-

The most successful mortgage originators will use artificial intelligence and machine learning to enhance and enable their people to have better, more meaningful engagements with customers.

September 20 Total Expert

Total Expert -

Seven real estate companies are now facing age-discrimination complaints over allegations they used advertisements posted on Facebook to filter out potential clients over a certain age.

September 19 -

Linda Lacewell, New York’s superintendent of financial services, said the CFPB's debt collection proposal does not go far enough to protect consumers.

September 18 -

The agency put to rest speculation that it might take the database offline, yet new disclosure statements are meant to combat the notion that a complaint proves a company’s guilt.

September 18 -

Like many regional banking companies, Huntington Bancshares casts itself as a community bank, albeit one with more than $100 billion in assets.

September 9 -

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

Syracuse Securities Inc., a family-run lender and servicer in New York, is planning to wind down and transfer its outstanding pipeline to Premium Mortgage Corp.

September 4 -

The bucket of homeowners in the money to refinance includes anyone who bought a home in the last 18 months, and lenders are on the phone calling them.

September 3 -

Long Island foreclosure sales doubled over the last five years as the county courts made a priority of clearing bust-era cases.

August 27 -

Sheila Bair, who holds board seats at several other organizations, will sit on Fannie's compensation, corporate governance and risk policy committees.

August 21 -

The pursuit of a more digital mortgage business always involves a balancing act between the drive for automation and the preference or need many consumers may have for some kind of personal touch.

August 16 -

Angel Oak is now offering mortgage brokers and correspondent loan sellers a prequalification tool to determine borrower eligibility for non-qualified mortgages.

August 14 -

HSBC anticipates its mortgage underwriting volume ramping up significantly after recent initiatives to provide loan officers with more tools and time to address the complex needs of affluent customers, often from overseas.

August 8 -

Zillow Group shares were poised to fall to a six-week low after its results and updated forecasts suggested its entire "portfolio is faltering" at a critical time for the company looking to pivot its business, analysts said.

August 8 -

Discover Bank is approaching $1 billion in home equity-related receivables, a milestone for the six-year-old home-loan division that aims to rework the lending process for both its customers and loan officers.

August 5 -

Before signing a home purchase contract, the vast majority of potential homebuyers already selected their mortgage lender in order to compete with investors, a Fannie Mae survey found.

August 5 -

Mortgage servicer customer satisfaction levels are among the lowest of any industry as more companies prioritize cost-cutting, regulation and default management over their borrowers, according to J.D. Power.

August 1 -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

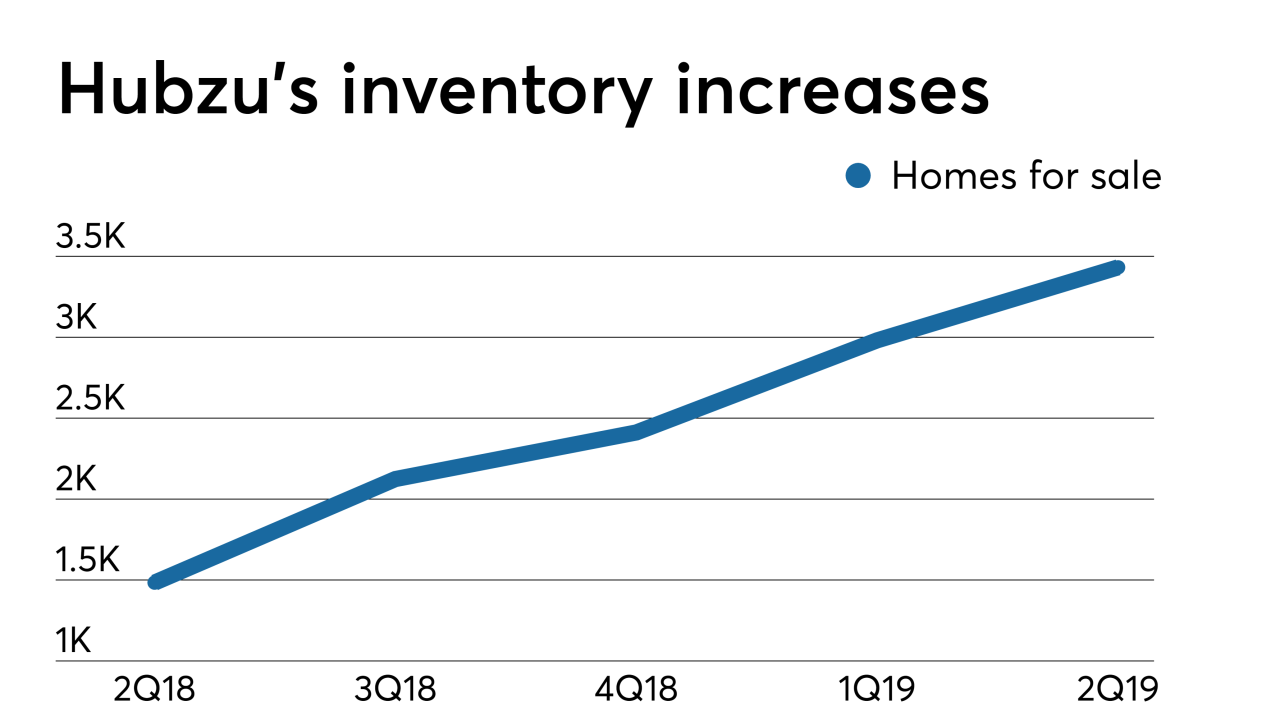

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25