Regulation and compliance

Regulation and compliance

-

CFPB Director Richard Cordray sent a letter to President Trump Monday asking him to veto a Republican resolution to nullify the bureau's arbitration rule.

October 30 -

If President Trump picks Federal Reserve Board Gov. Jerome Powell as its next chair, it may represent the best of all worlds for bankers — a policymaker who will continue the central bank's monetary policy but be open to regulatory changes.

October 30 -

Credit Suisse's plan for consumer relief in a multibillion-dollar Department of Justice settlement related to residential mortgage-backed securities could reduce the costs involved, according to the settlement monitor's first report.

October 30 -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 25 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

The Federal Housing Administration has extended waivers on timelines for disaster-related re-inspections to properties in Puerto Rico affected by Hurricane Maria as well as other properties impacted by California wildfires.

October 25 -

Republicans were able to use an obscure legislative process to overturn a rule that banks and credit unions feared would raise their litigation costs.

October 24 -

Legalizing the recreational use of marijuana has created jobs in Colorado, bringing people into the state and putting stress on its residential purchase and rental markets.

October 24 -

Federal Housing Finance Agency Director Mel Watt said the agency is poised to examine alternatives to how a Fannie Mae and Freddie Mac assess creditworthiness of home buyers, including seeking public comment on the issue later this fall.

October 23 -

The Treasury Department released an 18-page report saying the rule would “impose extraordinary costs” including legal fees mostly for lawyers that bring class-action lawsuits.

October 23 -

The CFPB's practice of "regulation by enforcement" forces mortgage companies to develop compliance standards based on the mistakes of their peers, rather than clear guidance from the enforcement agency, said David Motley, the new chairman of the Mortgage Bankers Association.

October 23 -

Texas is receiving $58 million from the Community Development Block Grant disaster recovery program that HUD administers.

October 20 -

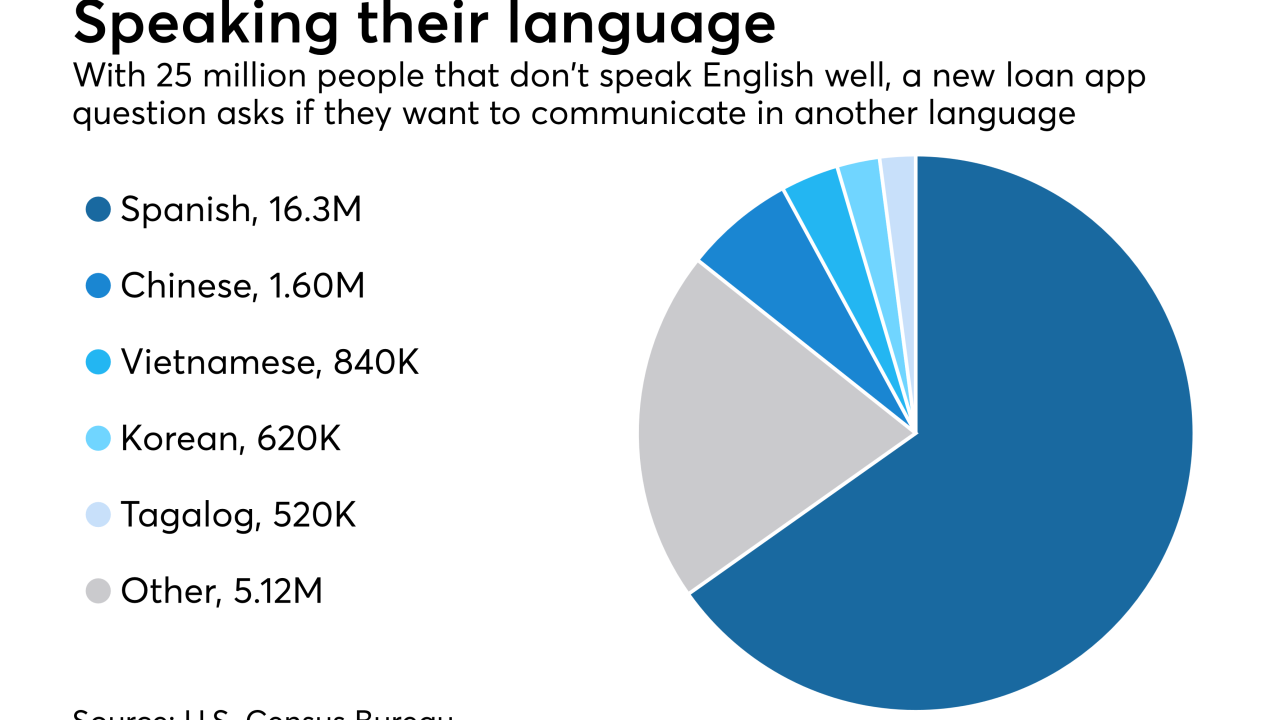

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

For the past eight years, Brian Montgomery has helped mortgage lenders fight penalties sought by the Federal Housing Administration. Now he's President Trump's nominee to lead the agency.

October 19 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

From debating the future compliance landscape to developing a digital mortgage strategy, here's a preview of the top issues, ideas and themes on tap when the industry convenes in Denver for the Mortgage Bankers Association's Annual Convention & Expo.

October 17 -

Fannie Mae used last year's Home Mortgage Disclosure Act data to increase its origination projections for both 2017 and 2018 even as its overall economic outlook remained unchanged from September.

October 17 -

A six-lane highway lined with strip malls cuts through a patchwork of tamed lawns and suburban houses in Delran, N.J., where population has sprouted rapidly in recent decades.

October 17 -

Ginnie Mae and the Department of Veterans Affairs have described in more detail the VA loan refinancing practices they will crack down on to eliminate a long-running churning concern.

October 16 -

The latest version of Ellie Mae's Encompass loan origination system includes new features for Home Mortgage Disclosure Act compliance and digital mortgages.

October 16