-

Recent Fannie Mae and Freddie Mac activities are “not the kind of day-to-day behavior that you would expect from companies” under federal control, the head of the Federal Housing Finance Agency said.

October 31 -

CFPB Director Kathy Kraninger announced the creation of a task force to research and identify potential conflicts in consumer finance law.

October 11 -

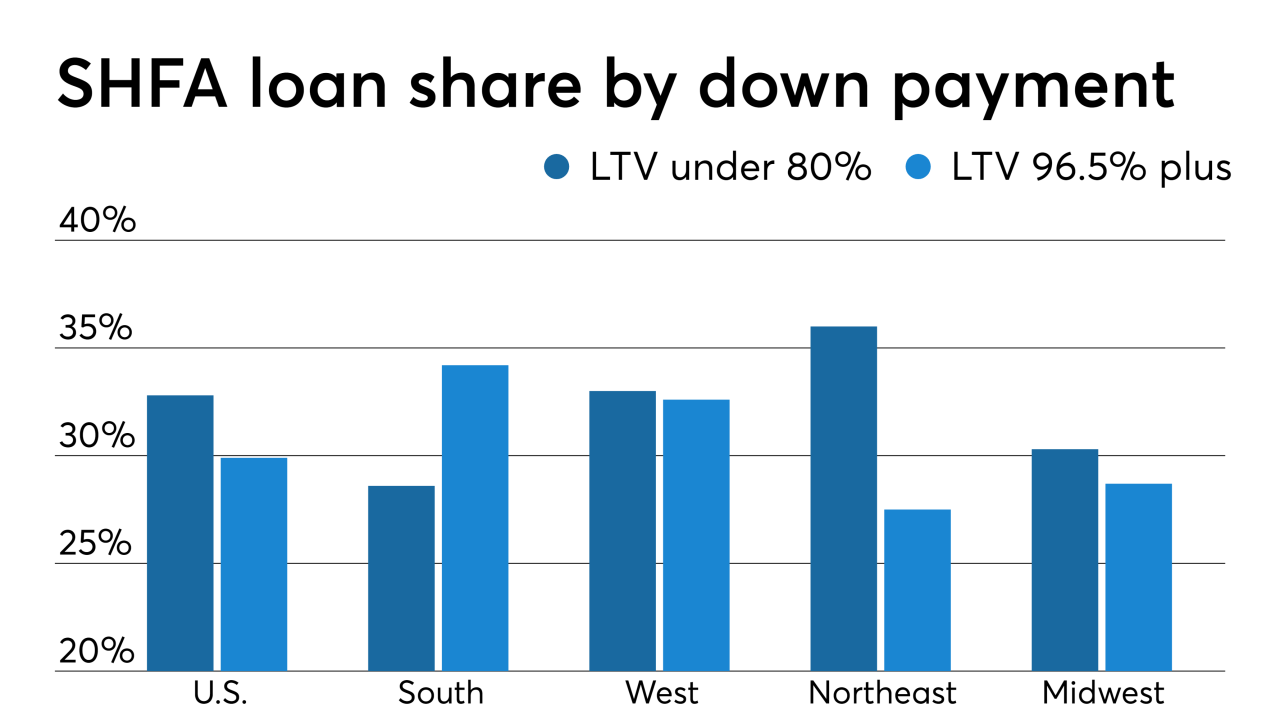

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

The Trump administration is not backing down even after a federal court blocked guidance that would have limited the operations of national housing funds.

September 4 -

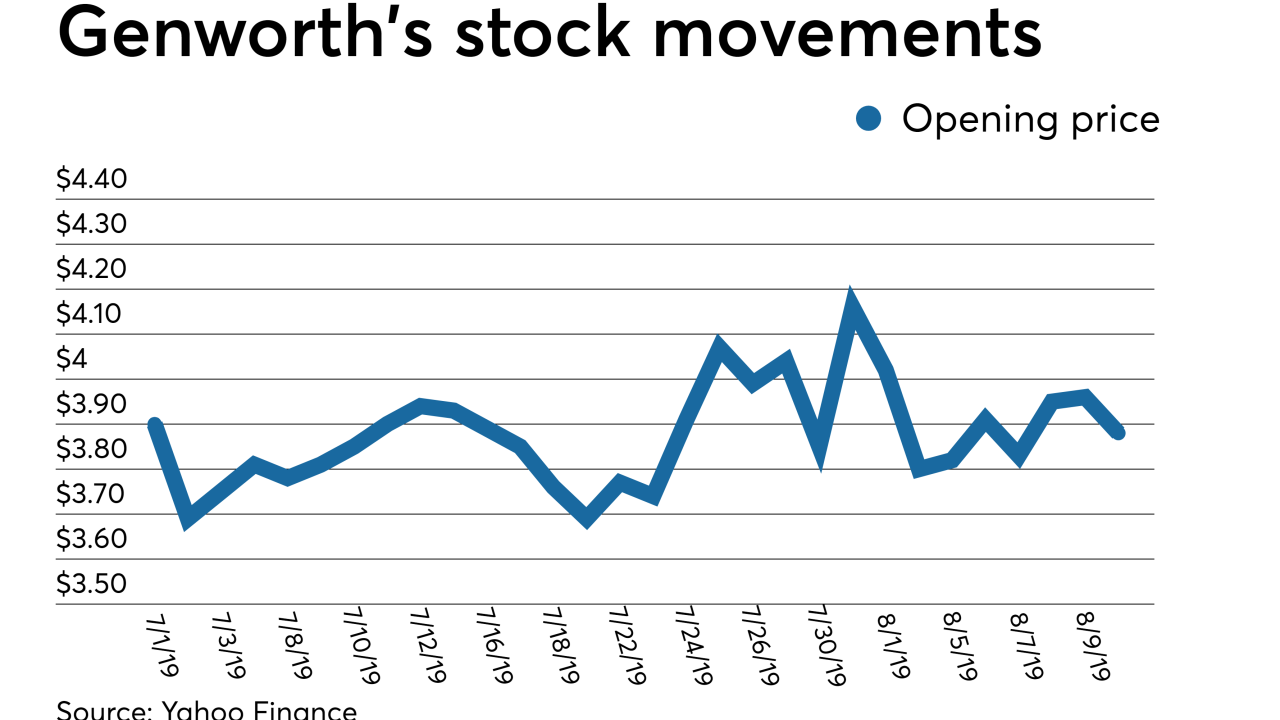

Genworth Financial agreed to sell its Canadian unit to Brookfield Business Partners for C$2.4 billion ($1.8 billion) as it works to win regulatory approval for its acquisition by China Oceanwide Holdings Group.

August 13 -

Genworth Financial's efforts to advance its sale to China Oceanwide hit a roadblock as bondholders did not respond to a consent solicitation for easing a possible Canadian mortgage insurance unit sale.

August 12 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17 -

-

The mortgage industry is calling for better alignment between the federal government and state of New York regarding proposed regulatory revisions that would affect local servicers.

July 1 -

The agency announced the series in April as an effort to encourage public dialogue on policy issues.

June 11 -

The Consumer Financial Protection Bureau received over a quarter-million complaints in 2018, according to analysis by an advocacy group that urged the agency to maintain public access to its database.

May 12 -

Two nonprofits threatened by the effort say the Department of Housing and Urban Development tried to avoid scrutiny last month when it announced the new policy outside the formal rulemaking process.

May 6 -

The Structured Finance Industry Group wants Treasury and the IRS to issue a notice that a change from Libor to an alternative index would not be treated as a taxable exchange.

March 31 -

The move allows the New York multifamily lender to make more loans without having to raise capital.

November 15 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6 -

Protecting consumers from intrusive cold calls and fax-spamming is having adverse effects on the mortgage industry as the Federal Communications Commission fails to reasonably interpret language under the Telephone Consumer Protection Act, according to the Mortgage Bankers Association.

October 25 -

The consumer bureau’s interim chief told an industry conference that “regulation by enforcement is done.”

October 15 -

Regulators will continue to issue guidance to articulate general views on appropriate practices, but they will not issue enforcement actions based on violations.

September 11 -

The Consumer Financial Protection Bureau's practice of "regulation by enforcement" and use of nonbinding guidance materials makes its regulatory efforts "unfair and ineffective" to lenders and servicers, the Mortgage Bankers Association said.

July 5 -

Most mortgage lenders and banks do not maintain a comprehensive vendor management strategy, exposing institutions to increased compliance risk, according to a recent survey.

June 26