to the coronavirus outbreak is adding urgency to a hiring spree across the mortgage industry.

March 4 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

Fidelity National Financial, the nation's largest title insurance underwriter, added a new digital title insurance opening package to its WireSafe homebuyer and seller program.

March 2 -

JPMorgan Chase & Co. is shifting workers to handle an expected surge in demand for home loans as the American housing market looks forward to its strongest spring in at least a decade and the coronavirus sends mortgage rates lower.

February 28 -

There is a real possibility of a large, nonmortgage brand coming into the industry and consolidating a disjointed loan origination process.

February 27 LodeStar Software Solutions

LodeStar Software Solutions -

CoreLogic's fourth-quarter earnings reflect the success of the transformation to an appraisal management company business model accelerated in the prior-year period.

February 27 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

Quontic has rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

February 19 -

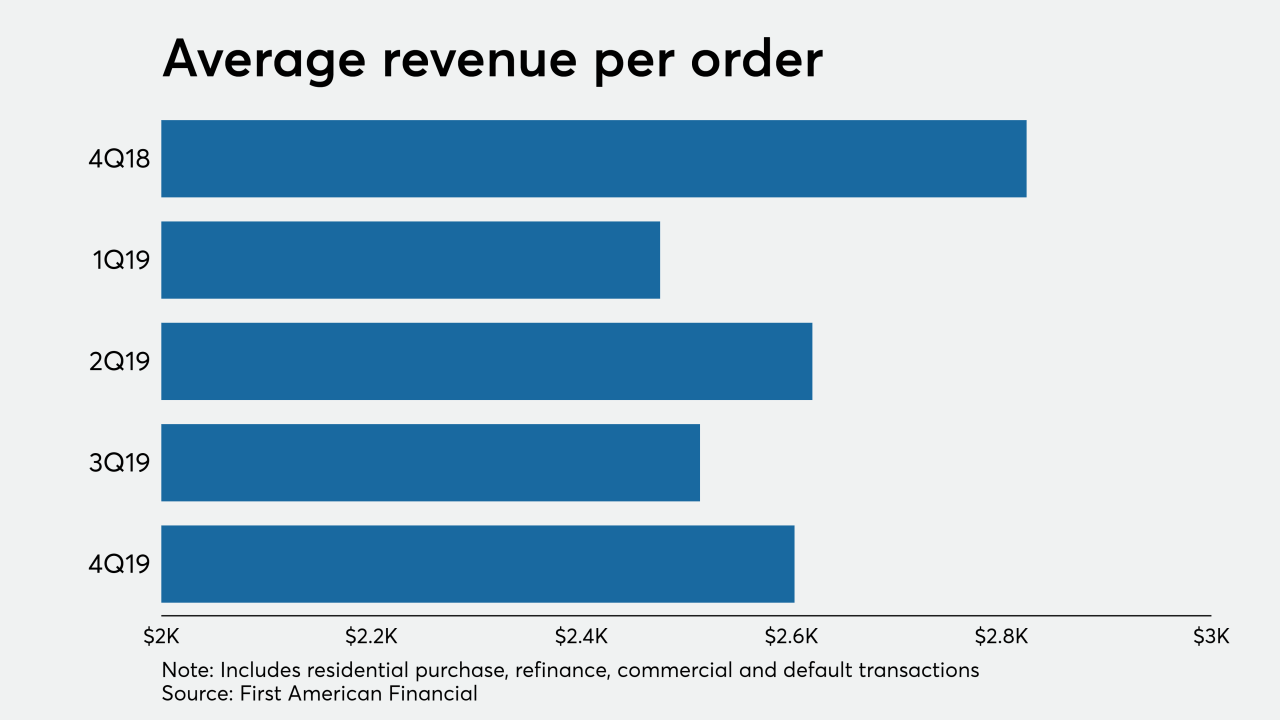

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Digitization presents opportunities for lenders to streamline the mortgage process in ways that benefit them and their borrowers, but three things stand in the path to full adoption.

February 12 Fiserv Inc.

Fiserv Inc. -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11 Nations Lending Corp.

Nations Lending Corp. -

PMI Rate Pro lets users compare mortgage insurance premium quotes from all six companies in the market.

February 10 -

Debt-to-income doesn't perfectly measure a borrower's likelihood of making timely mortgage payments, but it shouldn't be replaced as the ability-to-repay rule evolves, it should be made more flexible instead.

February 5 Platinum Home Mortgage Corp.

Platinum Home Mortgage Corp.