-

The home purchase target for Fannie Mae and Freddie Mac would set a new 10% benchmark for qualified single-family lending in census tracts that meet certain demographic and income targets.

August 18 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

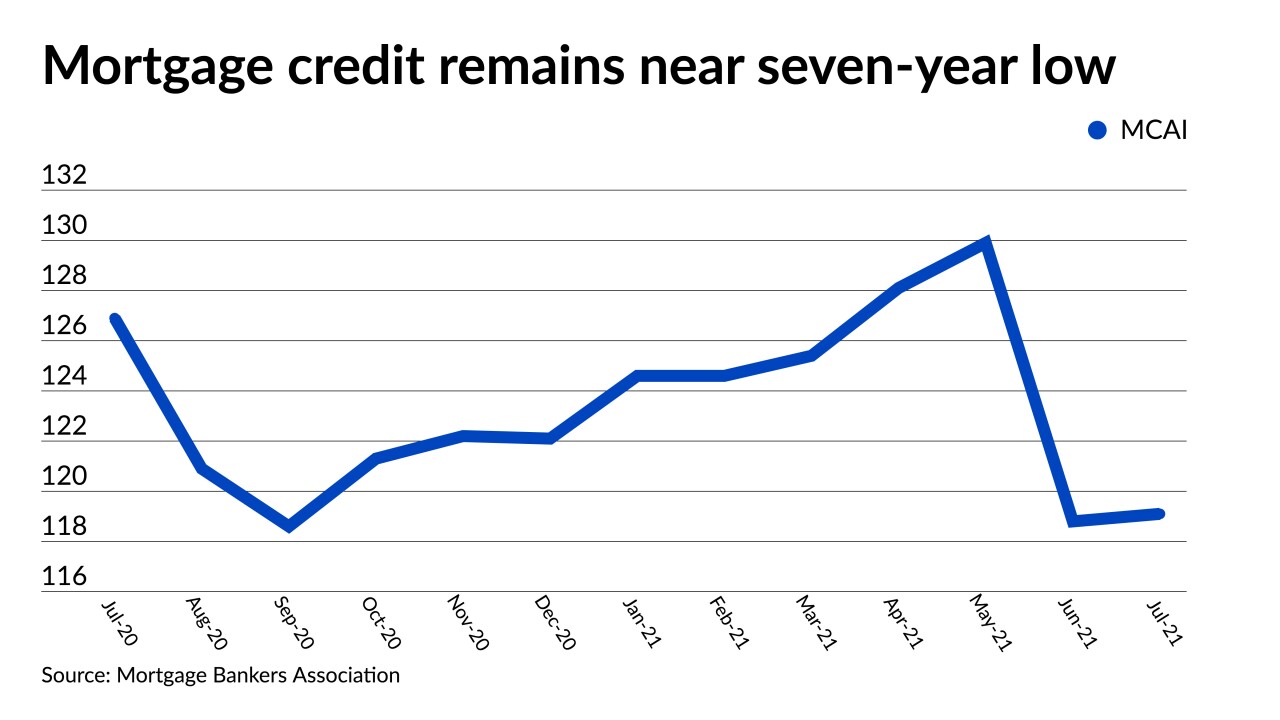

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

Total investment property lending this year should be 31% above 2020's pandemic-affected activity.

August 10 -

The company has been making investments in correspondent originations and servicing and “reverse” loans used by borrowers age 62 and up to withdraw home equity.

August 5 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

The company’s results included some transitory revenue sources, including early buyouts of loans in forbearance from securitized pools, but executives plan to maintain growth over time through economies of scale.

July 29 -

The MISMO protocols are aimed at ensuring nothing is lost in translation when information about billing, late payments and related processing moves to a new system.

July 28 -

The acquirer will use the liquidation of a residential mortgage company’s assets to move several notches up in the rankings.

July 26 -

In 2011 Congress paid for payroll tax relief by raising secondary market guarantee fees for 10 years. The Mortgage Bankers Association, and others, don’t want to see that happen again.

July 23 -

Regulators should create a simple liquidity formula that allows the secondary market to function rather than using depository rules as a model, writes the head of Whalen Global Advisors.

July 21 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

While the unit saw a bigger increase in purchase volume compared to its competitors, net income, loan sales margins and total volume was lower compared with prior periods.

July 21 -

The new deal will remove manual bid taping and automate secondary loan sales directly on the Encompass platform.

July 15 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

The Mortgage Bankers Association is advocating for more funding for the agency due to its elevated securitization activity, and counterparty risk linked to a lingering concentration of loans in forbearance.

July 12 -

The $16 billion Champion Mortgage portfolio sale follows Ocwen Financial’s purchase of different assets from MAM a few weeks prior.

July 6 -

The move is a vote of confidence for the private market in financing, which has been revitalized by limits government-related investors have put on certain loan purchases.

June 23 -

Evaluations for payment reduction still represent a relatively small share of home retention actions but their uptick could add incrementally to servicers’ workloads.

June 22 -

Errors created in the loan manufacturing process were partly responsible for the increase in 2020, according to an analysis by Aces Quality Management.

June 22