-

The move by the government bond insurer may pave the way for waivers of late fees, forbearance, modifications and foreclosure bans as the U.S. contends with damage from recent hurricanes.

October 4 -

Five days after Hurricane Ian slammed into the state — bringing with it a deadly storm surge, catastrophic flooding and powerful winds — the destruction it caused is becoming clearer.

October 4 -

Wind and storm surge damage to residential and commercial properties could reach $47 billion, according to a CoreLogic analysis.

September 30 -

Over 1 million single-family and multifamily homes along the coast are at risk of storm surge damage.

September 28 -

Speaking with the consumer regarding the proper amount and type of insurance needed is the best way for lenders and servicers to mitigate the likelihood of default.

August 19 -

-

Meanwhile, nearly half of consumers are more worried about severe weather now compared to five years ago, according to Realtor.com.

September 27 -

Property losses piled up in Mid-Atlantic and New England states as the tropical storm devastated the East Coast, according to CoreLogic.

September 9 -

Roughly $8 billion to $12 billion of the residential losses in the Louisiana area could be insured, according to CoreLogic. The storm’s more recent Northeast impact has not yet been calculated.

September 2 -

A ClimateCheck score measures the risk of disaster at the zip-code level over the period of a 30-year mortgage.

August 4 -

The guidance addresses confusion related to how lenders should handle situations in which borrowers have not paid for a year and need additional help due to a natural disaster.

June 11 -

Rising sea levels aren’t keeping buyers from scooping up oceanfront homes as work flexibility gives consumers wider options on where to live, according to Redfin.

June 9 -

Storm-related reconstruction costs — a large share of which may be concentrated in the New York City area — are estimated to total $1.9 trillion for water damage and $8.5 trillion for wind damage.

June 1 -

Increasingly extreme weather patterns and natural disasters weigh heavy on the majority of borrowers looking to buy a house, while half will move because of it, according to Redfin.

April 5 -

As global warming intensifies storms and flooding, formerly redlined neighborhoods with majority BIPOC occupants will likely bear the brunt of the damage risk, according to a Redfin analysis.

March 15 -

A Freddie Mac study of loans in forbearance from 2017 and 2020 found that, over both periods, borrowers had low credit scores and high debt-to-income ratios.

November 18 -

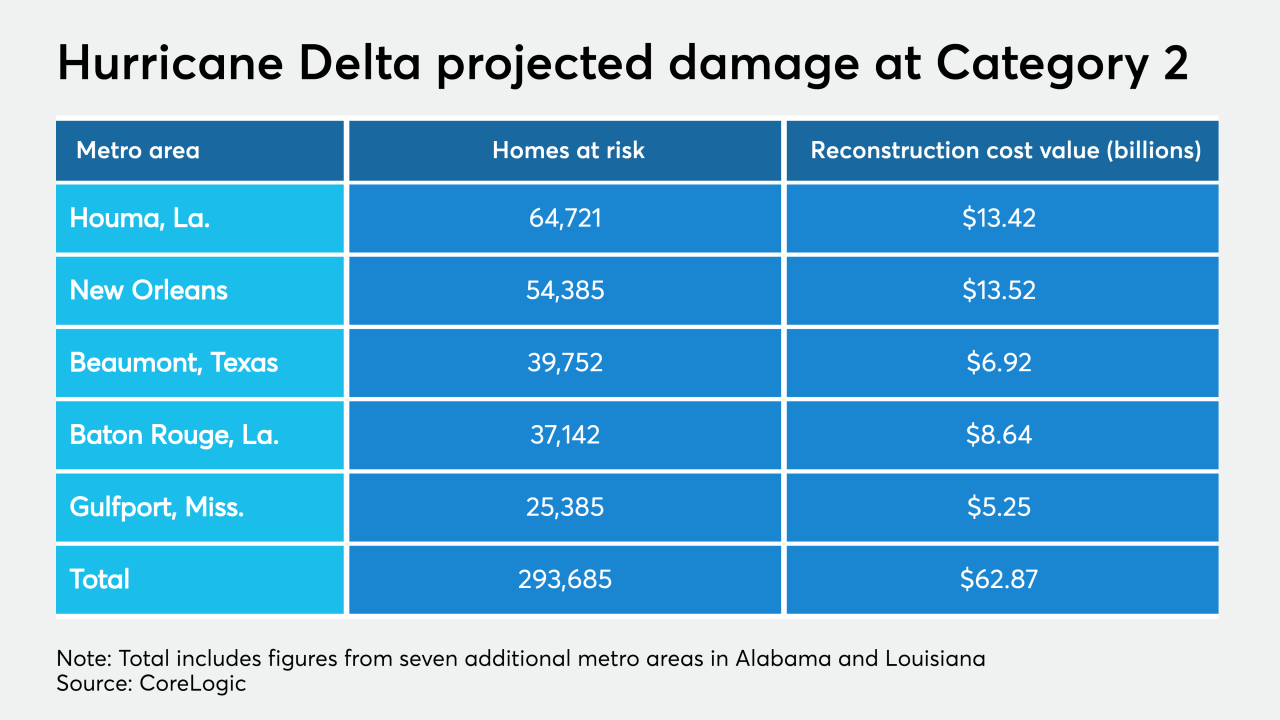

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

Despite a roller-coaster stock market, lingering pandemic and uncertainty caused by natural and made disasters, the real estate market continues to connect buyers to sellers.

September 28 -

Shannon King, a single mother, left the Bay Area a decade ago as housing costs soared, hoping to find an affordable place to live in southern Oregon.

September 21