- LIBOR

The statement comes after multiple small and midsize institutions earlier this year warned the agencies that the secured overnight financing rate was ill-suited to them.

November 6 -

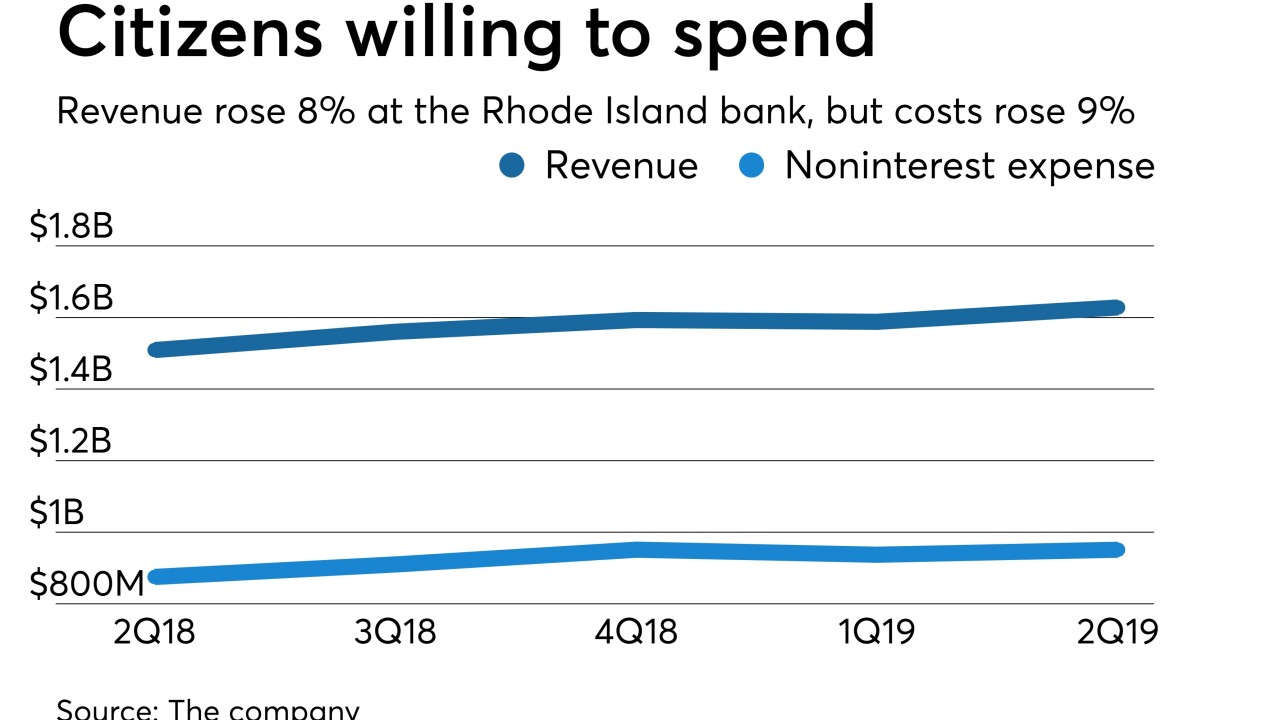

Strong mortgage and capital markets activity helped offset credit costs and one-time items in the third quarter at Citizens Financial Group. In a period of low rates, CEO Bruce Van Saun says he’d like to buy more fee-generating businesses.

October 16 -

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

July 22 -

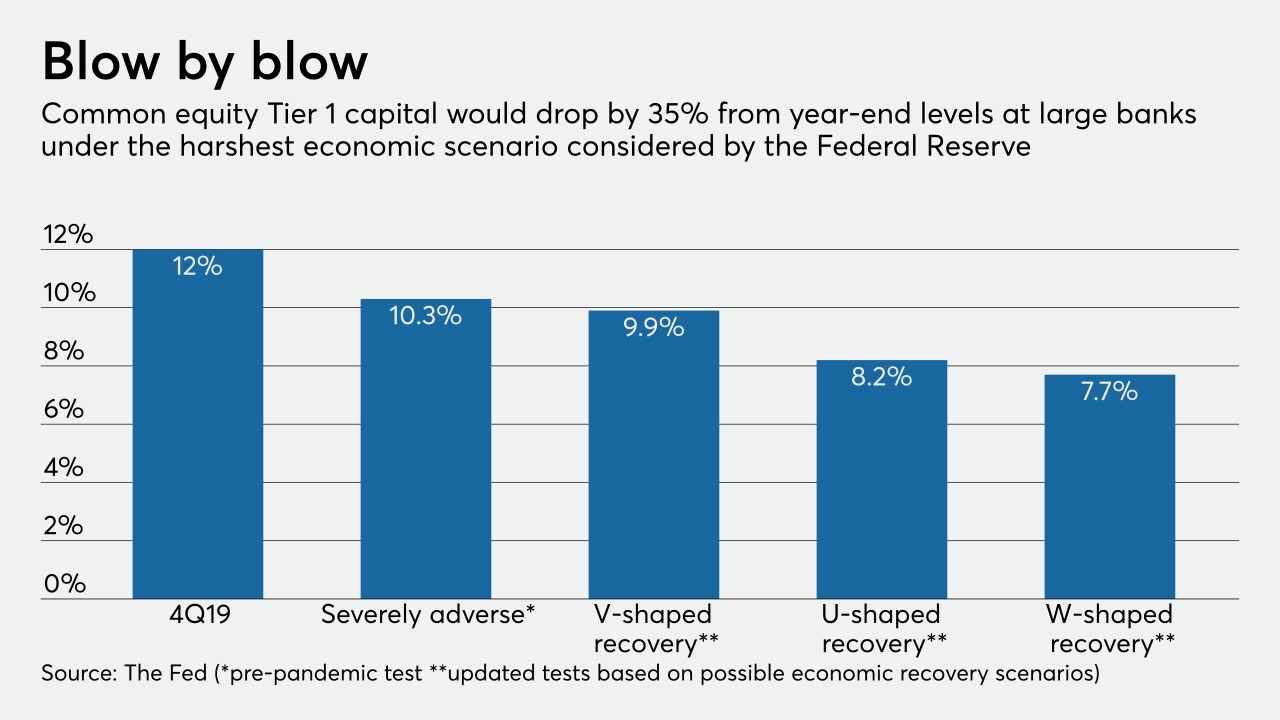

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

June 26 -

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

While clients are uneasy about the spread of coronavirus, Kelly King touted the added volume his company has seen from lower rates.

March 10 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

Shares in the lender fell after it reported lower third-quarter profits, said nonperforming assets rose and cautioned that it had lost multifamily loan deals to competitors offering easier terms.

October 30 -

Concerns over banks’ level of preparation have led to worries about disruptions in the lending market, and some financial institutions warn that a new interest rate benchmark could cause lenders to pull back on credit.

October 27 -

Count Citizens Financial’s Bruce Van Saun among those who think interest rate cuts could halt by mid-2020. The key, he says, is to focus on delivering services customers are willing to pay fees for and to skillfully reprice deposits until then.

October 18 -

The Minneapolis company attributed the uptick to new tech tools, additional loan officers and other process improvements — not to mention the refi boom fueled by lower rates. It’s a formula other banks are expected to copy.

October 16 -

Executives sent a letter to the federal banking regulators last month expressing concern that an alternative to the London interbank offered rate could limit credit availability.

October 16 -

The Minneapolis bank says recent investments in its retail operation contributed to strong improvement in home lending and mortgage banking fees.

October 16 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

With long-term interest rates at historic lows, mortgage refinancing is coming on strong. But that additional revenue may not be enough to offset net interest margin pressures and lost servicing income.

August 15 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17