-

Despite an overall weak mortgage originations market, Flagstar Bancorp's third-quarter earnings grew 20%, due in large part to its ongoing efforts to diversify operations.

October 23 -

MGIC Investment Corp.'s quarterly earnings were again driven by better-than-expected loss development, and those favorable results should be seen in the other private mortgage insurers' results as well, an industry analyst said.

October 17 -

A notable drop in home equity lending at Bank of America during the third quarter contributed to an overall decline in new single-family loans produced by the company.

October 16 -

Mortgage-related earnings at five banks were lower due to the effect of higher interest rates on loan volume this year, even though late-season homebuyers improved consecutive-quarter origination numbers at three companies.

October 12 -

Washington Mutual successor WMIH Corp. has completed its pending 1-for-12 reverse stock split and its common shares will soon begin trading under the Mr. Cooper name it inherited from Nationstar Mortgage.

October 10 -

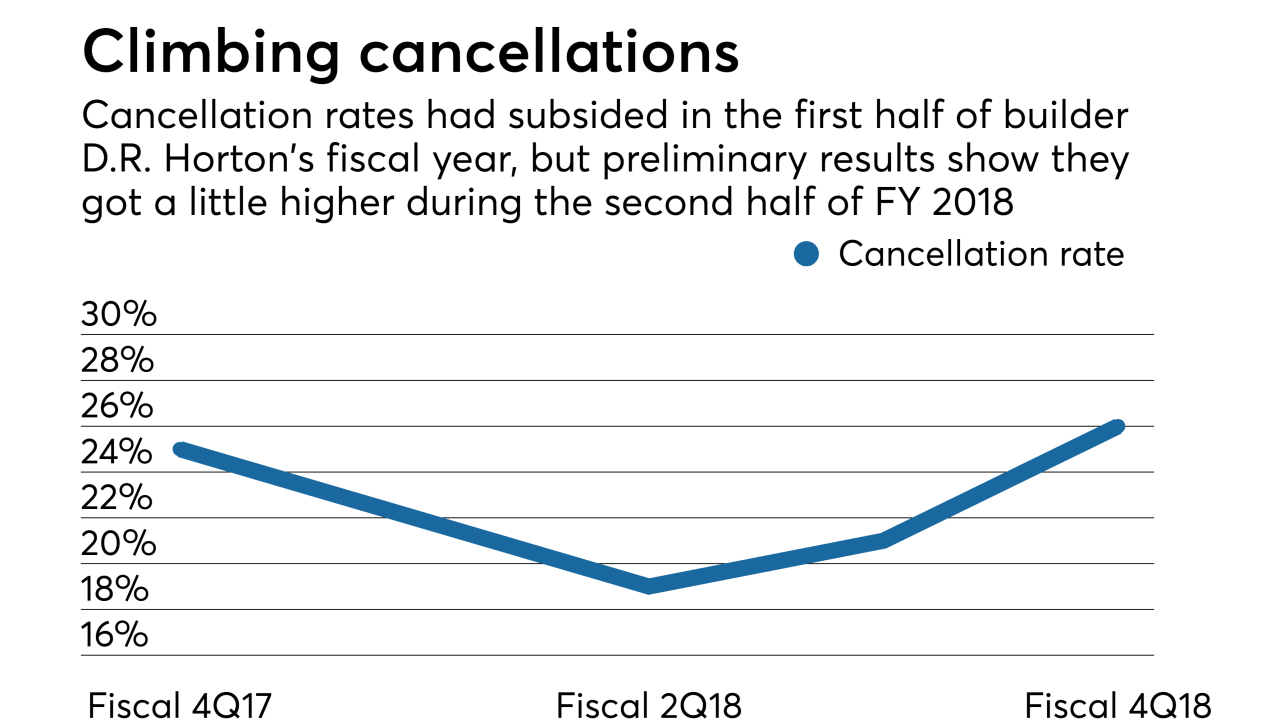

D.R. Horton is selling more homes, but its cancellation rates also are higher in the company's primary fiscal year results, a sign that rising mortgage rates may be affecting the market.

October 9 -

The housing market is stalling, and homebuilder stocks are feeling the pain.

September 24 -

Annaly Capital Management will be able to proceed with a delayed exchange offer needed for its acquisition of MTGE Investment Corp. because it has been able to satisfy incomplete deal conditions.

August 22 -

The expiration of Annaly Capital Management's offer to purchase MTGE Investment Corp. was delayed until Sept. 7 so the two real estate investment trusts have more time to satisfy deal conditions.

August 20 -

Ditech Holding Corp. posted a net loss of $40.5 million in its first full operating quarter since emerging from bankruptcy protection in February.

August 9 -

Redwood Trust's net income was down 30% from the prior quarter as mortgage banking activities earnings fell by 60%.

August 8 -

PHH Corp. remained above the adjusted net worth and cash requirements for the company's proposed acquisition by Ocwen to take place, even though it lost $35 million in the second quarter.

August 3 -

National MI deliberately dropped some of its customers in the second quarter, resulting in flat new insurance growth compared with the first quarter and a lower increase versus one year prior.

August 3 -

Arch MI U.S. returned to having the No. 1 market share among private mortgage insurers as it increased its new insurance written 15% over the previous year.

August 1 -

Black Knight reported net earnings of $40 million for the second quarter as adjusted revenue from its servicing and origination software businesses grew by 7% over the previous year.

July 31 -

Most Nationstar stockholders other than a Fortress affiliate are voting to accept a shares rather than cash as a shell company holding Washington Mutual legacy businesses acquires the company.

July 30 -

Ellie Mae saw a 20% year-over-year increase in second-quarter revenue with more loans closed using Encompass, but net income fell nearly 50% on an accounting change and acquisition costs.

July 26 -

Ocwen Financial took nearly a $30 million net loss in the second quarter due to expenses ahead of its PHH Corp. acquisition that outpaced its mortgage servicing profits.

July 26 -

Radian Group's second-quarter earnings beat consensus estimates because of lower loan loss provisions than forecast, along with record new mortgage insurance written.

July 26 -

Homebuilders are sinking — and blame that on disappointing economic data and earnings reports that trailed estimates.

July 25