Regulation and compliance

Regulation and compliance

-

The ex-employee was accused of violating conflict of interest rules and submitting falsified documents for $1.7 million worth of loans in her six-month tenure.

January 19 -

A pair of fair housing attorneys fired by the Department of Housing and Urban Development testified the agency has stopped enforcement of those laws.

January 16 -

The Bureau of Labor Statistics reported Tuesday morning that consumer prices rose 0.3% in December, with annual inflation stuck at 2.7%, lending credence to the Federal Reserve's cautious stance toward interest rates heading into 2026.

January 13 -

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants.

January 12 -

The Senate allowed the nomination of a permanent director of the Consumer Financial Protection Bureau to lapse, giving acting Director Russell Vought more time to lead the agency on a temporary basis.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

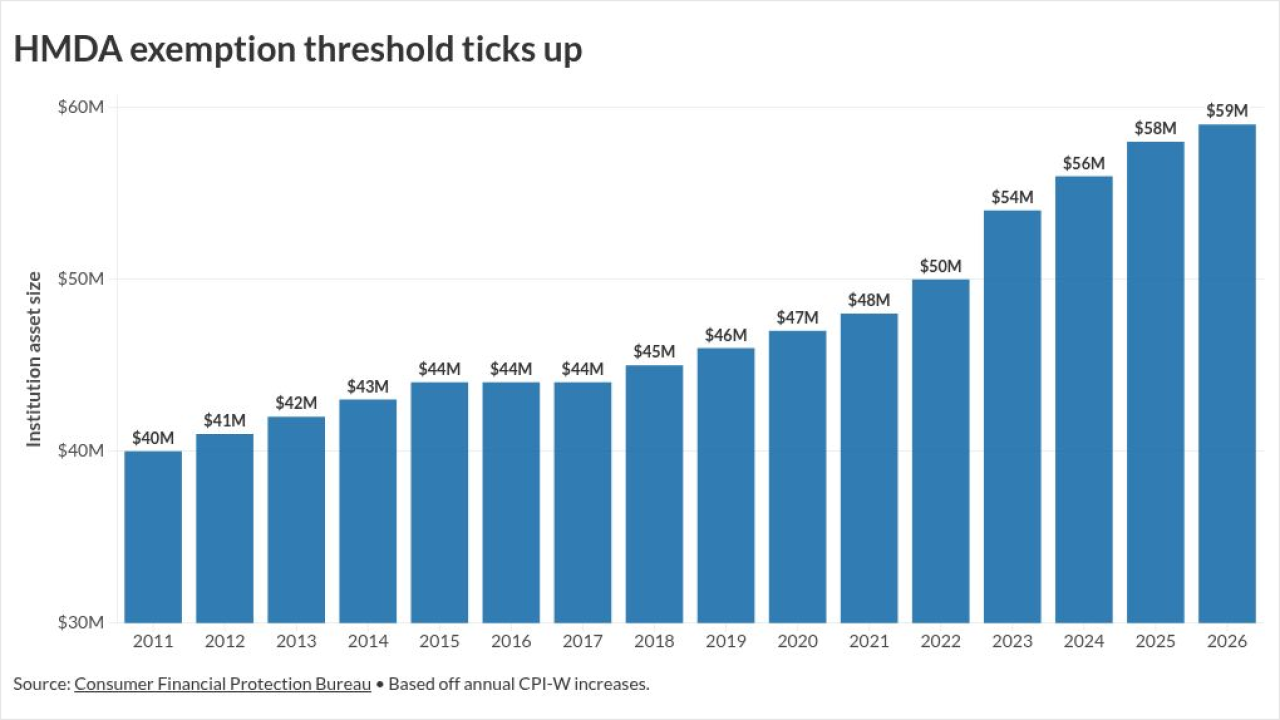

Originators with less than $59 million in assets don't have to share their loan data with CFPB, as the semi-shuttered regulator continues mortgage oversight.

January 8 -

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30 -

As CFPB oversight recedes, servicers are turning to FHA, VA and state rules for guidance, with distressed loan compliance, redefaults and local registration risks rising in 2026.

December 30 -

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29 -

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

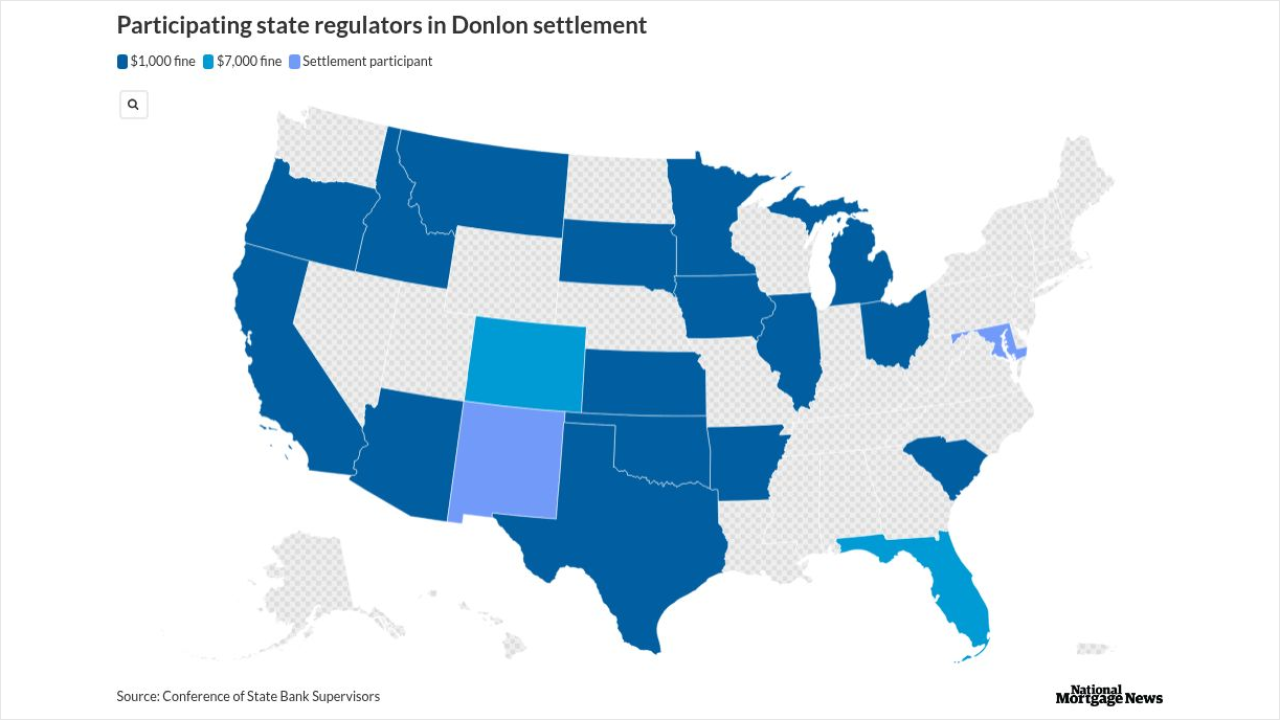

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

December 26 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

The regulator lowered benchmarks for acquisitions of certain single-family loans including low-income refinances, and left multifamily targets intact.

December 23 -

A group of 22 Democratic state attorneys general filed a lawsuit against acting Consumer Financial Protection Bureau Director Russell Vought, the bureau and the Federal Reserve, arguing that the administration's position that the CFPB cannot be funded is wrong.

December 23 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

A coalition of mortgagees said the zombie seconds law negatively impacts 1.2 million junior liens statewide, despite just over 500 potential "zombie" loans.

December 18