-

The Senate approved the final tax reform plan 51-48 early Wednesday, the second-to-last obstacle before sending it to President Trump for his signature.

December 20 -

Top officials at the Internal Revenue Service met with mortgage industry groups this week to discuss possible fixes to the agency’s verification system, which lenders rely on to process mortgage loans.

December 19 -

The House vote moved a sharp reduction in the corporate tax rate for banks and other businesses to within a few steps of becoming law.

December 19 -

Residential and commercial property tax delinquencies are slightly higher in the Northeast and South than in the Midwest and West, but improving economic conditions are keeping the national delinquency rate in check.

December 19 -

New Jersey's home values in some markets could take a 10% hit under the tax overhaul nearing a vote in Congress, according to a new report.

December 19 -

With tax reform close to the finish line, bankers are still clear winners from the compromise worked out between House and Senate negotiators. But the bill includes some caveats that might give institutions pause.

December 18 -

Mortgage lenders are bracing for big delays in the processing of mortgage applications, citing a problem with the income verification system at the Internal Revenue Service.

December 17 -

Regulatory changes that would put an end to state and local tax deductions could prompt many homeowners in high-tax states to consider relocating, a Redfin survey shows.

December 11 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

While consumer optimism about the nation's housing market returned to near-record levels in November, it could be tested in December as they digest the impact of tax reform.

December 7 -

The lower mortgage interest deduction cap in House Republicans' tax bill would create a disincentive for existing homeowners to sell and add to already tight housing inventory concerns, according to Black Knight.

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

A provision in the tax bill passed by the House of Representatives would only intensify the housing crunch by crippling affordable housing construction, developers and local government officials say.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

The Senate tax reform proposal could force servicers to pay tax upfront on income that is currently tax deferred, according to the Mortgage Bankers Association and the Consumer Mortgage Coalition.

November 28 -

Mortgage closing costs average nearly $4,900 nationwide. But in some states, those fees can reach or exceed five figures. Here's a look at the areas where it costs the most to close a mortgage.

November 21 -

Sales of previously owned U.S. homes rose to a four-month high, indicating demand was firming at the start of the quarter as the impact from the late summer hurricanes faded, according to a National Association of Realtors report.

November 21 -

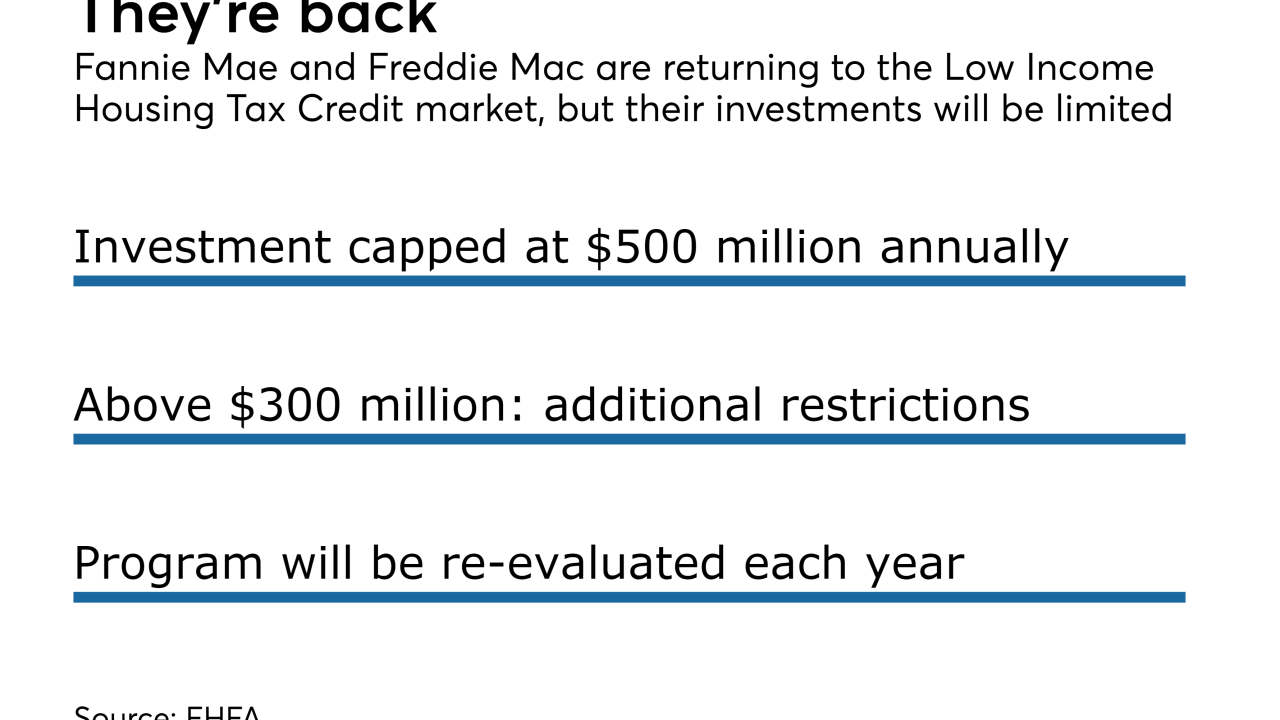

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16 -

Housing advocates are pressing Senate Republicans to expand the low-income housing tax credit program while pushing back against a House GOP plan that would eliminate financing for half of all affordable housing units.

November 14