-

The transaction represents one of the biggest mortgage-backed bond offerings of large-balance home loans this year — behind only Wells first prime jumbo RMBS in January.

May 8 -

A GSE exemption in the bureau’s “qualified mortgage” rule is set to sunset in 2021, and regulators should not try to extend it as some experts have suggested.

May 8 American Enterprise Institute

American Enterprise Institute -

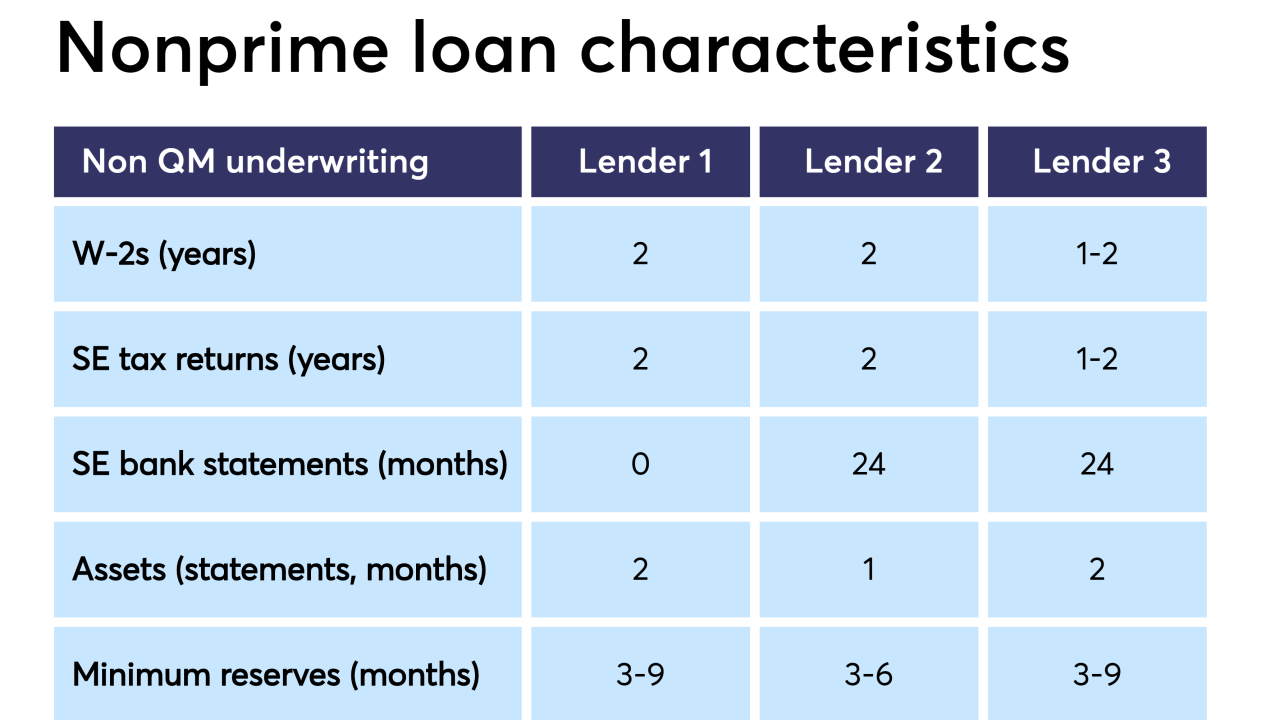

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

New FHFA Director Mark Calabria isn't just charting a future for Fannie Mae and Freddie Mac, but also fixing problems resulting from the "qualified mortgage" exemption for the GSEs and taking a "deep dive" into problems in the mortgage servicing market.

April 25 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

Absent some policy change, nearly a third of the loans backed by Fannie Mae and Freddie Mac could be in violation of the Consumer Financial Protection Bureau's Qualified Mortgage rule in two years.

February 4 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

In a slow mortgage market, construction loans are considered the most likely source of growth for lenders, according to a new study.

January 22 -

As required by the Dodd-Frank Act, the bureau released long-awaited "look-back" reviews to assess the impact of mortgage underwriting and servicing rules on the industry and the credit markets.

January 10 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Private-label residential mortgage-backed securitization is approaching a post-crisis high, according to Kroll Bond Rating Agency.

December 3 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16 -

Mortgage industry executives claim sparse affordable housing supply is the most impactful hurdle for first-time homebuyers entering the market in 2019, but the majority don't think regulatory policy will help the cause.

November 6 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24