-

Ellie Mae is tackling home equity lines of credit loans with its latest Encompass Digital Mortgage Solution update as signs point to a surge in home equity borrowing.

October 22 -

Incenter Mortgage Advisors is facilitating the sale of $3.7 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans, roughly one-third of which have private mortgage insurance.

October 19 -

The mortgages being reinsured are more seasoned than most other deals rated by Morningstar, which helps offset the risk of lower initial weighed average LTV.

October 17 -

MGIC Investment Corp.'s quarterly earnings were again driven by better-than-expected loss development, and those favorable results should be seen in the other private mortgage insurers' results as well, an industry analyst said.

October 17 -

Fannie Mae and Freddie Mac issued new capital requirements for private mortgage insurers that will create big swings in carriers' asset reserves.

September 27 -

NMI Holdings is laying the groundwork for President Claudia Merkle to replace CEO Bradley Shuster next year.

September 14 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The percentage of low down payment loans using private mortgage insurance continues to grow, and should continue as more first-time homebuyers get conforming loans, according to Keefe Bruyette & Woods.

August 14 -

National MI deliberately dropped some of its customers in the second quarter, resulting in flat new insurance growth compared with the first quarter and a lower increase versus one year prior.

August 3 -

Arch MI U.S. returned to having the No. 1 market share among private mortgage insurers as it increased its new insurance written 15% over the previous year.

August 1 -

Radian Group's second-quarter earnings beat consensus estimates because of lower loan loss provisions than forecast, along with record new mortgage insurance written.

July 26 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

The Internal Revenue Service's settlement with Radian Group may result in a $74 million tax benefit for the mortgage insurer that could improve its second-quarter results.

July 19 -

Oaktown Re II is National Mortgage Insurance's first rated transaction, according to Morningstar; it reinsures $5.47 billion of policies on mortgages with a total balance of $30.12 billion.

July 18 -

Continued favorable loss development trends allowed MGIC Investment Corp. to beat analyst estimates for the second-quarter earnings report.

July 18 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11 -

Private mortgage insurance was used on approximately 4% fewer loans in 2017 when compared with 2016, according to the U.S. Mortgage Insurers.

June 8 -

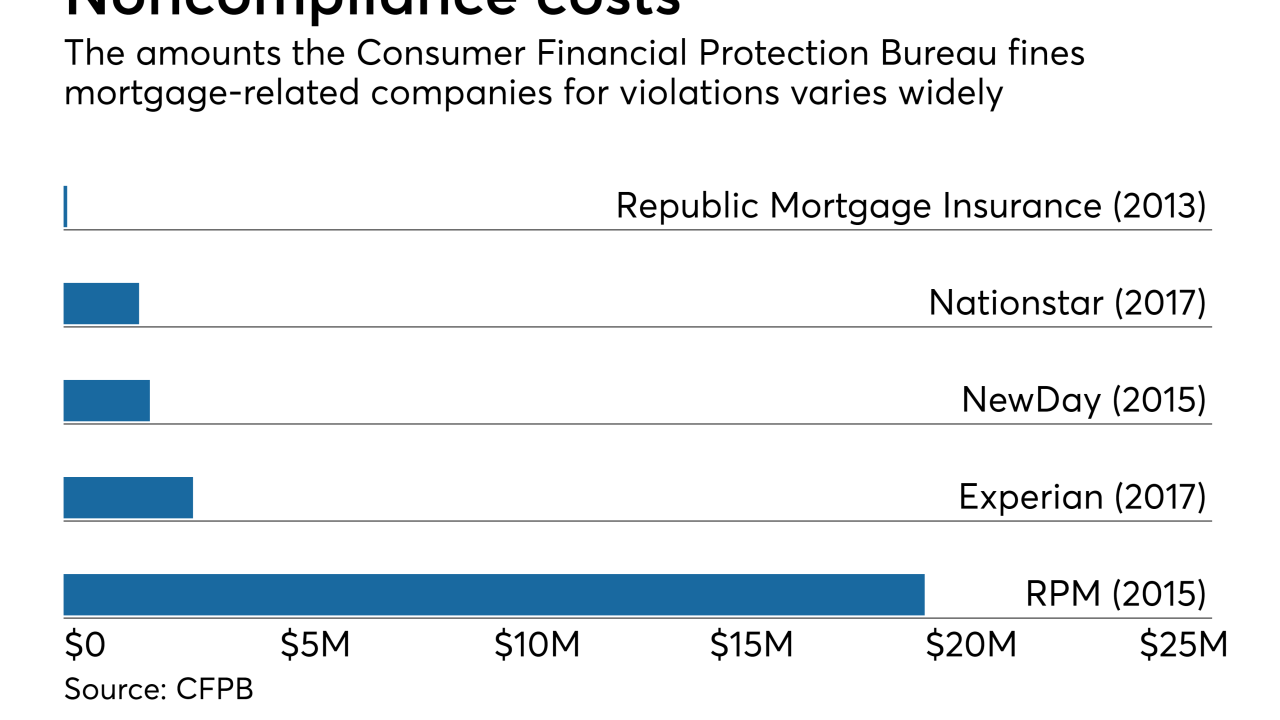

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

An increase in title orders opened helped Fidelity National Financial improve its first-quarter net income by 59% over the same period last year.

May 4