-

The gap between Black and white homeownership rates is extremely wide in some areas, and it could get worse if the industry fails to proactively address local and national inequities.

June 30 -

Nonbank servicers have been seeking more sources of cash since the coronavirus disrupted markets and elevated forbearance rates. These are some strategies they may be able to use.

June 26 -

The government-sponsored enterprises had been considering tightening counterparty requirements for nonbanks, but in light of COVID-19's spread, they've reconsidered that.

June 25 -

The Mortgage Bankers Association points to better lender diversity and a stronger housing finance network as reasons for its support.

June 25 -

Nonbank mortgage hiring inched down when overall employment plunged in April. The subsequent recovery in overall jobs suggests the housing-finance industry is still bearing up well despite coronavirus-related strain.

June 5 -

Independent mortgage banks started 2020 strong after three quarters of high profits, according to the Mortgage Bankers Association.

June 4 -

Embrace will originate and close home loans in its own name for clients of the wealth management firm.

May 28 -

The sale completes First Choice affiliate Berkshire Hills Bancorp's exit from the mortgage origination business.

May 19 -

Previously, mortgage firms concentrated on borrower-facing systems at the expense of internal experience.

May 13 -

Hiring by nonbank mortgage and brokers held up unusually well through the early days of the coronavirus outbreak in March, but April's all-time high in unemployment suggests that's unlikely to last.

May 8 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

The Treasury secretary said recent government moves will help the firms get through the risk of millions of borrowers missing their loan payments.

April 24 -

The Federal Housing Finance Agency has promised to take care of advances on principal and interest payments for coronavirus forbearances after four months, but servicers remain concerned about other responsibilities.

April 22 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

April 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The lender is one of many taking advantage of the disruption in the market to grow their businesses.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

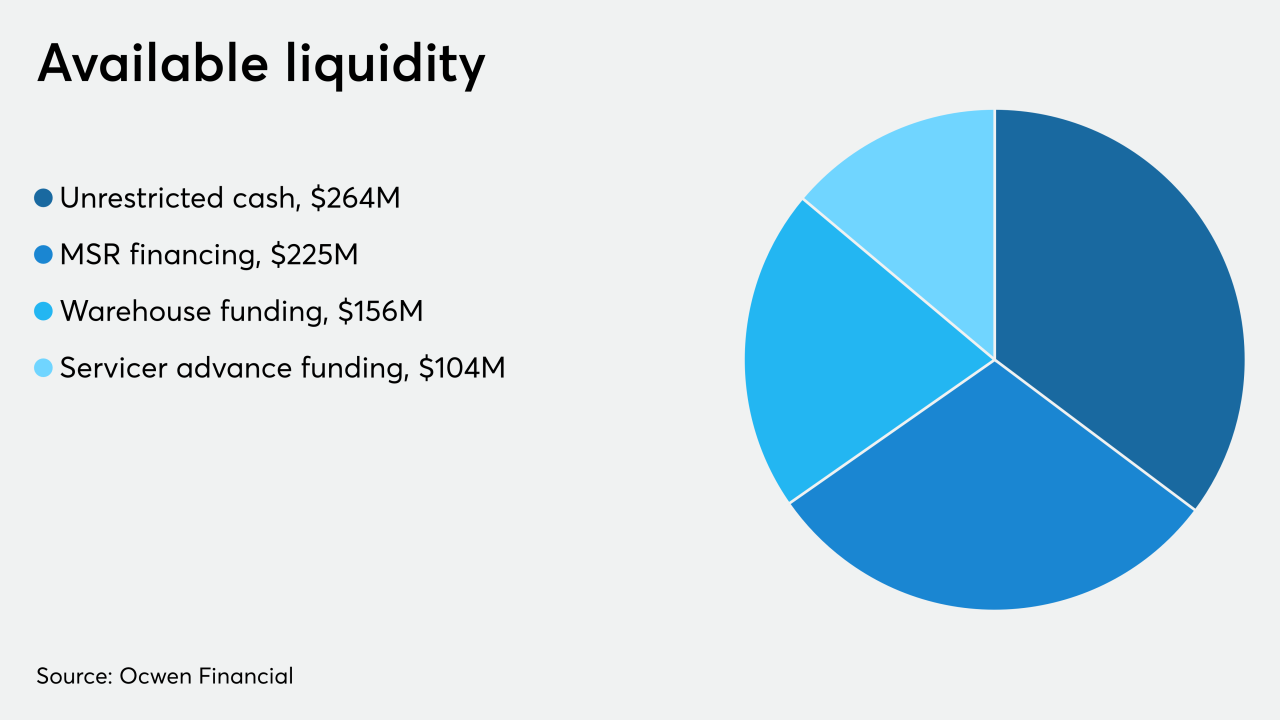

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2