-

The share of closed purchase loans remained flat in June, affected by the lack of homes for sale, according to Ellie Mae's Origination Insight report.

July 19 -

California Gov. Jerry Brown and legislative leaders announced that the state's housing crisis will be at the top of their agenda when lawmakers return in August from a month-long break.

July 19 -

Home sales — and prices — reached a new high in the Twin Cities area last month, but the dearth of listings continued and may soon put a brake on deals.

July 19 -

Residential construction ended the second quarter on a stronger note as groundbreaking on new homes rebounded in June to the fastest annualized pace in four months.

July 19 -

Canadians may be shouldering near-record household debt but homeowners have been managing it better than those that don't own property.

July 18 -

A decade after the summer of '07, when Orlando real estate began a years-long crash, median home prices have not returned to their high but continued to rise incrementally.

July 18 -

Wage gains have fallen far behind skyrocketing costs for housing, a gap that's emerged despite a robust job market in recent years, according to an unsettling report released Monday.

July 18 -

Loan application activity for the purchase of newly constructed homes decreased 4% in June from the previous month, according to the Mortgage Bankers Association.

July 17 -

Canadian home sales fell 6.7% in June from the previous month, led by a 15.1% decline in transactions in the once-surging market of Toronto.

July 17 -

Last month, Natalie and David Buckholdt were searching for a home to rent in Lima, Ohio, where David was being transferred.

July 17 -

When Suna and Robert Shaw bought their previous home in Windham in 2004, the process was akin to taking a leisurely stroll.

July 17 -

Finding a place to live in Brooklyn is easy if you want to rent a home — not so much if you want to buy one.

July 14 -

From Indianapolis to Nashville, here's a look at the 15 hottest residential real estate markets of summer 2017.

July 13 -

New compliance challenges and competition make real estate alliances harder to secure. But they're essential for lenders to maximize market share. (Part three in a four-part series on the mortgage industry's response to the housing inventory shortage.)

July 13 -

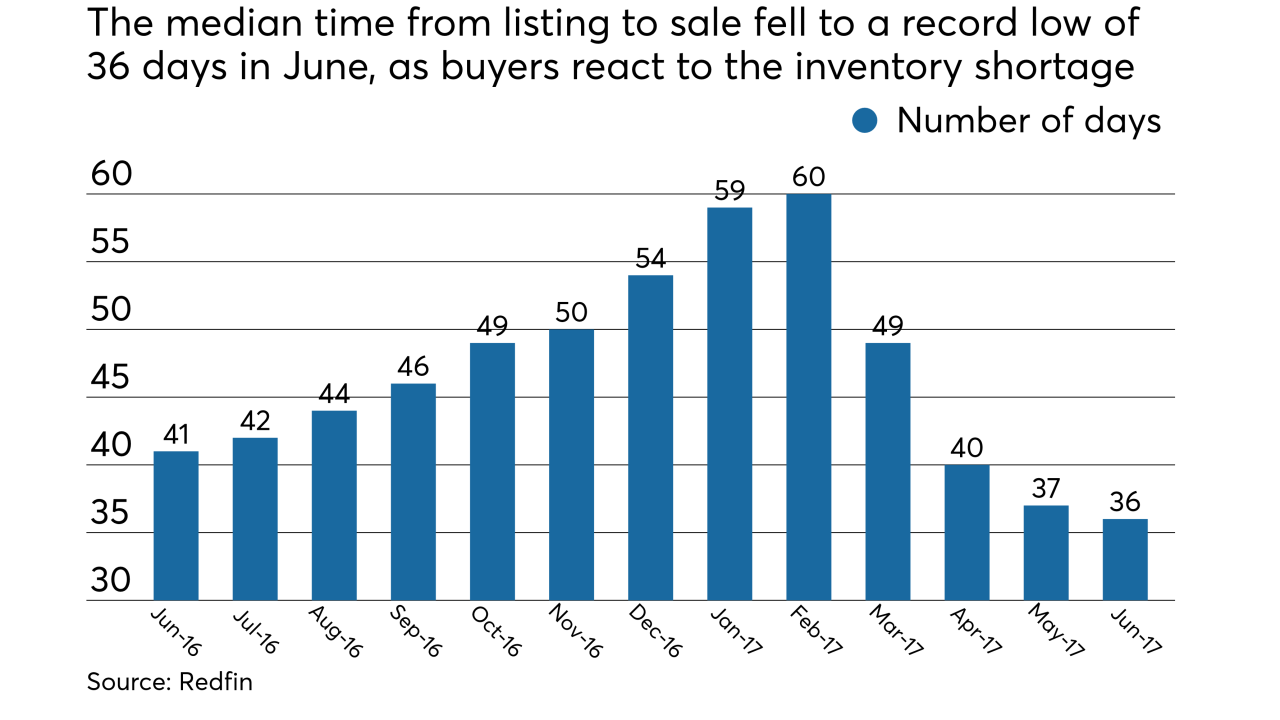

The inventory crunch caused the time a property lists until it goes into contract to reach a new low in June, at 36 days, according to Redfin.

July 13 -

Houston homebuyers increasingly are putting the oil slump behind them, snapping up houses in record numbers and paying more for them than ever.

July 13 -

To close gaps in volume caused by inventory shortages and help consumers get over the homeownership hump, lenders are offering mortgage programs and features like low down payments, bridge loans for home sellers and student loan refinancing. (Part two in a four-part series on the mortgage industry's response to the housing inventory shortage.)

July 12 -

North Texas real estate agents sold a record number of houses in June.

July 12 -

Property owners estimate their homes are worth 1.7% more than appraisers do, according to Quicken Loans.

July 12 -

Home sales and the number of houses on the market dropped in Charlotte last month, but the price buyers are paying continued rising quickly, largely a product of limited inventory.

July 12