-

The collateral includes both QM and non-QM loans; however, certain loans are designated as QM even though the borrower’s DTI may be above 43%, due to a temporary exemption for GSE-eligible loans.

July 13 -

The $109.3 million CLEAN 2018-1 is also the first deal to be marketed as a Rule 144A transaction under securities regulation making it available to wide base of institutional investors.

July 10 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

The Royal Bank of Scotland is paying $20 million to settle an investigation by the Illinois attorney general related to the bank's marketing and sale of residential mortgage-backed securities.

July 5 -

With better-than-expected performance of the underlying mortgages, Fitch Ratings cut its loss projections for seasoned government-sponsored enterprise credit risk transfer deals.

July 3 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

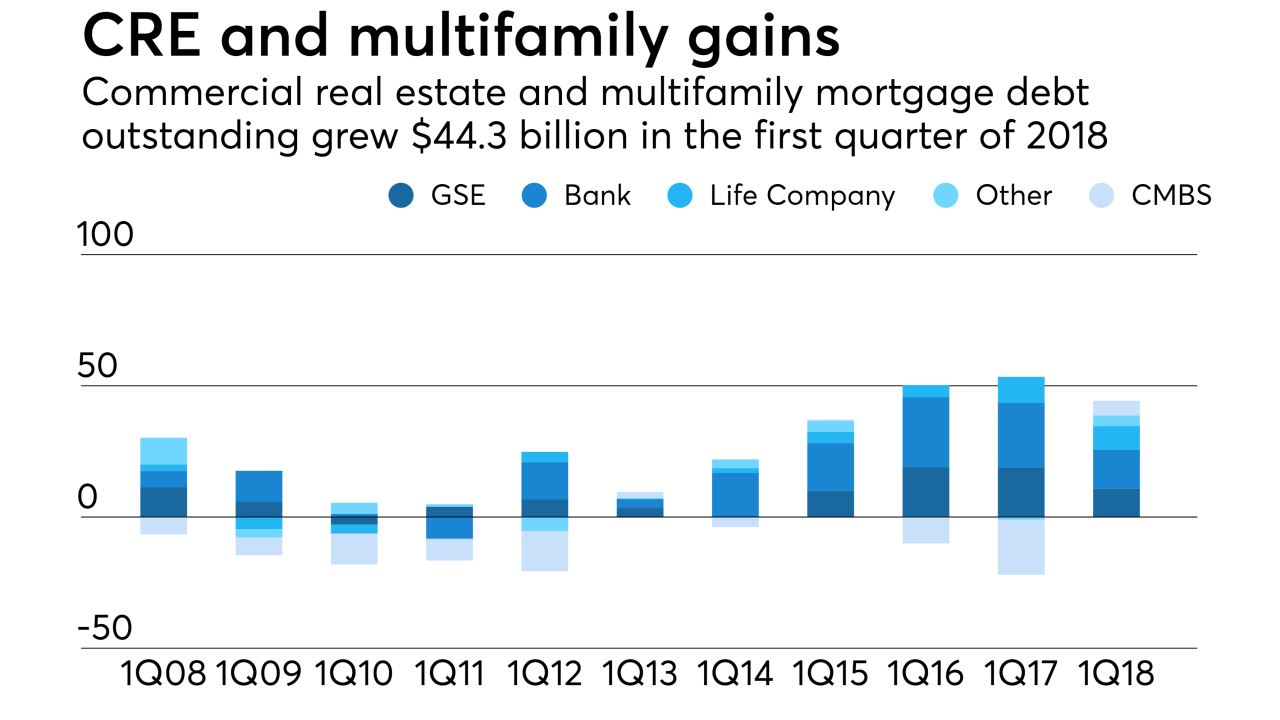

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

Impac Mortgage Holdings will sell up to $600 million of non-qualified mortgage loans to Starwood Property Trust over the next 12 months that will be securitized.

June 27 -

An appeals court has rejected claims by a Washington state housing finance agency that the National Homebuyers Fund is limited to operating in California.

June 25 -

CoreVest American Finance’s next offering of rental bonds is backed by homes that are older and smaller than any of its previous transactions, according to Kroll Bond Rating Agency.

June 25 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

New securitizations backed by reverse mortgages are now at a low not seen in two years, signaling that higher volumes seen in recent months may be tapering off.

June 18 -

Goldman Sachs affiliate MTGLQ Investors won another bid for Fannie Mae's nonperforming loans, persisting as a buyer for the product even as Fannie keeps working to diversify the investor base.

June 13 -

Bank of America Corp.'s Merrill Lynch unit will pay $15.7 million to settle a U.S. regulator's allegations that it failed to properly supervise traders who persuaded clients to overpay for mortgage bonds by misleading them about how much the firm paid for the securities.

June 12 -

IH 2018-SFR1 refinances three earlier transactions (one each from 2013, 2014 and 2015) and is initially sized at $1.1 billion; it may be upsized to $1.3 billion, depending on investor demand.

June 11 -

All five – Plaza West Covina Mall (Calif.), Franklin Park Mall (Ohio), Parkway Plaza (Calif.), Capital Mall (Wash.), and Great Northern Mall (Ohio) – were built in the 1970s and have JCPenney or Sears as a major tenant.

June 7 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Blame the decline in the oil and gas industry; many 2014 vintage deals have exposure to a number of multifamily and hotel properties in North Dakota and Texas, according to Fitch.

June 5