-

The number of home listings collapsed to the lowest level on record, leaving “nearly all of the shelves empty,” Glenn Kelman said in the company’s latest home sales report.

February 26 -

The mortgage brokerage franchisor added 30 operating offices and had its best year yet for unit sales.

February 26 -

After several weeks of resistance, mortgage rates are now moving in lockstep with the recent increases in the 10-year Treasury yield.

February 25 -

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

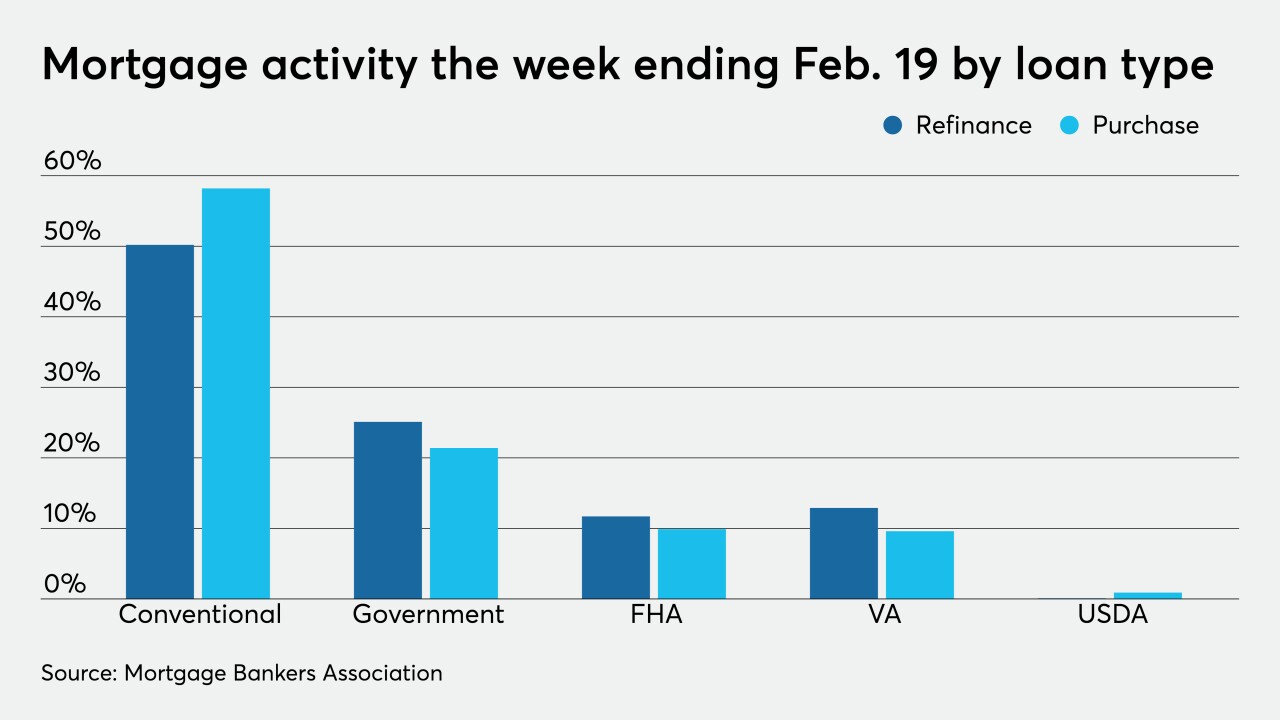

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10 -

The mortgage industry’s technology emphasizes speed, but a surge in volume has elongated the closing process for many, which is problematic ahead of a potential seasonal uptick in more time-sensitive purchase loans.

February 9 -

With low mortgage rates billowing demand as homebuying season approaches, consumer confidence for selling jumped in January, according to Fannie Mae.

February 8 -

As 2021 shapes up to be a robust year for mortgage volumes, local lenders discuss the 12 metro areas that are expected to get the most interest from buyers, according to Zillow.

February 8 -

“It’s time for us to stop treating the purchase mortgage as some kind of market impediment or red flag for our forecasts,” says Chairman of JJAM Financial and former Ginnie Mae President Joseph Murin

February 5 Chrysalis Holdings

Chrysalis Holdings -

Even as the company posted record numbers, it could have originated more loans if it had not stopped buying FHA and jumbo mortgages from brokers.

February 4 -

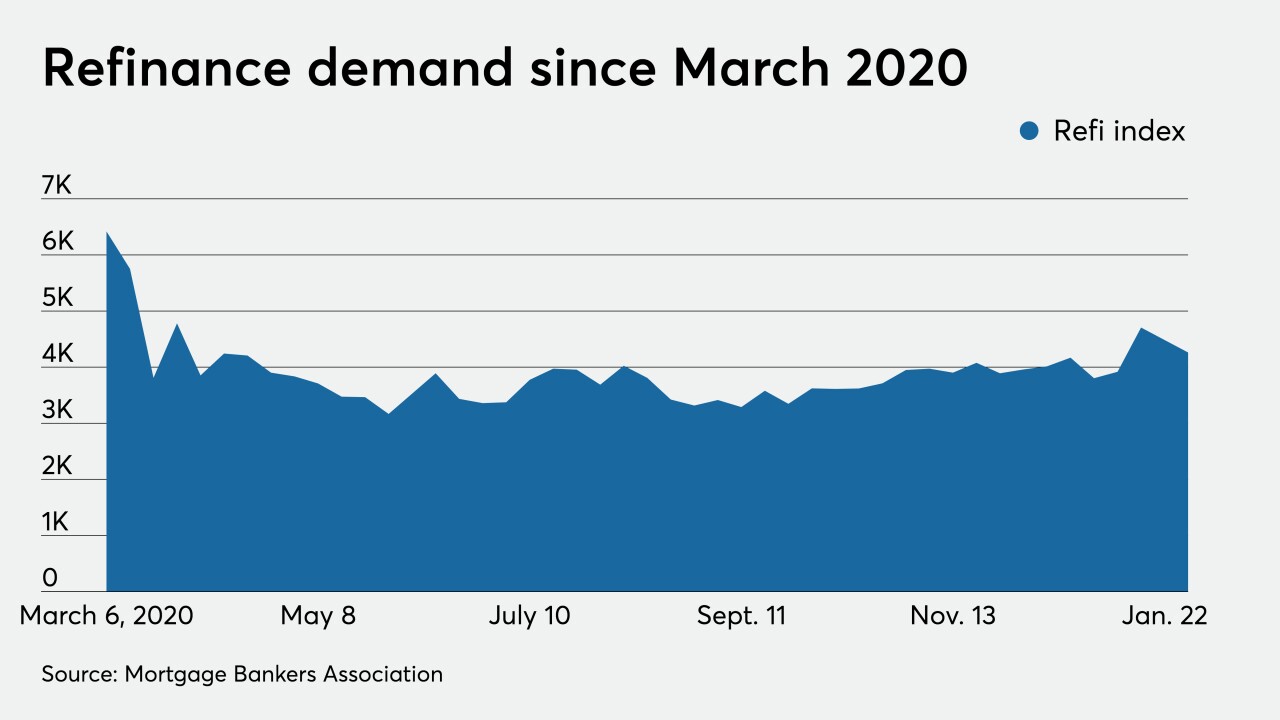

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

With the shift to a low-rate environment dominated by no cash-out refinancing, use of an alternative to traditional valuations has soared.

February 2 -

The 2020 price increase was more than double 2019's and above CoreLogic's year-ago prediction, but its forecast for 2021 puts the pace at just one-third of last year’s.

February 2 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

As home prices surged in 2020 due to shrinking inventory and raging demand, sellers received the highest returns on investment since at least 2005, according to Attom Data Solutions.

January 28 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27