-

Their summer gains come as home price growth begins to slip and reverse mortgage volumes hit a two-and-a-half year low in September.

October 12 -

In the face of a growing number in home-equity products, HECM endorsements dropped nationwide by over 43% on a monthly basis to its lowest point in more than two years.

October 4 -

But knowledge of HELOCs and HECMs is higher among Gen Z and millennials than boomers.

July 26 -

New home equity conversion mortgage endorsements slowed in April, but remained almost 50% higher than the level from one year ago.

June 22 -

Monthly growth for home equity conversion mortgages was observed across the country, with the Eastern U.S. seeing a significant uptick.

April 4 -

An increase in loan-limit size and the rapid growth of home equity fueled interest in reverse mortgages in January.

March 15 -

The move takes Constellation Mortgage Solutions into the reverse mortgage business, which has fewer competitors than forward loan origination and servicing systems.

February 10 -

Originations of home equity conversion mortgages surged nationwide at the end of the year, with December numbers near a 4-year high.

January 4 -

Nearly half of the company’s revenue comes from sources outside of the traditional home lending market, CEO Patricia Cook told analysts during the company’s earnings call.

November 10 -

Recent offerings come with lower age-eligibility requirements compared to traditional government-backed home equity conversion mortgages.

November 1 -

The company has been making investments in correspondent originations and servicing and “reverse” loans used by borrowers age 62 and up to withdraw home equity.

August 5 -

The $16 billion Champion Mortgage portfolio sale follows Ocwen Financial’s purchase of different assets from MAM a few weeks prior.

July 6 -

The ruling confirms that a state precedent regarding forward mortgages also applies to home equity conversion loans.

July 1 -

The deal will add $7.8 billion in reverse mortgage subservicing to Ocwen $6.7 billion portfolio.

June 18 -

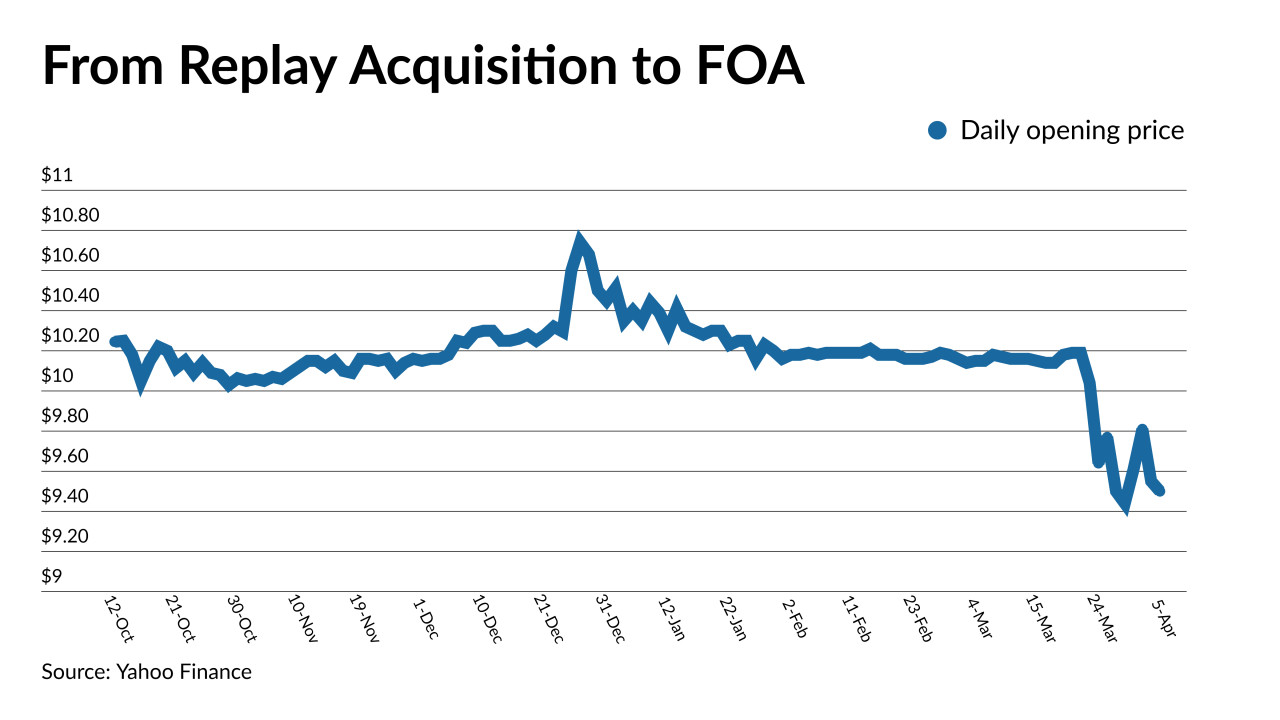

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13 -

Hild, 46, schemed with other Live Well executives to increase the reported value of a pool of bonds used as collateral for loans, Assistant U.S. Attorney Jordan Estes told jurors in opening statements on Wednesday.

April 14 -

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

Finance of America Reverse's product combines features of a forward mortgage, like 10 years of payments, with parts of a non-recourse reverse loan.

March 10 -

The servicer owned by Mr. Cooper agreed to pay a penalty for allegedly failing to provide its clients with clear information on foreclosure and defaults.

March 3 - LIBOR

The deadline for inclusion in Ginnie mortgage-backed securities has been extended and an exception will be made for some participations.

December 16