-

Mortgage rates declined over the past week as worried investors increased their purchases of 10-year Treasuries, according to Freddie Mac.

June 28 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Mortgage rates slid over the past week and have now declined in three of the past four weeks, according to Freddie Mac.

June 21 -

Higher interest rates on home mortgages drove the share of loans used to purchase houses rather than refinance to new heights in May.

June 20 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

The House Financial Services Committee approved a bill that would roll back the requirements of the TILA-RESPA integrated disclosures rule for charities like Habitat for Humanity and instead allow them to use the old good faith estimate and HUD-1 mortgage forms.

June 15 -

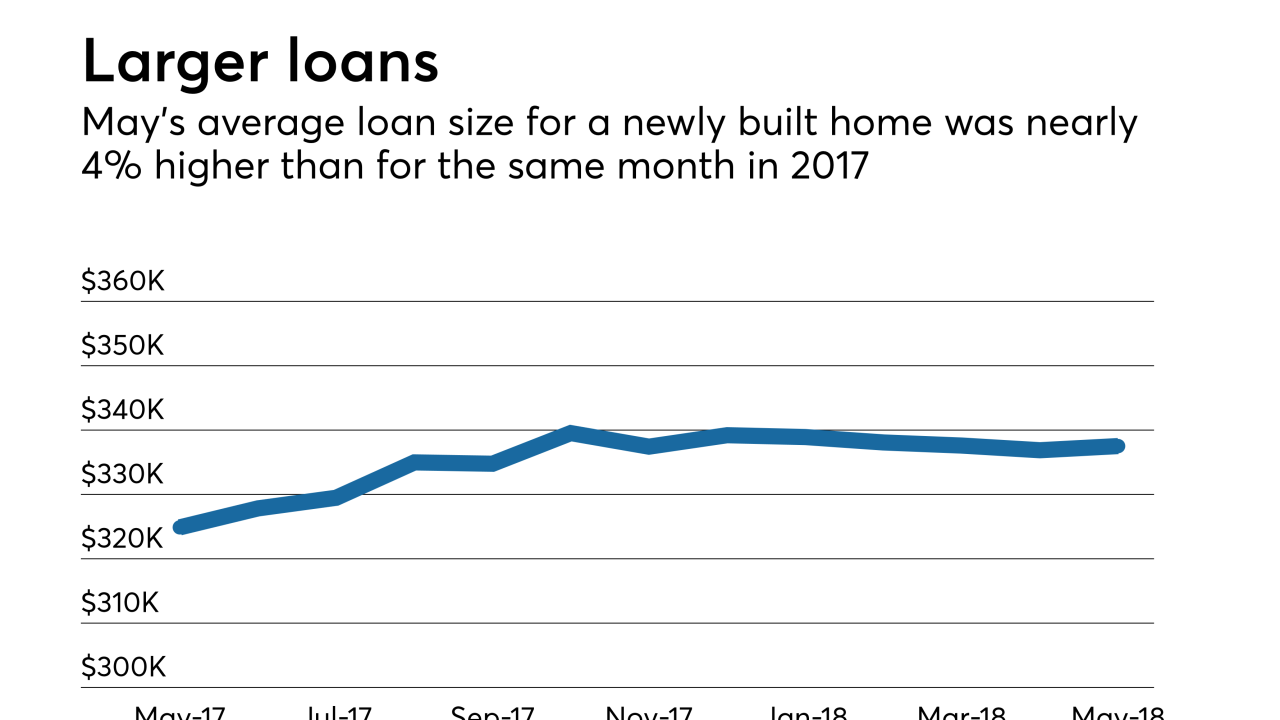

Mortgage applications for newly constructed homes declined in May as sales and supply are not keeping up with demand, the Mortgage Bankers Association said.

June 15 -

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

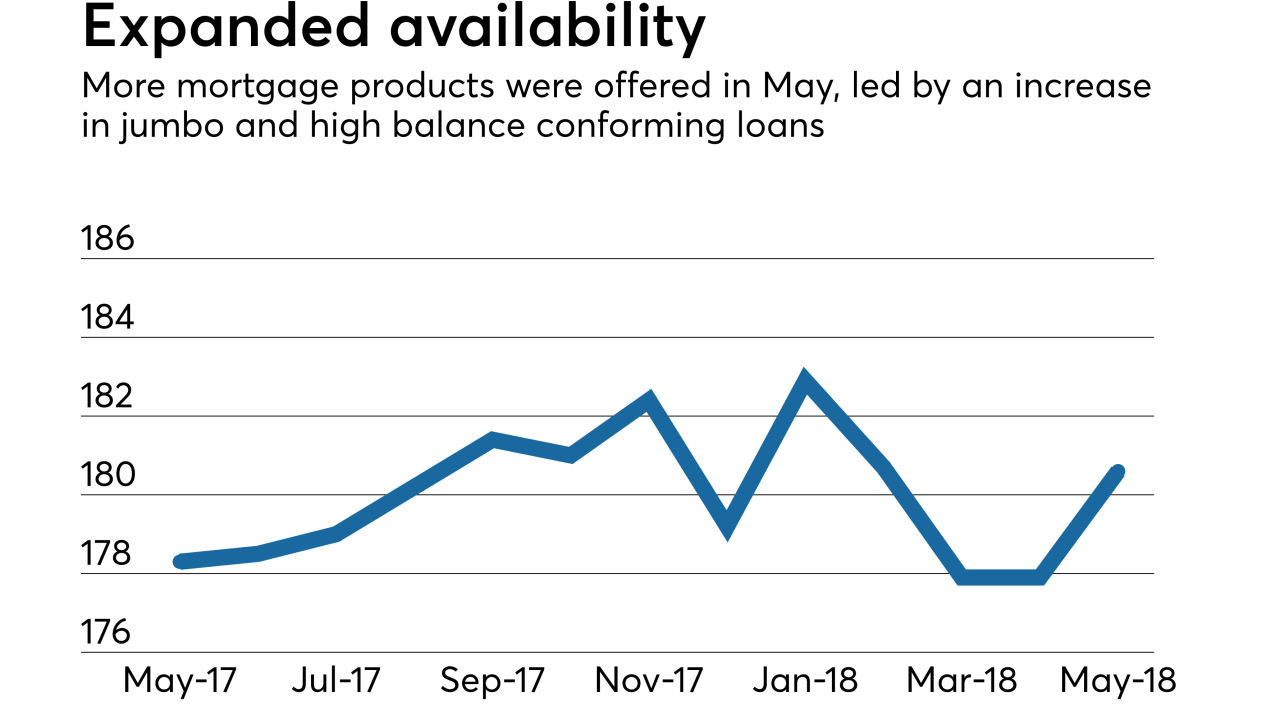

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11 -

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

June 7 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

Commercial mortgage bonds are getting stuffed with the lowest-quality loans since the financial crisis by one measure, according to Moody's Investors Service.

June 1 -

Movement Mortgage is laying off 100 employees nationwide as the lender founded by a former Carolina Panthers player braces for an industry slowdown.

June 1 -

Overcapacity in the mortgage industry led to more competitive pricing in the first quarter, said Wells Fargo CEO Tim Sloan.

June 1 -

The value of commercial-property deals rose 6.7% in the first quarter from a year earlier, but higher interest rates and softer demand will weigh on the market, Ten-X Commercial said.

May 31