-

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The PSMC 2019-3 Trust is bringing $298.6 million in notes to the market, backed by residential mortgages rounded up by subsidiaries of American International Group.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

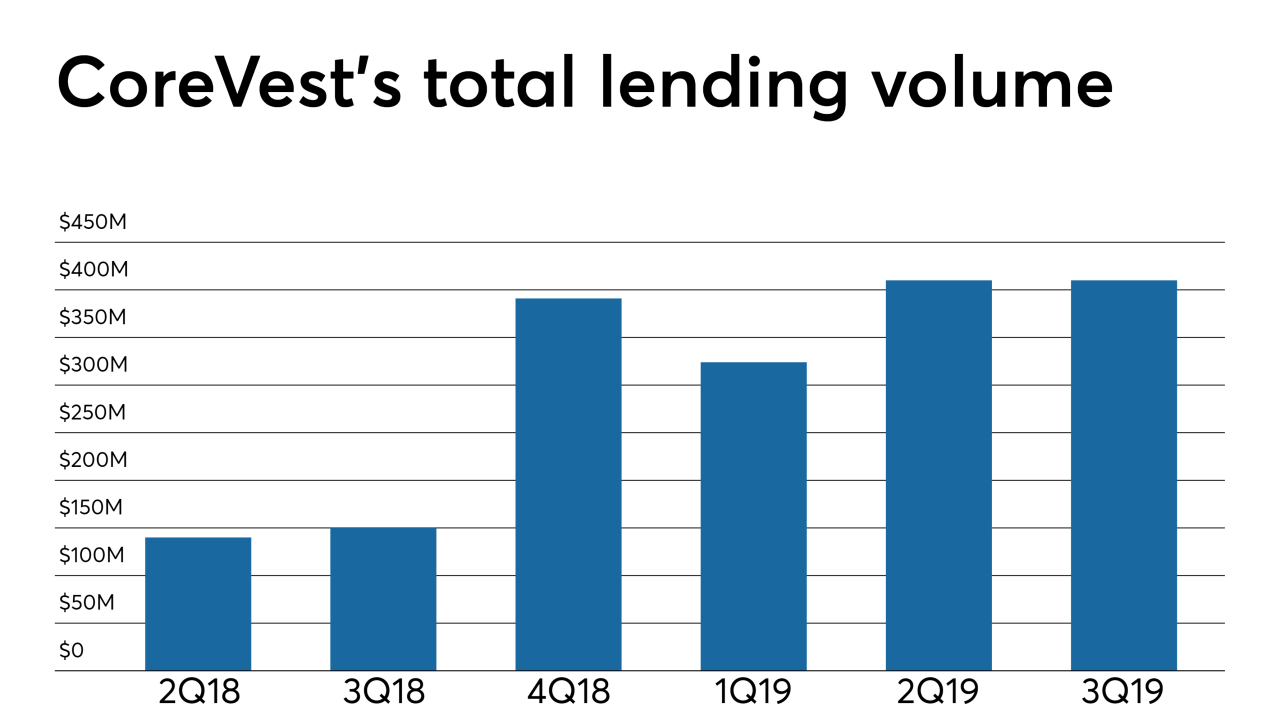

Redwood Trust is adding to its single-family rental lending business by purchasing CoreVest American Finance Lender from its management team and affiliates of Fortress Investment Group.

October 16 -

For the mortgage industry, the question of whether the Fed can control its target range for interest rates is crucial for managing volatility.

October 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The $50.4 million participation is the largest loan in UBS' next $807.3 million commercial mortgage securitization.

October 15 -

RESIMAC Bastille Trust RESIMAC Series 2019-1NC is an Australian-dollar (AUD) $1 billion transaction (approximately US$674.5 million) that will feature a US$250 million Class A-1 tranche of notes, according to Fitch.

October 15 -

Maren Kasper, who has led Ginnie Mae in the absence of a permanent president, is leaving the agency on Oct. 18 to pursue an opportunity in the private sector.

October 10 -

A year after Fannie Mae launched its first credit-risk transfer securitization using a real estate mortgage investment conduit, Freddie is now electing to also opt for a REMIC format in offloading the credit risk to private investors.

October 10 -

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

BX Commercial Mortgage Trust 2019-XL, via Citigroup, features 11 note classes backed by a floating-rate, first-lien mortgage on 406 Blackstone-owned properties with a tenant roster of over 2,000 lessees — including Home Depot, UPS, FedEx and Amazon.

October 7 -

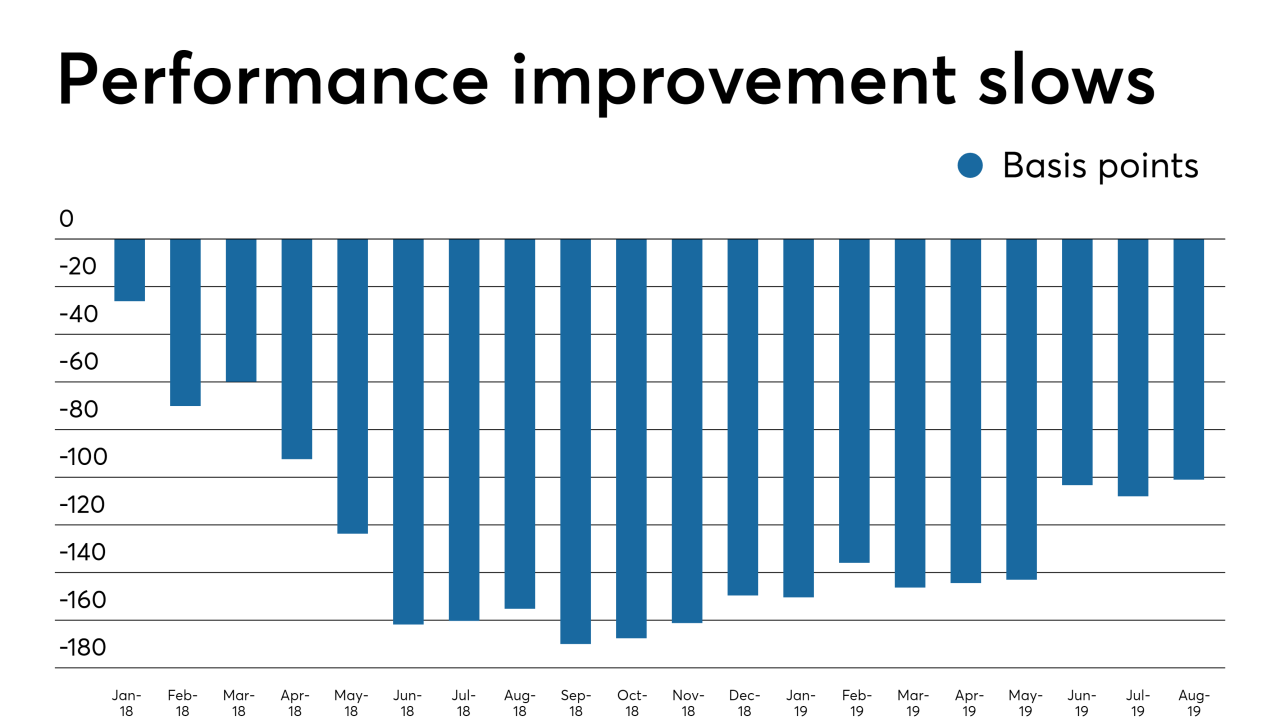

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

Ginnie Mae's stress testing model was based on large issuers, and does not appear to adequately reflect important qualitative differences between larger and smaller issuers.

October 1 Hallmark Home Mortgage

Hallmark Home Mortgage -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

Fitch Ratings reports the deal is the first post-crisis RMBS securitization it has rated consisting entirely of manufactured-housing loans.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

The spike in overnight repurchase agreements may prompt the Federal Reserve to expand its balance sheet.

September 18 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6