ReverseVision and Stratmor Group are building a benchmark for Home Equity Conversion Mortgages that could help determine how well these Federal Housing Administration loans serve seniors.

"We expect the MortgageSAT survey results, including borrower comments, will shed light on the fact that reverse borrowers are thoughtful people who are planning for their financial futures," John Button, ReverseVision's president and CEO, said in a press release. "The vast majority of them are very happy with both the process and the loan product."

Stratmor, a mortgage industry consultancy which has developed a borrower satisfaction benchmark for traditional mortgages, is partnering with the reverse mortgage technology provider to help create this new benchmark because there are processes unique to HECMs that need to be measured.

"ReverseVision is uniquely positioned to engage a large sample of lender participants, making this a true benchmark lenders can use to assess their performance against a meaningful peer dataset," said Mike Seminari, Stratmor's program director, who oversees the company's borrower satisfaction program.

Lenders who use ReverseVision will be surveying each borrower within 24 hours of loans closing with the aim of getting feedback that will help them take corrective action if necessary.

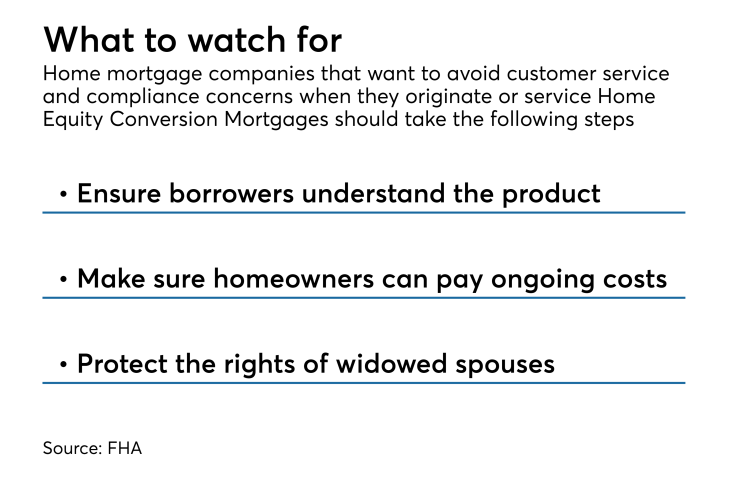

The FHA has been keeping a close eye on the HECM program, and revised it from time-to-time over the years to address loan performance issues that have implications for its insurance fund as well as for borrowers.

Most recently the FHA began