-

About 7.3% of U.S. mortgages entered forbearance plans in April, providing temporary relief to more than 3.8 million borrowers who have lost income during the coronavirus pandemic.

May 1 -

The first-quarter loss ended a two-quarter profitability streak the company hoped to maintain.

April 30 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

The number of loans in forbearance increased by a full percentage point over the past week, according to the Mortgage Bankers Association.

April 27 -

Due to COVID-19's economic impact, the number of mortgaged properties in default or foreclosure rose in March for the first time since the turn of the century, according to Black Knight.

April 23 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Simply stated, the federal forbearance of mortgage payments is perhaps the largest unfunded public mandate in American history.

April 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

A top U.S. regulator is exploring whether to throw a lifeline to mortgage servicers stressed by the coronavirus pandemic by tapping a program meant to address natural disasters.

March 27 -

Treasury Secretary Steven Mnuchin reiterated Thursday that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he's focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain.

March 27 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

Detroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

March 25 -

Independent mortgage bankers had their most profitable fourth quarter in seven years for originations, but the fallout from the coronavirus could upset the economics of the industry in the short term.

March 24 -

The Federal Reserve Board should create a dedicated facility for mortgage servicers to access in order to make required advances, industry participants and observers, including its largest trade group, said.

March 24 -

A proposal to tighten financial requirements for government-sponsored enterprise counterparties that sought to lower risk in a volatile market should be suspended, a group representing smaller lenders said, arguing it would aggravate current distress.

March 18 -

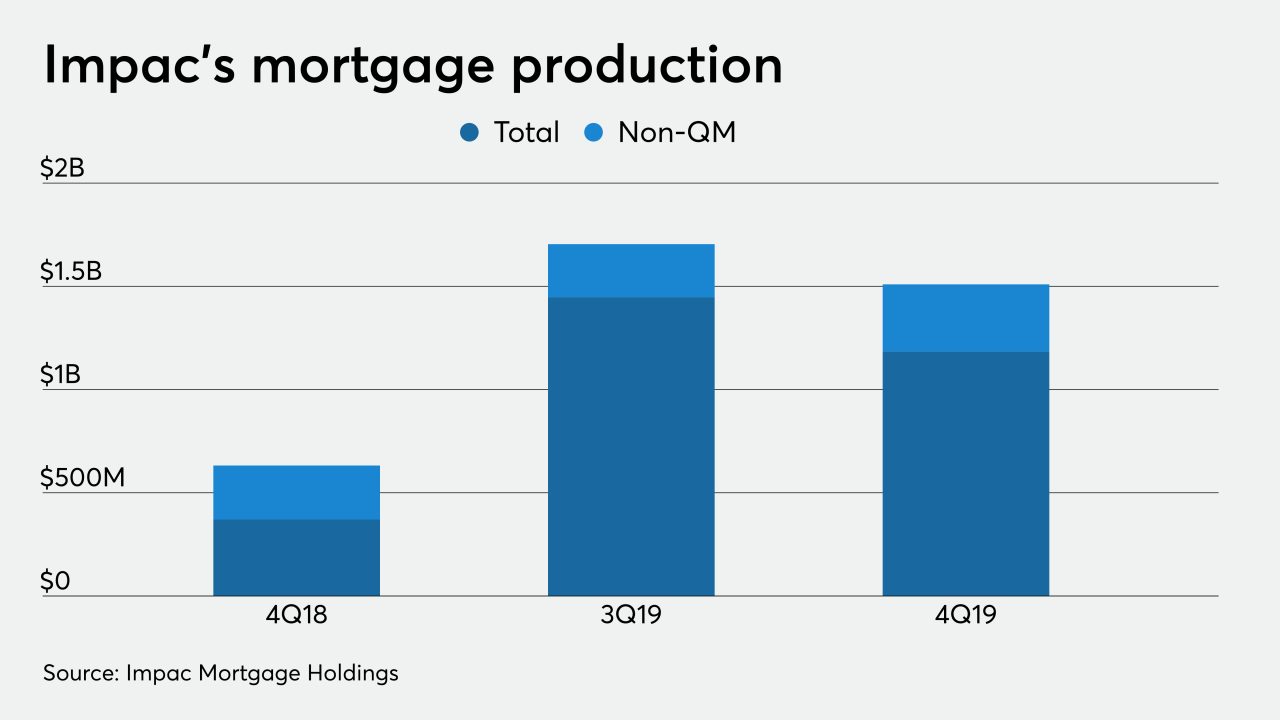

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13