-

The company's Dun & Bradstreet investment reduced its results by $31 million.

August 10 -

The company reported nearly $23 million in losses for the second quarter, but that was an improvement on a quarter-to-quarter basis.

August 7 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

The company's servicing segment recorded a pretax loss of $251 million over the period.

July 31 -

Even with the second quarter's market disruption, Redwood Trust still regained profitability.

July 31 -

The company's second-quarter net income was $116 million, with mortgage banking revenue of $239 million.

July 28 -

The number of loans going into coronavirus-related forbearance dropped for the sixth consecutive week, as the growth rate fell 6 basis points between July 13 and July 19, according to the Mortgage Bankers Association.

July 27 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

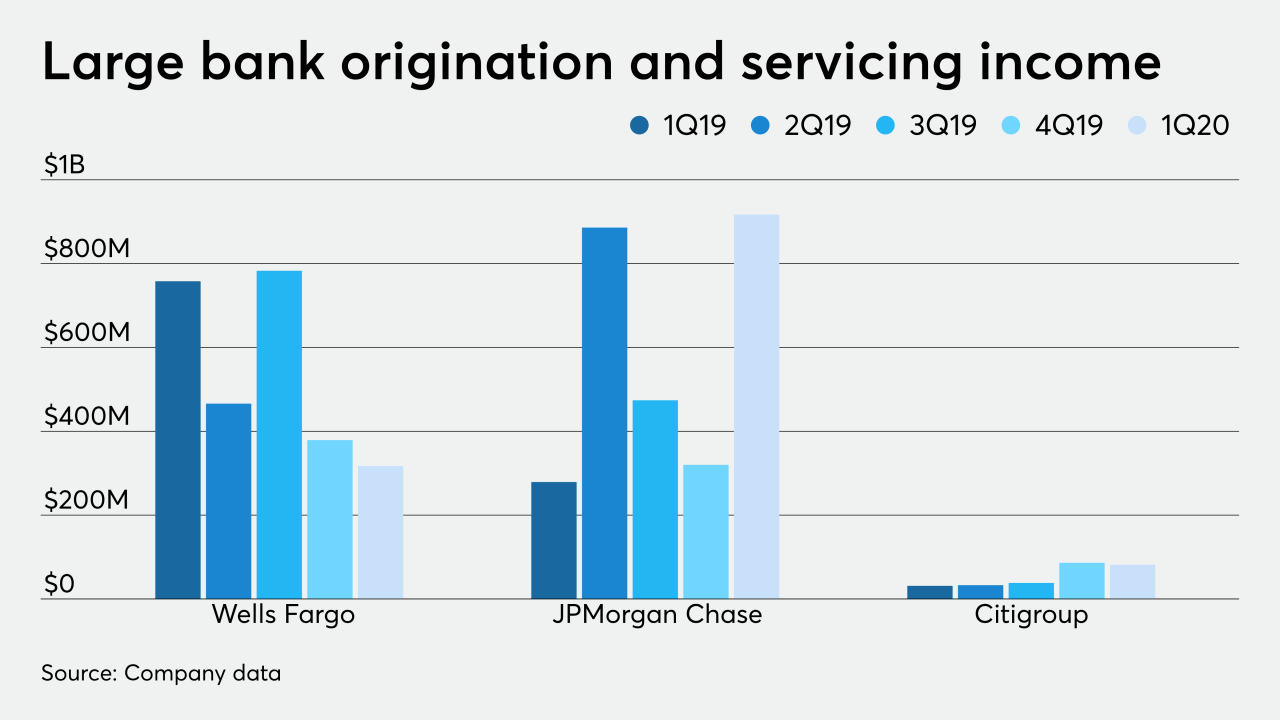

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

A more than $5 billion offering going up for bid is one of the first large transactions seen since the coronavirus complicated trading.

July 10 -

The number of loans going into coronavirus-related forbearance dropped for the third consecutive week, as the growth rate fell 8 basis points between June 22 and June 28, according to the Mortgage Bankers Association.

July 7 -

Mortgage insurers had been operating under the belief that rules pertaining to natural disaster delinquencies apply with COVID-19, but now it's in writing.

July 1 -

The number of loans going into coronavirus-related forbearance edged down slightly, with the growth rate dipping 1 basis point between June 15 and June 21, according to the Mortgage Bankers Association.

June 29 -

The company formally reported a nearly $65 million loss in the first quarter as the coronavirus affected its operations in March.

June 26 -

The number of loans going into coronavirus-related forbearance dropped, with the growth rate falling 7 basis points between June 8 and June 14, according to the Mortgage Bankers Association.

June 22 -

New Residential Investment Corp., fresh off a substantial first-quarter reduction of its asset holdings, is now planning to securitize the receivables on its $200 billion servicing portfolio of Fannie Mae-owned mortgages.

June 17