-

Walter Investment Management Corp. plans to emerge from Chapter 11 bankruptcy and start trading again under a new name in a matter of days.

February 8 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

Lenders need to be aware of a possible investor backlash as critical defects found in closed loans increased in frequency as the shift continued to a purchase market.

January 30 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

Genworth Financial's acquisition by a Chinese insurance company, which has already been delayed several times, might be in peril following the failure of another cross-border merger to gain approval.

January 4 -

From origination to servicing and everything in between, here's a look at what's in store for the mortgage industry in 2018.

December 26 -

Fannie Mae and Freddie Mac have new technology-driven initiatives planned for 2018 that are expected to help lenders improve the borrowing experience for home buyers and make full use of the government-sponsored enterprises' credit box.

December 26 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

Royal Bank of Scotland Chief Executive Officer Ross McEwan said the likelihood is waning that the lender will settle a U.S. mortgage-bond probe before the end of the year as he'd hoped, though it's well-capitalized to handle a settlement.

December 8 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

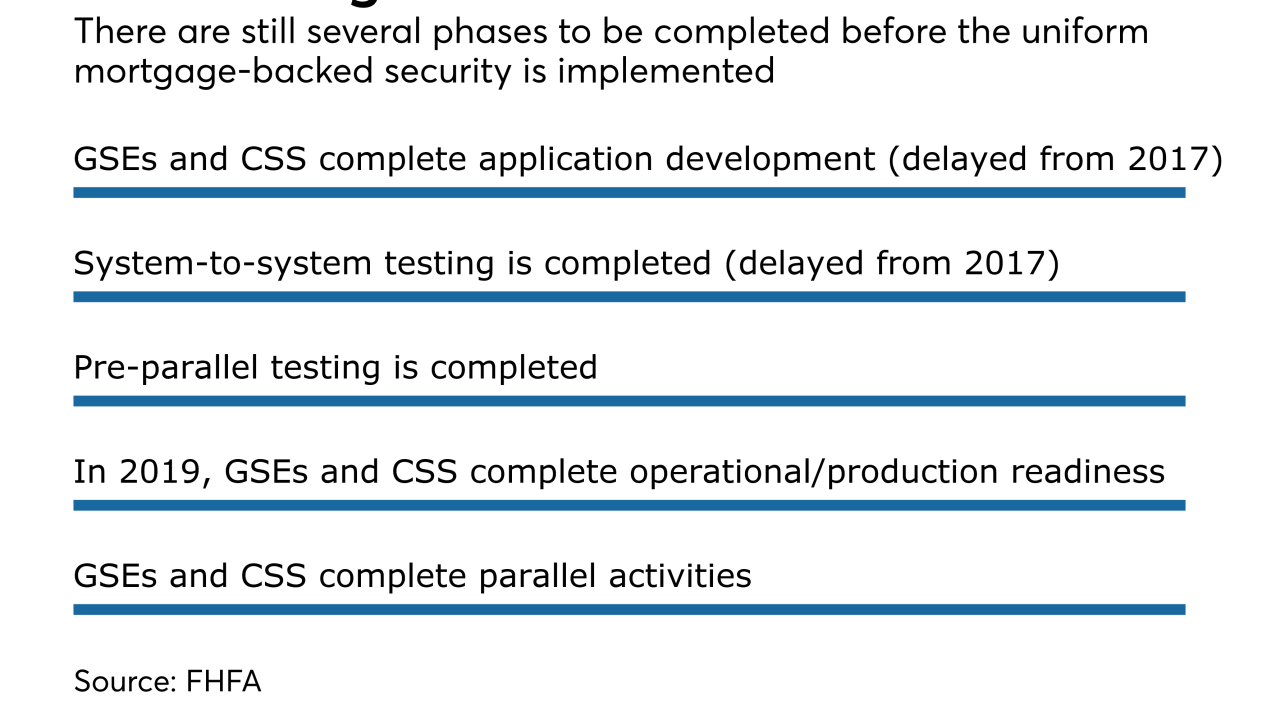

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

The senior tranche of Angel Oak 2017-3 benefits from 46.25% credit enhancement, up significantly from 37.75% for the sponsor’s July transaction, but in line with its April deal.

November 21 -

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

Credit Suisse's plan for consumer relief in a multibillion-dollar Department of Justice settlement related to residential mortgage-backed securities could reduce the costs involved, according to the settlement monitor's first report.

October 30 -

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

Fintech and marketplace lender LendingHome is getting more than $450 million in investment and funding from different channels to help support mortgage production growth and technology improvements.

October 16 -

With a debt deadline looming and regulators again delaying approval of its takeover by China Ocwenwide, Genworth Financial is weighing how to protect its private mortgage insurance unit from its troubled life insurance business.

October 2 -

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

Lima One Capital is expanding its single-family investor financing business by acquiring the residential debt business of the marketplace lender RealtyShares.

September 12