-

With low mortgage rates billowing demand as homebuying season approaches, consumer confidence for selling jumped in January, according to Fannie Mae.

February 8 -

As 2021 shapes up to be a robust year for mortgage volumes, local lenders discuss the 12 metro areas that are expected to get the most interest from buyers, according to Zillow.

February 8 -

“It’s time for us to stop treating the purchase mortgage as some kind of market impediment or red flag for our forecasts,” says Chairman of JJAM Financial and former Ginnie Mae President Joseph Murin

February 5 Chrysalis Holdings

Chrysalis Holdings -

Even as the company posted record numbers, it could have originated more loans if it had not stopped buying FHA and jumbo mortgages from brokers.

February 4 -

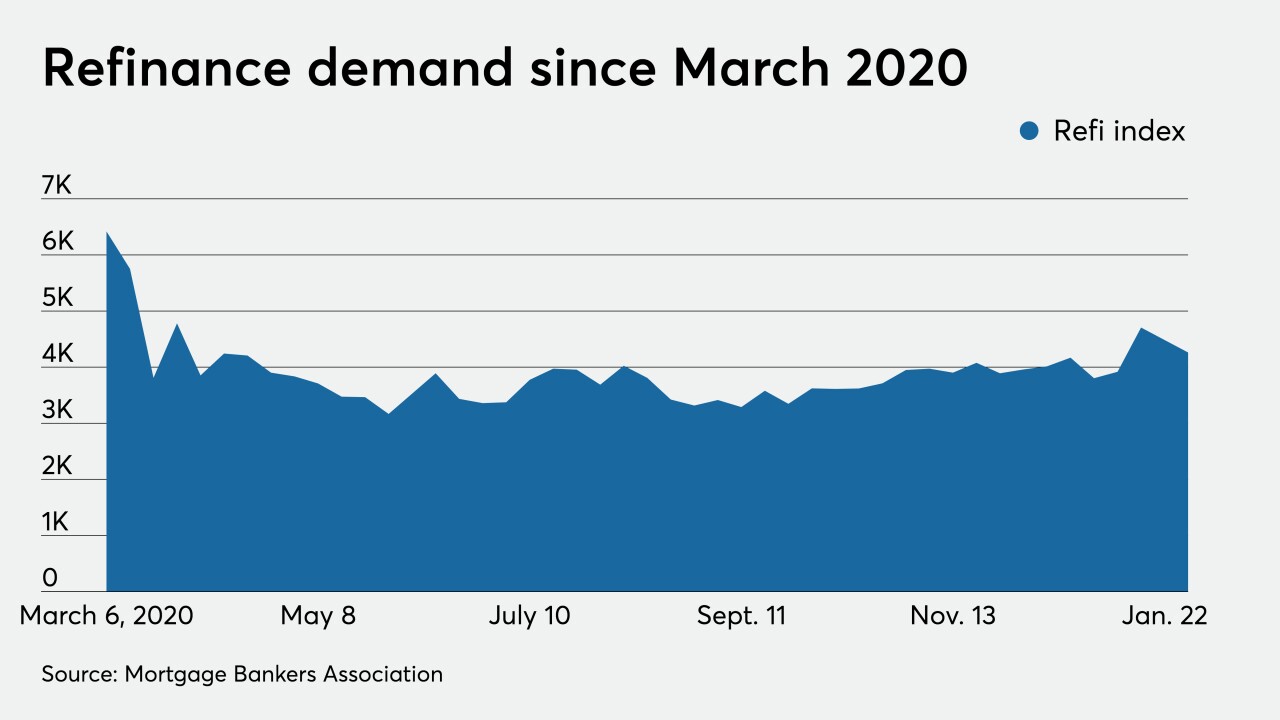

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

With the shift to a low-rate environment dominated by no cash-out refinancing, use of an alternative to traditional valuations has soared.

February 2 -

The 2020 price increase was more than double 2019's and above CoreLogic's year-ago prediction, but its forecast for 2021 puts the pace at just one-third of last year’s.

February 2 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

As home prices surged in 2020 due to shrinking inventory and raging demand, sellers received the highest returns on investment since at least 2005, according to Attom Data Solutions.

January 28 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

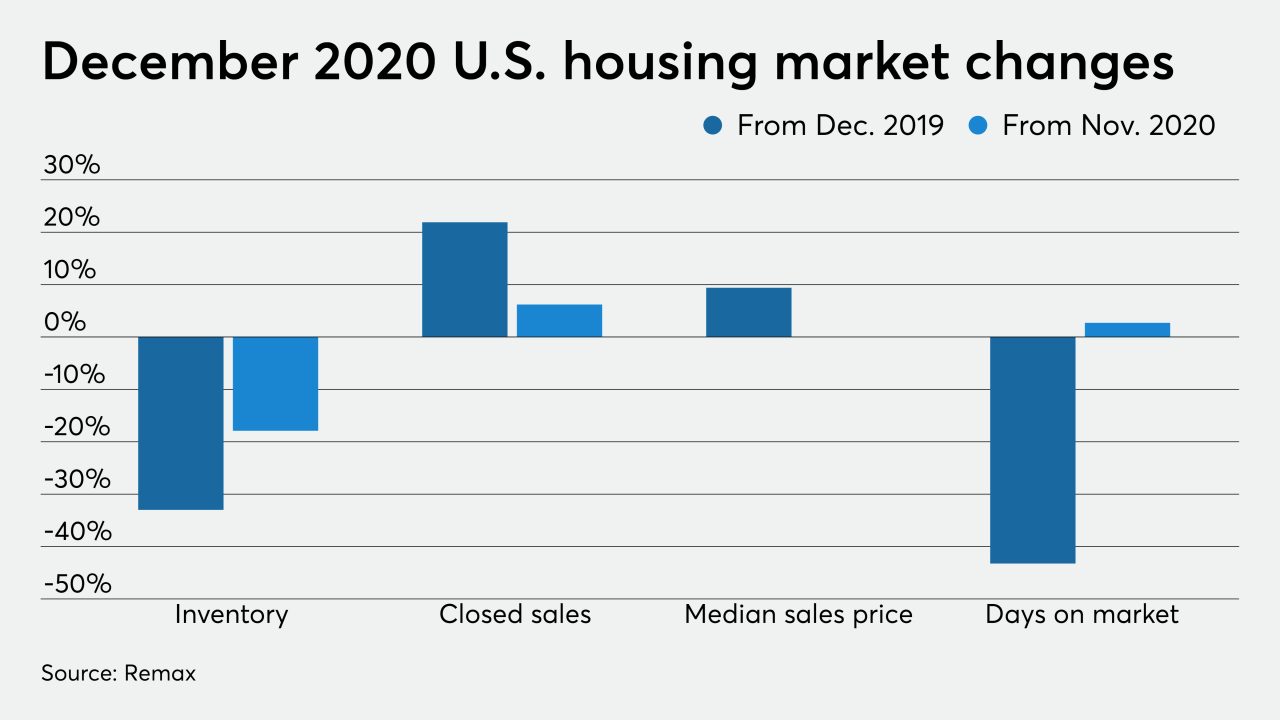

Sales of previously owned homes increased unexpectedly in December, capping the best year for the housing market since 2006 as historically low mortgage rates helped power demand.

January 22 -

In a year beset with a pandemic, tornadoes and civil unrest, one bright spot that emerged in 2020 was a residential real estate market that enjoyed record-high sales and home prices in Chattanooga, Tenn.

January 21 -

For the 10th straight year, annual home sales in Central Texas and the median price of those sales surpassed the year-before totals, with 2020's records coming despite the global coronavirus pandemic.

January 21 -

Remote work and pandemic-induced requirements from the government related agencies forced lenders to pivot on a dime, making it entirely possible that compliance defects will have a larger share in future quarters, Nick Volpe, executive vice president of ACES Quality Management, says.

January 20 ACES Quality Management

ACES Quality Management -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

Bottomed-out mortgage rates cut listing times and housing inventory while sales volume and average prices jumped annually.

January 19 -

Upcoming changes to underwriting regulations, as well as the end of the QM patch, in addition to growing home values, all add up for this market to have a good year.

January 19 -

The pandemic-fueled exodus from New York City propelled nearby Westchester County to its strongest year for home sales in more than two decades.

January 15 -

Purchase apps for new homes only eked out a small gain in December but the Mortgage Bankers Association is forecasting that they will continue to increase.

January 14 -

Cash offers are taking priority in the Boise, Idaho, area, shutting out homebuyers who need a conventional mortgage.

January 13