-

Freedom Mortgage's acquisition of RoundPoint Mortgage Servicing gives it a major subservicer and will increase the Mount Laurel N.J.-based company's mortgage servicing rights portfolio by nearly 44%.

May 24 -

An institution that services housing finance authority loans is putting $2.65 billion in servicing rights from Washington state up for bid through the Mortgage Industry Advisory Corp.

May 16 -

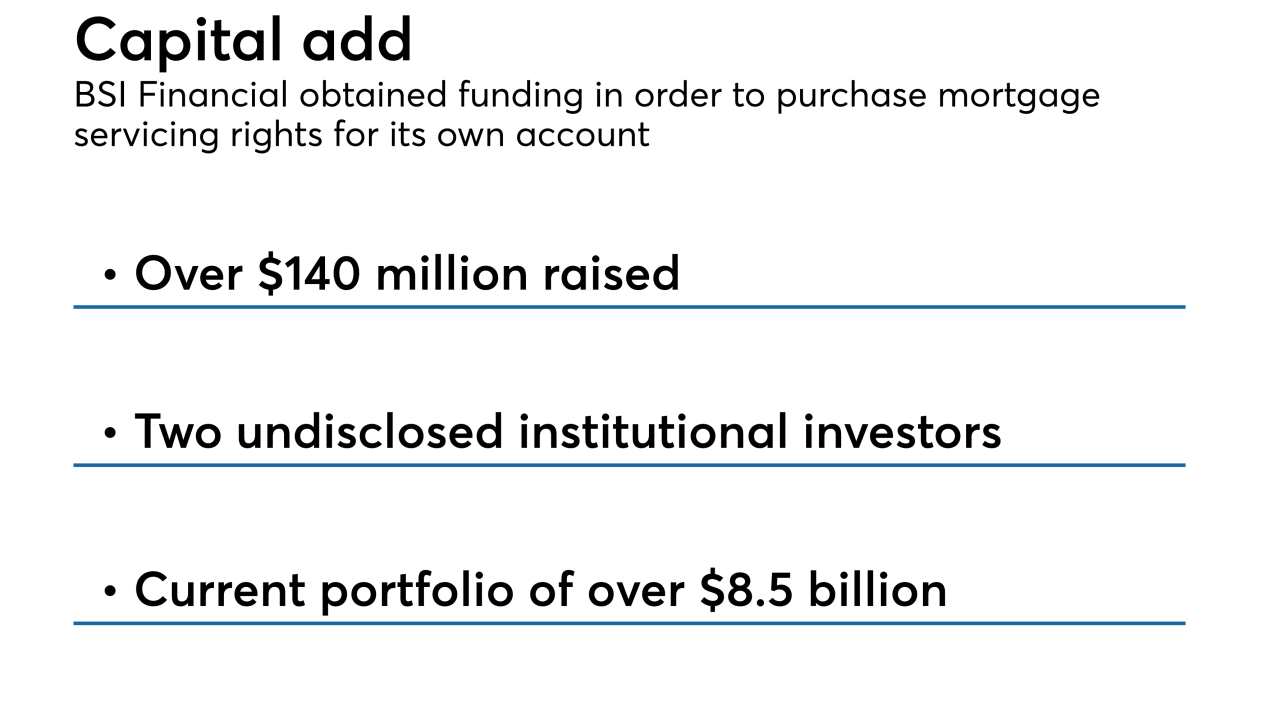

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

January 9 -

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

January 3 -

Nonbank lenders are gearing up for new secondary market requirements and must make some difficult choices about whether to buy, sell or hold mortgage servicing rights, says Ruth Lee, the executive vice president of MorVest Capital.

December 28 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

New Penn Financial will change its name to NewRez at the start of 2019, reflecting its acquisition earlier this year by New Residential Investment Corp.

December 7 -

Ginnie Mae is adding steps to its process for evaluating new issuers, including new notification requirements related to subservicer advances, servicing income, and borrowing facilities secured by mortgage servicing rights.

November 16 -

Mr. Cooper Group — the new name following the combination of Nationstar Mortgage and WMIH Corp. — posted a $54 million third-quarter profit and announced plans to buy Pacific Union Financial, as well as make other strategic acquisitions.

November 8 -

Despite an overall weak mortgage originations market, Flagstar Bancorp's third-quarter earnings grew 20%, due in large part to its ongoing efforts to diversify operations.

October 23 -

Incenter Mortgage Advisors is facilitating the sale of $3.7 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans, roughly one-third of which have private mortgage insurance.

October 19 -

Ocwen Financial Corp. has gotten the go-ahead to acquire PHH Mortgage Corp., subject to revised New York restrictions on acquisitions of mortgage servicing rights, and other conditions imposed by the state.

September 28 -

Most mortgage servicers in the state of Washington are about to be more tightly regulated, in line with a broader trend, but smaller master servicers can get a waiver.

August 10 -

PHH Corp. remained above the adjusted net worth and cash requirements for the company's proposed acquisition by Ocwen to take place, even though it lost $35 million in the second quarter.

August 3 -

Servicers and MSR investors face increased regulation and oversight as nearly all states now require some form of licensing for firms responsible for mortgage collections.

July 23 -

Incenter Mortgage Advisors is facilitating the sale of more than $10 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans originated by mortgage brokers.

June 21 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24 -

Ditech Holding Corp. lost $426.9 million in 2017, with almost half of that recorded during the fourth quarter, when the company filed for bankruptcy.

April 17 -

Situs subsidiary MountainView Financial Solutions is brokering a $6.1 billion package of government-sponsored enterprise and Ginnie Mae servicing rights.

April 11