-

A reduction in Ditech Holdings' quarterly net loss fell short of what the company needed to avoid the possibility of another Chapter 11 filing.

November 15 -

The mortgage insurer’s annual actuarial report showed strength in the agency’s capital reserves even though losses in the “home equity conversion mortgage” program are still a problem.

November 15 -

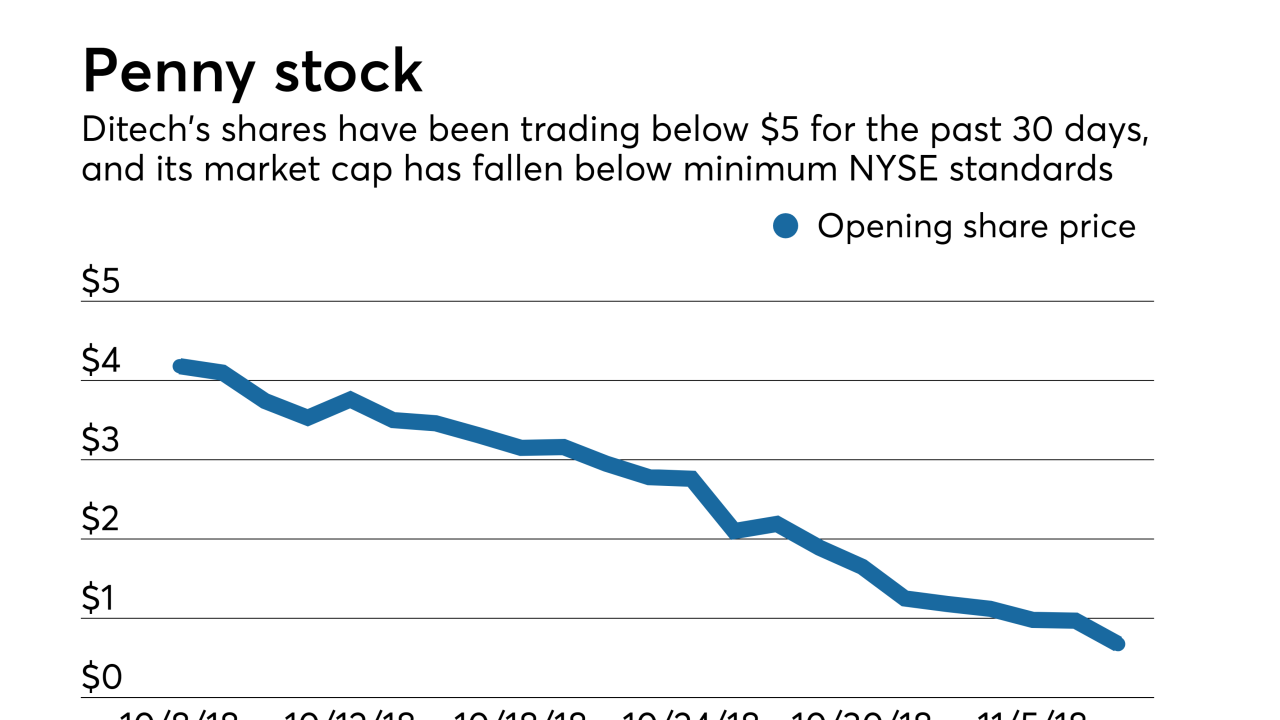

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Ocwen Financial Corp. recorded a deeper quarterly loss of $40 million after acquiring PHH Corp., but still expects the deal's economies of scale to eventually lower costs and restore profitability.

November 6 -

As the Federal Housing Administration prepares to release its annual actuarial report this month, the industry is questioning how the reverse mortgage program fits into the agency's future.

November 2 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

The $571 million transaction is backed by 915 loans originated from 2002 and 2008 that Waterfall Asset Management acquired over eight years.

November 1 -

The Federal Housing Administration is making it easier for reverse mortgage servicers to submit insurance claims by expanding the types of supporting documentation it will accept on defaulted loans.

October 22 -

ReverseVision and Stratmor Group are building a benchmark for Home Equity Conversion Mortgages that could help determine how well these Federal Housing Administration loans serve seniors.

October 17 -

Ex-Ginnie Mae President Joseph Murin is among several industry veterans joining Ainsworth Advisors, a consultancy run by former mortgage banker David Lykken and former Texas Capital Bank executive Gary Ort.

October 15 -

The Federal Housing Administration is mandating that lenders originating new reverse mortgages offer a second property appraisal in certain cases.

September 28 -

Finance of America Reverse is offering a new second-lien alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that can be placed on a property with a pre-existing first-lien loan.

September 26 -

Private-label versions of the Federal Housing Administration's Home Equity Conversion Mortgage have spread to the point where a widely-used loan origination system has added technology to handle the product.

August 24 -

Ditech Holding Corp. posted a net loss of $40.5 million in its first full operating quarter since emerging from bankruptcy protection in February.

August 9 -

Quicken Loans subsidiary One Reverse Mortgage is rolling out a private-label alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that offers higher loan limits and more flexible underwriting terms.

August 8 -

Brian Montgomery is examining why the reverse mortgage program has suffered big losses, but he said he opposes any changes that could make it harder for the elderly to stay in their homes.

July 10 -

Some continue to doubt there will be a premium cut, while others say there's no telling which way Brian Montgomery will go.

June 21 -

New securitizations backed by reverse mortgages are now at a low not seen in two years, signaling that higher volumes seen in recent months may be tapering off.

June 18 -

Ditech Holding Corp. returned to profitability in the first quarter, benefiting from accounting adjustments related to its emergence from bankruptcy protection in February.

June 6 -

Mutual of Omaha Bank's purchase of Synergy One Lending will add reverse mortgages to its product line.

May 10