-

New York regulators rejected Fidelity National Financial's acquisition of Stewart Information Services because the combination would have a dominant share of title insurance in the state.

March 6 -

Ocwen Financial reduced the size of its net loss by nearly half during 2018 thanks to cost-cutting measures, and economies of scale from its acquisition of PHH Corp.

February 27 -

CoreLogic's fourth-quarter earnings declined from the previous year because of the slower mortgage origination market and an $8 million impairment charge due to its restructuring plans.

February 27 -

Altisource Portfolio Solutions recorded multimillion-dollar net losses in the fourth quarter and the full year for 2018, due to the reduction of the Ocwen Financial servicing portfolio and other repositioning activities.

February 26 -

The six private mortgage insurers had a great year as they continued to grab market share from the Federal Housing Administration. Despite some headwinds, 2019 is shaping up to be another good year.

February 22 -

Zillow Group Inc., the housing search website that's taken a hit to its stock price as it pursues an ambitious plan to buy homes and originate mortgages, is bringing back its first chief executive officer to lead the transformation.

February 21 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

Mortgage insurer Radian Group was in takeover talks with an investor group earlier this month including Apollo Global Management and Centerbridge Partners, before discussions stalled over the terms of a potential deal.

February 19 -

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

Taylor Morrison Home Corp. mortgage volume inched down during the fourth quarter, but is hoping a recently added rate-buydown feature could bolster future lending.

February 13 -

Black Knight reported lower net earnings, but higher revenue in the fourth quarter compared with the previous year, driven by growth in the company's software segment.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

Ditech Holding Corp. is refiling for bankruptcy almost a year after emerging from it in order to facilitate a restructuring agreement with lenders holding more than 75% of its term loans.

February 11 -

Fourth-quarter increases in Fannie Mae and Freddie Mac mortgage origination volume helped Walker & Dunlop reach a new quarterly high in revenue of $215 million.

February 6 -

Genworth's U.S. mortgage insurance unit's adjusted operating income increased over the previous year as the lower corporate tax rate and lower loss ratio overcame a 9% reduction in new insurance written.

February 6 -

The New York Department of Financial Services disapproved the merger between Fidelity National Financial and Stewart Information Services, regulatory filings from both title insurance underwriters said.

February 4 -

China Oceanwide's acquisition of Genworth has been postponed until March, prolonging uncertainty about the fate of the acquired company's U.S. private mortgage insurance unit that could be resolved by the deal.

January 31 -

PulteGroup's housing-finance unit recorded a year-to-year decline in its capture rate for the fourth quarter, as competition in the market intensified.

January 29 -

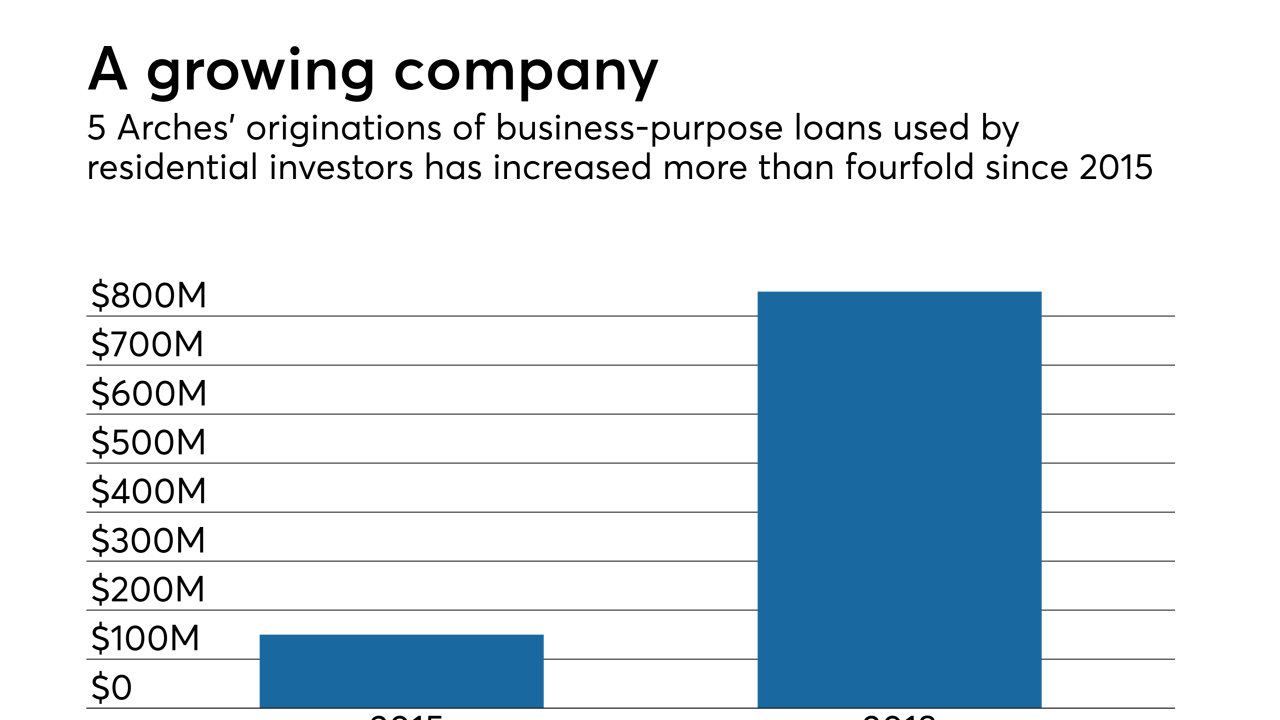

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Flagstar Bancorp's acquisition of 52 Midwest branches of Wells Fargo helped increase its core customer base, but its mortgage results were lower than anticipated in the fourth quarter, according to the Troy, Mich.-based bank.

January 22