-

While moratoria keep foreclosures low compared to last year's rates, October activity jumped 20% from September, according to Attom Data Solutions.

November 10 -

MCS isn’t the only distressed mortgage services entity gaining interest from investors as poor economic conditions threaten more hardships for homeowners.

October 6 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

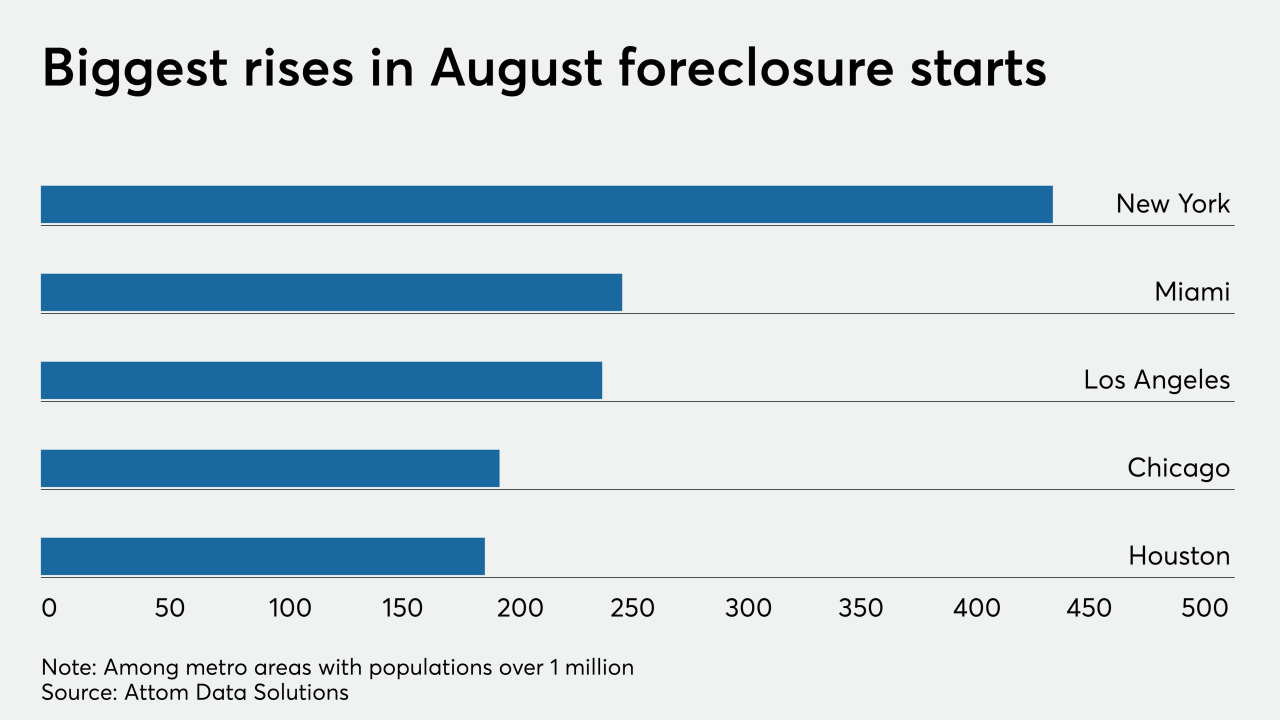

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

With the moratorium still in place, mortgage foreclosure activity fell 83% in July compared to the year before and 4% from June, according to Attom Data Solutions.

August 13 -

A strong housing market prior to the pandemic and the subsequent coronavirus-related moratorium helped to pull foreclosure activity down to historic lows in the first half of 2020, though that could all change soon, according to Attom Data Solutions.

July 17 -

Blackhawk Community Credit Union sold the buildings it acquired in lieu of foreclosure to Rock Renaissance Partnership for $165,000.

June 19 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

Pittsburgh rose from the ash heap of the Great Recession and then became one of the hottest cities in the country for real estate flippers.

March 3 -

While the overall foreclosure rate fell, the share of zombie properties grew in the first quarter of 2020, according to Attom Data Solutions.

February 28 -

The Department of Housing and Urban Development asked mortgage servicers and other stakeholders to respond quickly to a proposed set of foreclosure-sale policy improvements so it can finalize them soon.

February 25 -

Foreclosure auction sales rates plummeted a year before home prices began dropping in 2006, and that was a red flag something was amiss.

January 24 Auction.com

Auction.com -

A strong economy and a bustling housing market helped push Colorado Springs-area foreclosures to a 22-year low in 2019.

January 24 -

Foreclosure activity during 2019 fell 21% from the previous year, but a few indicators show a change in direction could be possible, according to Attom Data Solutions.

January 16 -

A former Fannie Mae employee is facing more than six years in federal prison for participating in a scam involving discount sales of properties owned by the government-sponsored enterprise.

January 15 -

Every month, the Madison County Sheriff's Department conducts a sale of properties where banks and lending institutions have regained possession.

January 13 -

Wells Fargo, which contested the prior sale of a Manhattan, Kan., home for only $1 in a foreclosure auction, was the winning bidder at a new sheriff sale for the property.

January 10 -

In another sign of the hot real estate market in the Colorado Springs area, the number of mortgage foreclosures filed in El Paso County last month fell to a near-20-year low.

November 29 -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21