-

With limited seasoning and primarily a clean payment history, OBX 2026-NQM1 had a seasoned probability of default of 33.3% among the AAA stresses and 11.4% among the B.

January 6 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

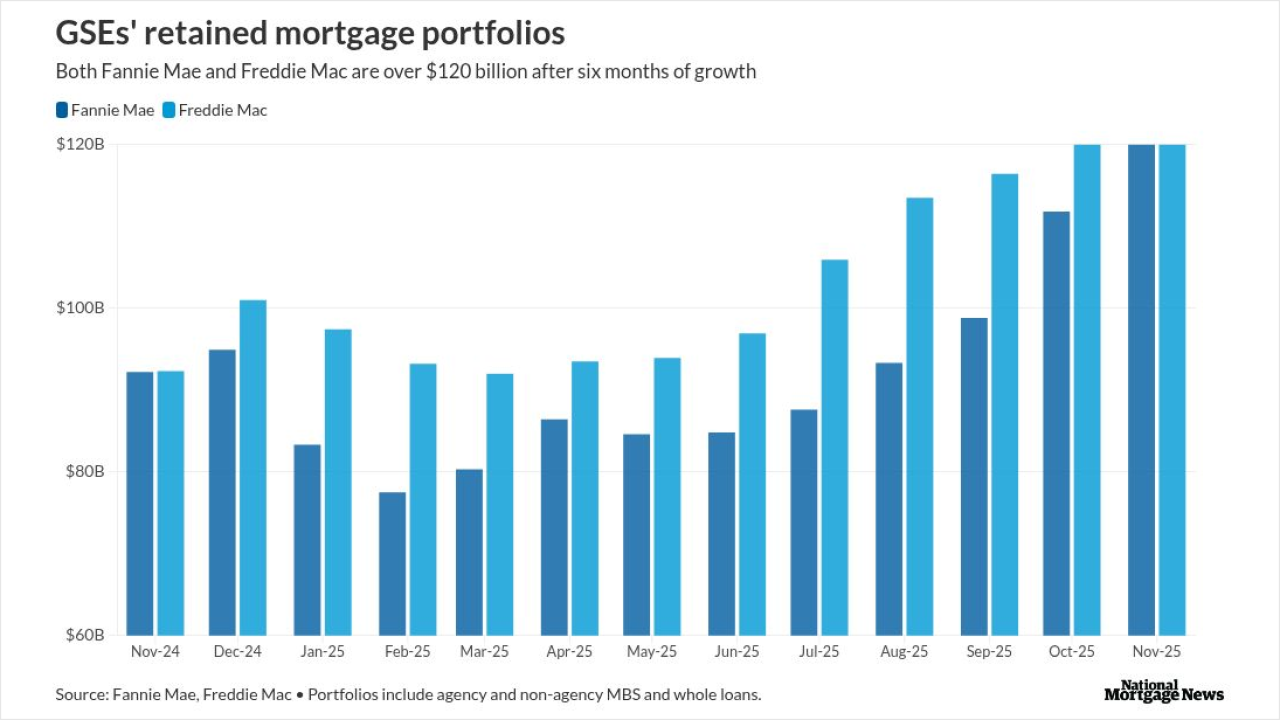

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

A significant portion of the loans in the pool by balance, 44.5%, are designated at non-QM, according to DBRS, adding that about 50% of the loans in the pool were made to investors for business purposes.

December 29 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

December 26 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they're trying to push down lending rates and boost their profitability ahead of a potential public offering.

December 15 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

Hildene, which partners with Crosscountry Mortgage for non-QM securitizations, is doing this deal as part of its buy of an annuity provider, SILAC.

December 8 -

Delinquency trends split in Q3, with securitized and agency loans showing more strain while banks and life companies saw small improvements amid uneven vacancy and rent conditions.

December 4 -

Declining issuances since 2022 led to a request for information regarding the future direction of the reverse mortgage program, and NRMLA and MBA responded.

December 3 -

Mortgage bonds are on track to deliver their strongest returns in two decades, with the Bloomberg US Mortgage Backed Securities Index having gained 8.35% in 2025 through Friday.

December 2 -

Federal Reserve bank supervisors are monitoring community and regional banks' commercial real estate portfolios amid concerns over "lower commercial property values," the agency said.

December 1 -

If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

November 26 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24