-

It would cost nearly $30 billion to rebuild the tens of thousands of homes that are most vulnerable to wildfires in the Sacramento metropolitan area, a projection that ranks California's capital region fourth highest in the nation for wildfire risk, according to CoreLogic.

September 17 -

A final rule on residential appraisals published this month could save depositories time and money in the short term, but potentially increase collateral risk.

August 30 -

The second half of 2019 is a prudent time to examine the CRE market in the context of an inevitable slowdown, taking into account how the current landscape is impacting lending practices.

August 29 EDR Insight

EDR Insight -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

Wide short-term swings in interest rates — and loan prepayments — that we've all witnessed have serious secondary effects on consumers, lenders, investors and also policymakers.

August 19 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The potential for negative long-term mortgage rates is surfacing around the world, and with global tensions building in the U.S. market, there's a small but growing chance it could happen here, too.

August 7 -

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

Mortgage fraud risk took a serious dive in the second quarter amid lower interest rates, which brought more refinance transactions into the market, according to CoreLogic.

July 25 -

Ginnie Mae is requesting feedback on a new proposed stress test for mortgage-backed securities issuers that would take into account the government agency's increased nonbank counterparty risk.

July 24 -

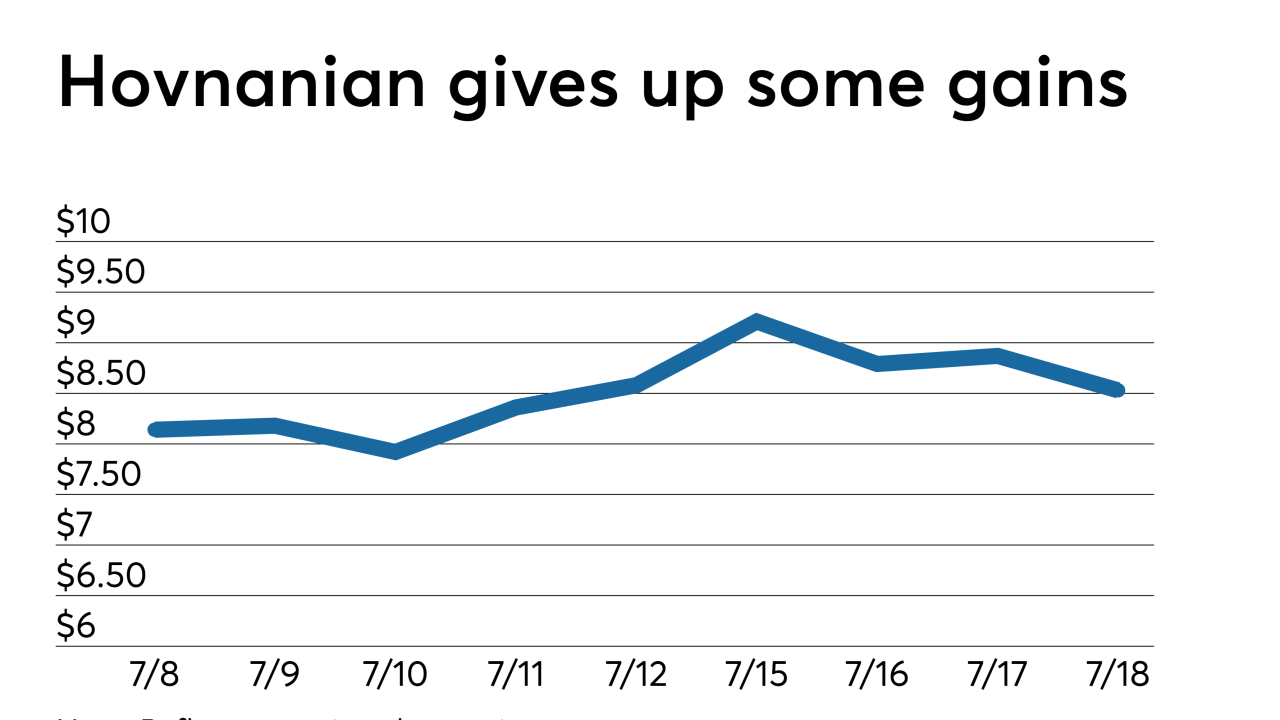

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

Ginnie Mae is examining whether the shift in business to nonbank issuers has implications beyond the risks it has historically looked at, and identifying advantages that should be nurtured as well.

June 10 -

The Federal Housing Finance Agency has far more authority to upend the status quo than most realize, according to a new report.

June 7 -

Private mortgage insurers can help to ease banks' compliance burden when it comes to the Current Expected Credit Loss accounting standard, an industry executive said.

May 22 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

Having poor credit doesn't necessarily keep someone looking to become a mortgage broker from obtaining a surety bond, but it can complicate matters.

May 1 JW Surety Bonds

JW Surety Bonds -

Learning to understand the risk rather than adding steps to the mortgage application process is the way to mitigate fraud.

April 10 CoreLogic

CoreLogic -

An emerging gap between the government-sponsored enterprises on a Federal Housing Finance Agency scorecard item is prompting Fannie Mae to diversify its multifamily credit risk transfer efforts.

March 29 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27