-

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

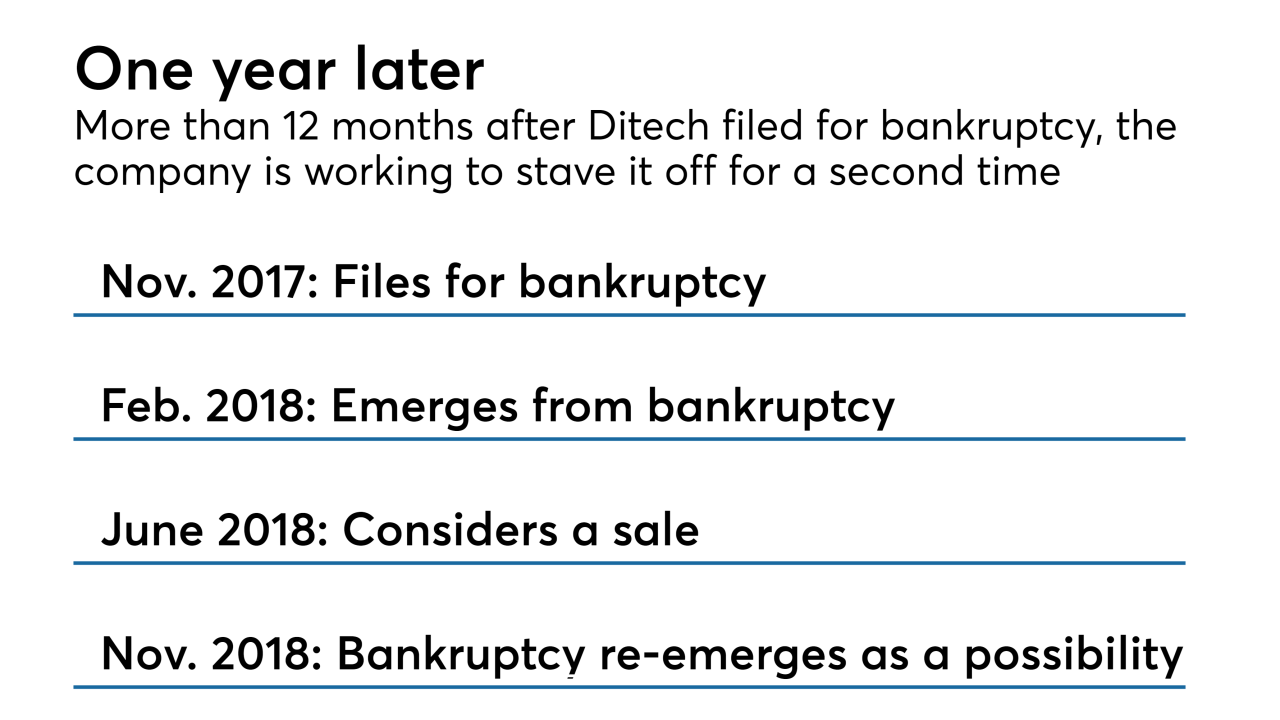

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

Another adjustable-rate mortgage index is going away as the Federal Home Loan Bank of San Francisco will no longer publish the monthly Eleventh District Cost of Funds Index after January 2020.

December 10 -

Mortgage credit available to consumers increased in November by 1.1% from the previous month as lenders offered more conventional products with expanded underwriting criteria, the Mortgage Bankers Association said.

December 6 -

There was an 8% year-over-year increase in mortgage loan application defect risk in California during October and that should rise further because of the wildfires that devastated the state, First American said.

December 3 -

Greenway Mortgage, a New Jersey lender that pledges to support charitable causes, is launching a consumer-direct digital mortgage division that will specialize in one-stop shopping for home renovations.

November 27 -

Private mortgage insurers are moving away from traditional rate cards in favor of more granular risk-based pricing to make their products more competitive and efficient for lenders.

November 26 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16 -

Borrowers will get more leeway to finance energy- and water-efficient improvements under a new program coming from Freddie Mac.

November 14 -

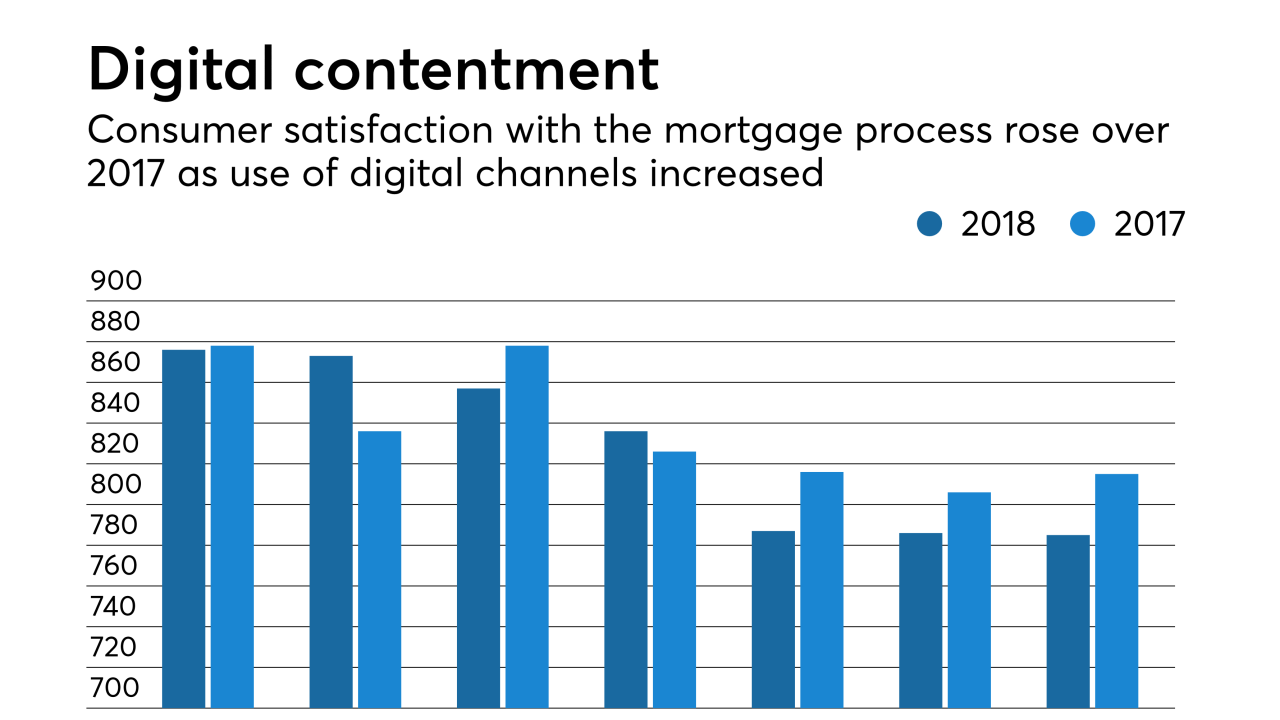

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Wells Fargo said Tuesday that an internal error that affected customers requesting mortgage modifications to remain in their homes impacted hundreds more people than the bank initially thought.

November 6 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

-

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

While all portions of mortgage credit underwriting standards have slipped since the early post-crisis period, it is the deteriorating conditions that most increases vulnerability for future loan quality, a Moody's report said.

October 29 -

There was a 1.3% uptick in mortgage application defects in September from the previous month, with states affected by Hurricane Florence showing preliminary spikes in activity following the storm, according to First American.

October 26 -

Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

October 25 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24