-

Most of the pool is made up of office-property loans, but also includes a sizeable exposure to hotel and retail properties.

February 27 -

Ginnie Mae in 2020 is going to seriously examine what it would take to respond to a longstanding, priority request of its issuers.

February 27 -

A rally in Treasuries that's driven 10-year yields toward record lows could have more room to run, a Goldman Sachs report said.

February 24 -

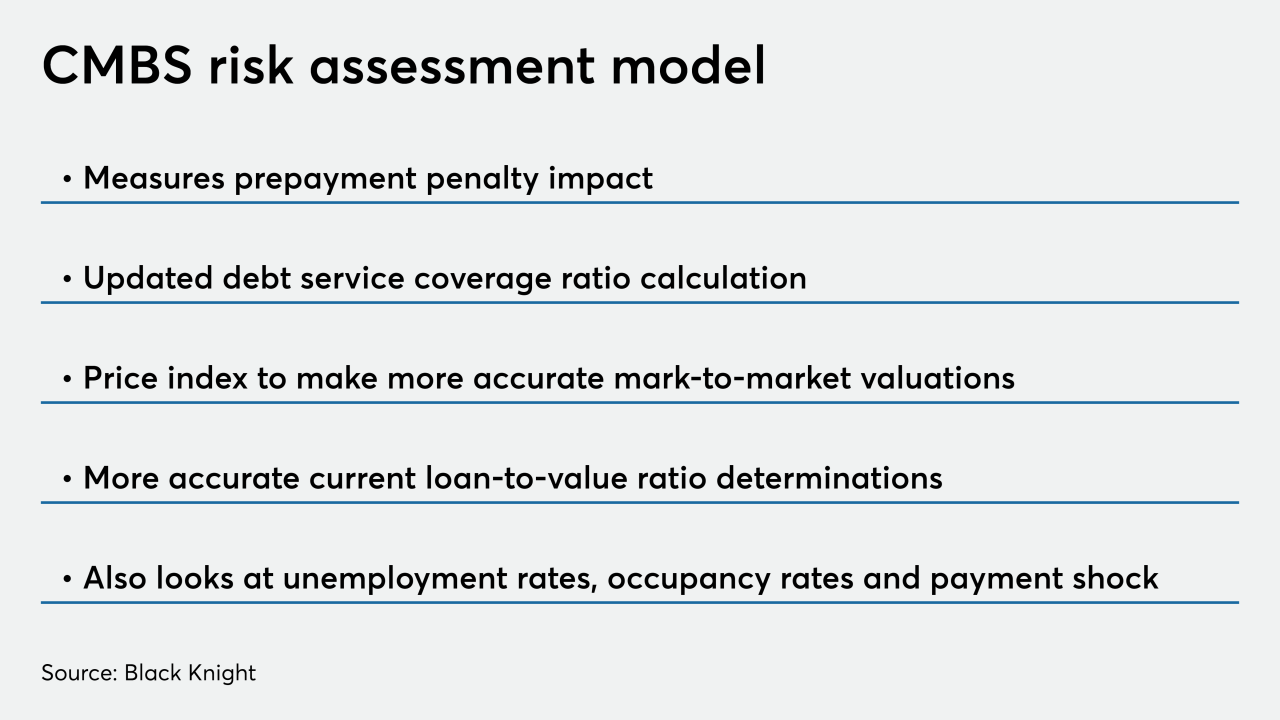

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

DBRS Morningstar and Moody’s Investors Service have assigned preliminary ratings to the Classic RMBS Trust, Series 2020-1 transaction sponsored by Home Trust Co.

February 24 -

Freddie Mac elevated Corley to executive vice president and head of its single-family business, putting her permanently in the role she occupied since last October.

February 20 -

Over 67% of the loan balances in Sabal Capital Partners' commercial mortgage MBS deal were for apartment buildings financed through the Irvine, Calif.-based firm.

February 19 -

The notes in Citigroup Commercial Mortgage Trust 2020-555 are backed by a beneficial interest in the trust’s $350 million portion of the 119-month fixed-rate commercial loan. The loan is secured by a 52-story New York luxury apartment building in Manhattan’s Midtown West submarket.

February 18 -

As the hunt for yield intensifies, investors including Pacific Investment Management Co. see an attractive opportunity in mortgage bonds.

February 14 -

Five MBS pools of predominantly non-QM mortgages have been launched into the market by originators and loan aggregators, according to ratings agency presale reports published since Monday.

February 13 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11 Nations Lending Corp.

Nations Lending Corp. - LIBOR

The government-sponsored enterprises’ plan to cease accepting loans pegged to the London interbank offered rate a year ahead of its scheduled expiration is expected to hasten action in securitized markets.

February 10 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

The mortgage securitization market can expect some changes, particularly in the specified pool and to-be-announced markets, alongside a continuation of trends in other areas.

January 31 Vice Capital Markets

Vice Capital Markets -

The loan participation is part of a debt refinancing package that paves the way for expanding the Parkmerced mega-development.

January 28 -

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 22 -

Radian Group sold Clayton Services, a due diligence company it acquired in the 2014 purchase of Clayton Holdings, to Covius Holdings.

January 22 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

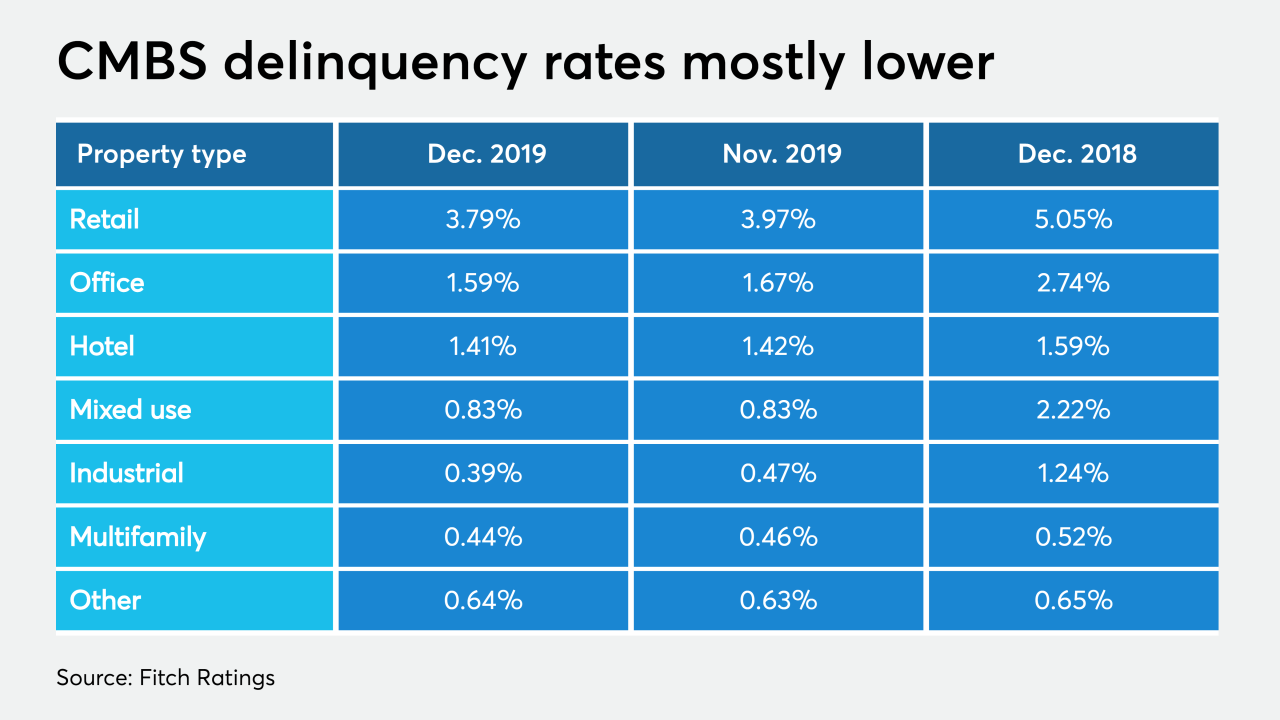

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10