-

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Private-label residential mortgage-backed securitization is approaching a post-crisis high, according to Kroll Bond Rating Agency.

December 3 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Rating agencies are sparring over a new feature in a private-label RMBS that upends the relationship between senior and sub bondholders.

October 19 -

Wells Fargo’s first private-label mortgage securitization since the financial crisis doesn’t break any new ground — and that’s probably the point.

October 10 -

Finance of America Reverse is offering a new second-lien alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that can be placed on a property with a pre-existing first-lien loan.

September 26 -

New Penn Financial has launched a condo loan program that features more flexible property restrictions than what's allowed under Fannie Mae and Freddie Mac guidelines.

September 13 -

The dollar volume of private-label residential mortgage-backed securities issuance this year is the highest it has been since the Great Recession, despite a decline in new originations.

September 6 -

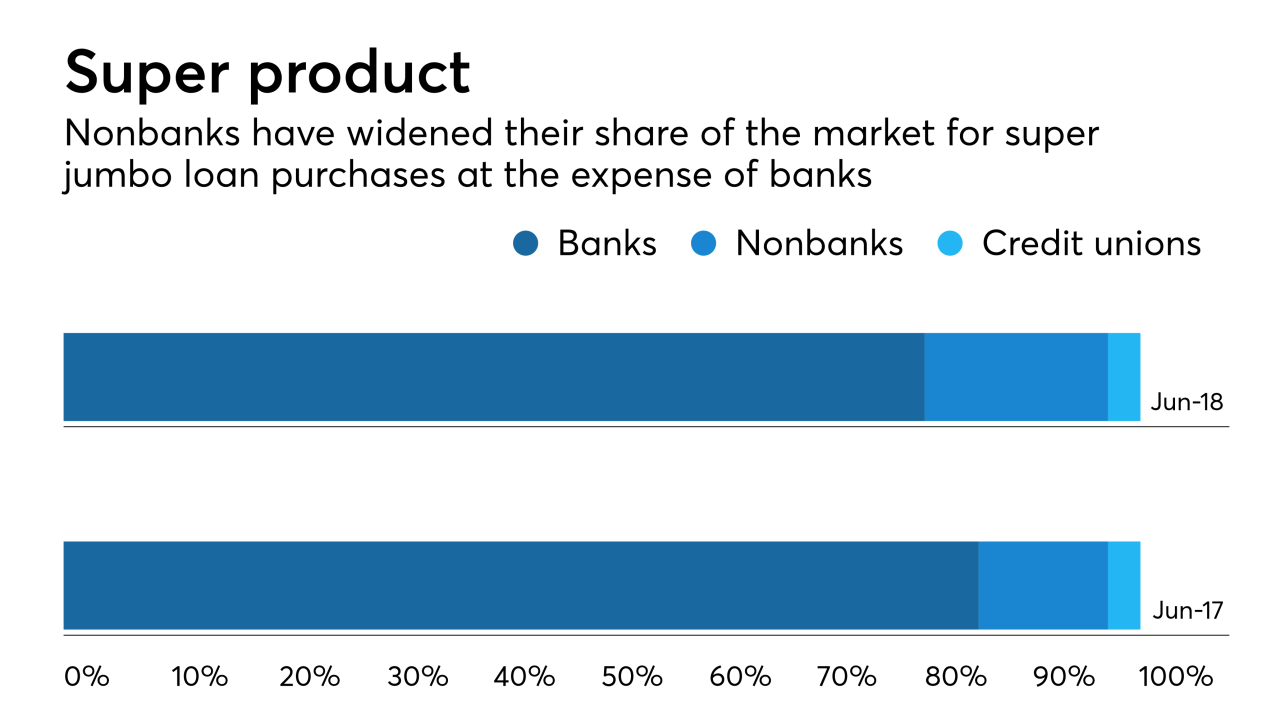

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

Atlantic Bay Mortgage Group and Virginia Community Bank have agreed to back out of a merger that would have been a rare instance of a nondepository lender acquiring a depository institution.

August 14 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

Impac Mortgage Holdings will sell up to $600 million of non-qualified mortgage loans to Starwood Property Trust over the next 12 months that will be securitized.

June 27 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

The $446 million Pearl Street Mortgage Company 2018-1 Trust is backed by 30-year, fixed-rate loans with credit characteristics in line with recent private-label prime jumbo transactions rated by Fitch Ratings.

March 5 -

A new due diligence firm created by a trio of former Clayton Holdings executives wants to shake up a static business model.

February 12 -

Some commercial buildings that are not required to obtain earthquake insurance may still be susceptible to significant structural damage that could put the borrowers at risk of default, according to Kroll Bond Rating Agency.

January 2 -

DoubleLine Capital is embarking on a plan to originate and securitize mortgages, seeking to fill a niche that has traditionally belonged to banks and brokerage firms.

December 21