-

Borrowers will get more leeway to finance energy- and water-efficient improvements under a new program coming from Freddie Mac.

November 14 -

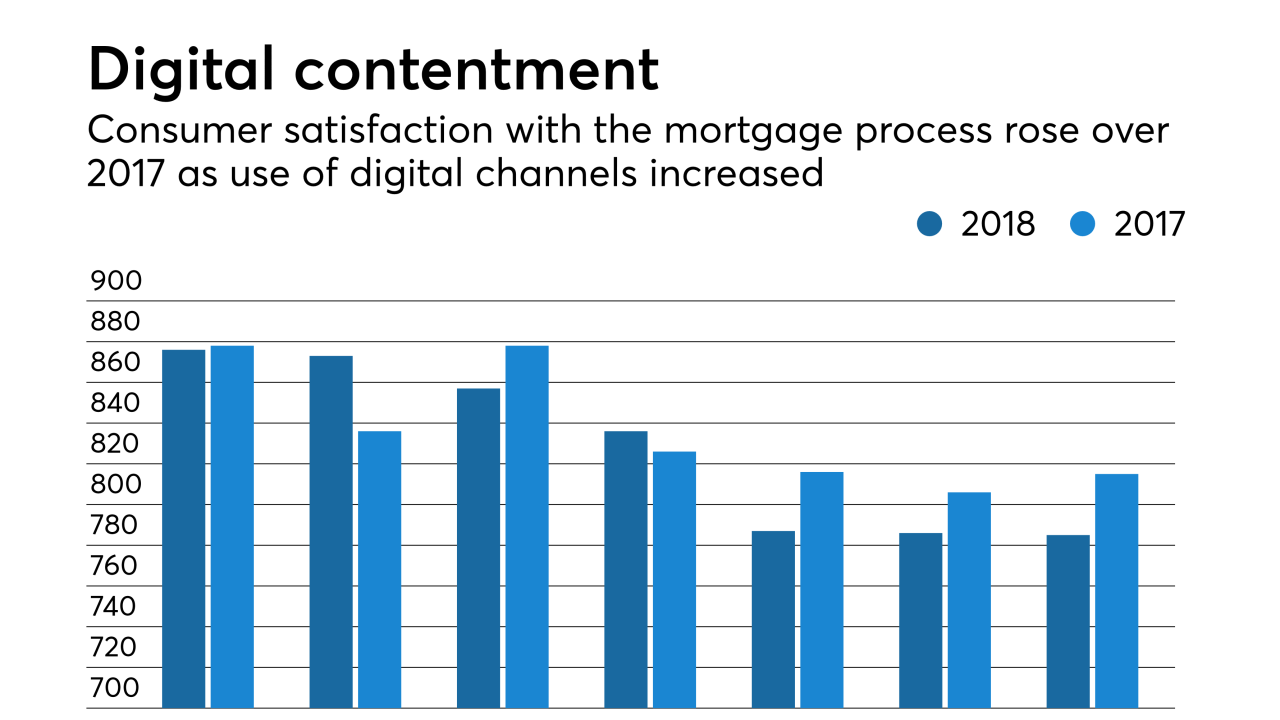

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Wells Fargo said Tuesday that an internal error that affected customers requesting mortgage modifications to remain in their homes impacted hundreds more people than the bank initially thought.

November 6 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

-

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

While all portions of mortgage credit underwriting standards have slipped since the early post-crisis period, it is the deteriorating conditions that most increases vulnerability for future loan quality, a Moody's report said.

October 29 -

There was a 1.3% uptick in mortgage application defects in September from the previous month, with states affected by Hurricane Florence showing preliminary spikes in activity following the storm, according to First American.

October 26 -

Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

October 25 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

Lennar's mortgage banking unit agreed to settle False Claims Act allegations for $13.2 million, a smaller amount than other lenders paid to the government prior to the end of fiscal year 2017.

October 22 -

Providing borrowers with an incentive to create financial reserves after closing is a better tool to prevent mortgage loan defaults than measures taken at underwriting, a JPMorgan Chase Institute study declared.

October 18 -

Exploration and adoption of new technologies is essential for achieving strategic goals and satisfying the needs and expectations of mortgage borrowers.

October 16 Freddie Mac

Freddie Mac -

Nomura Holding America and affiliates agreed to pay a $480 million penalty to resolve U.S. claims that the bank misled investors in marketing and selling mortgage-backed securities tied to the 2008 financial crisis, according to the Justice Department.

October 16 -

Industry downsizing resulted in an increase in critical defects found in closed mortgages as loan packaging errors continued to rise during the first quarter, according to Aces Risk Management.

October 15 -

Movement Mortgage, citing the continuing deterioration of the housing market, is eliminating approximately 180 back office positions on Oct. 5.

October 4 -

Some lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 4 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

Mid America Mortgage CEO Jeff Bode is on a mission to show reluctant title agents and other business partners the value of embracing digital mortgages.

September 24